Trading on your mind?

LEARN the basics and beyond

What do we know about trading?

The adventure is unbeatable

the rush, the framework, the constant movement

The emotions are extreme

the excitement, the panic, the fear and the greed

The outcomes are not certain

the wins, the losses, the fight for a balanced win

Trading in a nutshell

What is trading?

Trading is the intentional side of investing. Instead of buying and holding valuable assets, trading “rides the waves” of the asset’s rising and falling prices

What is an asset?

Anything valuable owned by an individual, a company or other entity, and has the potential to generate further economic value. Think real estate, inventory, cash, machinery, financial instruments

A tradeable asset?

Anything with economic value that can be bought, sold, or exchanged with the goal of profit. Grouped into categories called asset classes, they share similar characteristics, behaviour, and legal governance

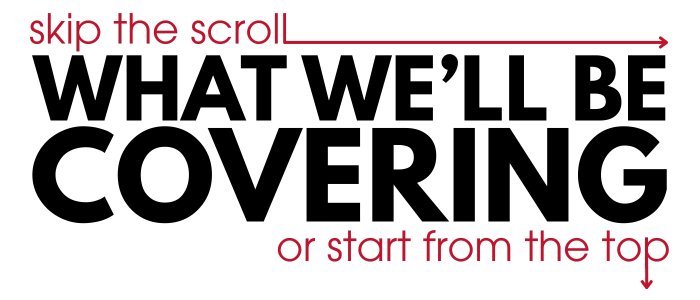

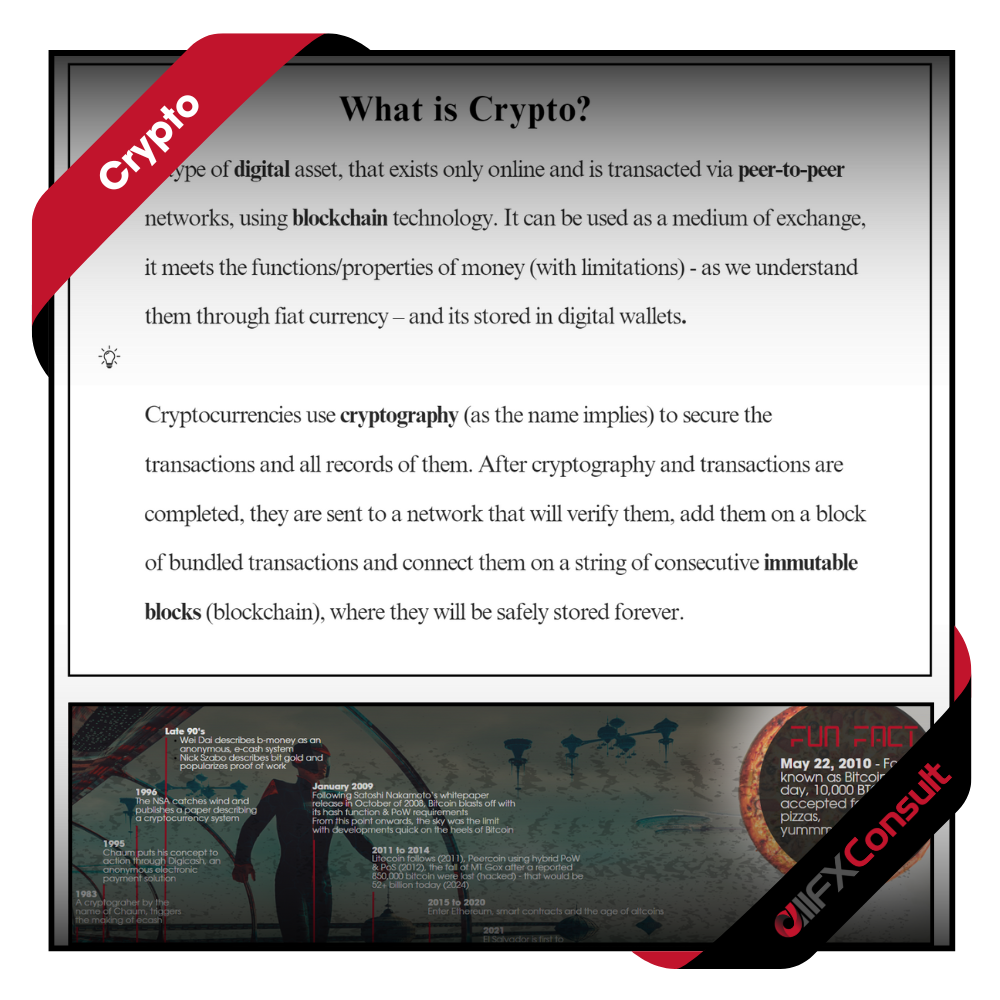

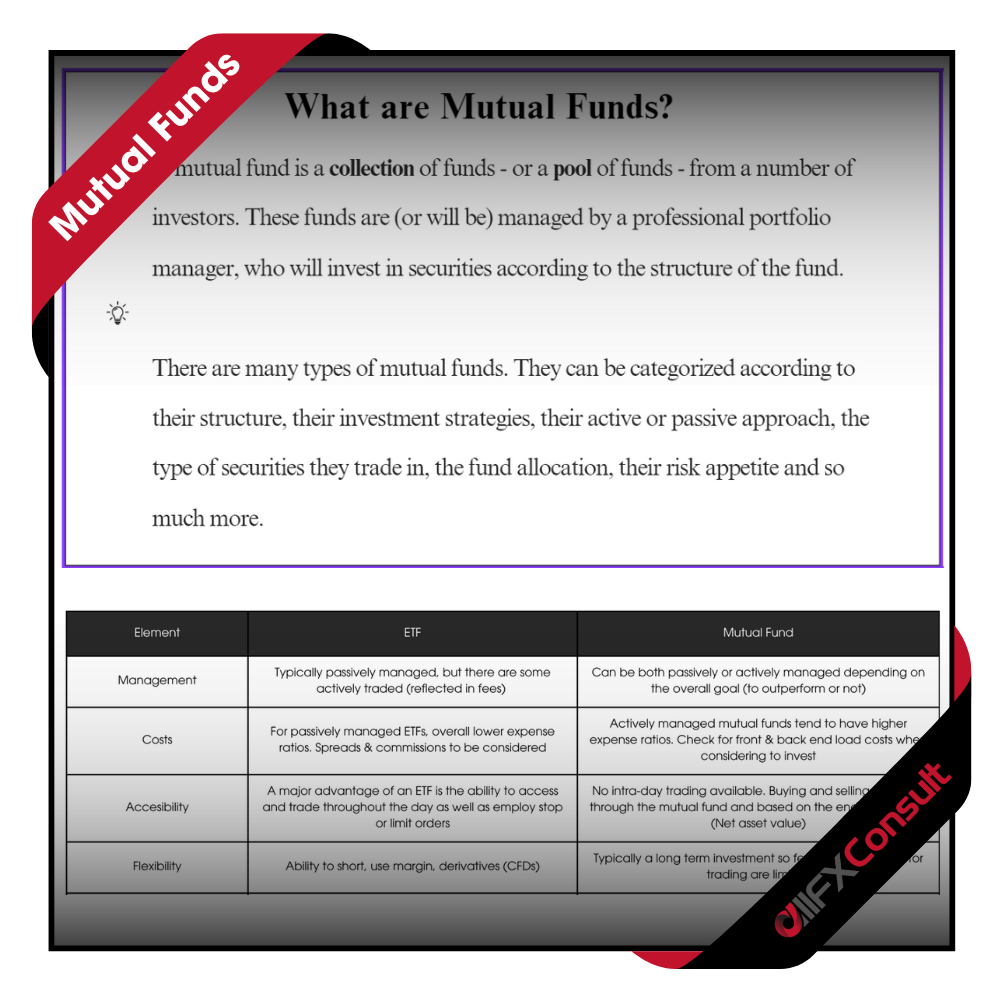

Forex, Stocks, Bonds, Commodities, Indices, ETFs, Crypto, Funds

a collection of resources for anyone

Now that we know our asset classes

let’s look at trading terminology

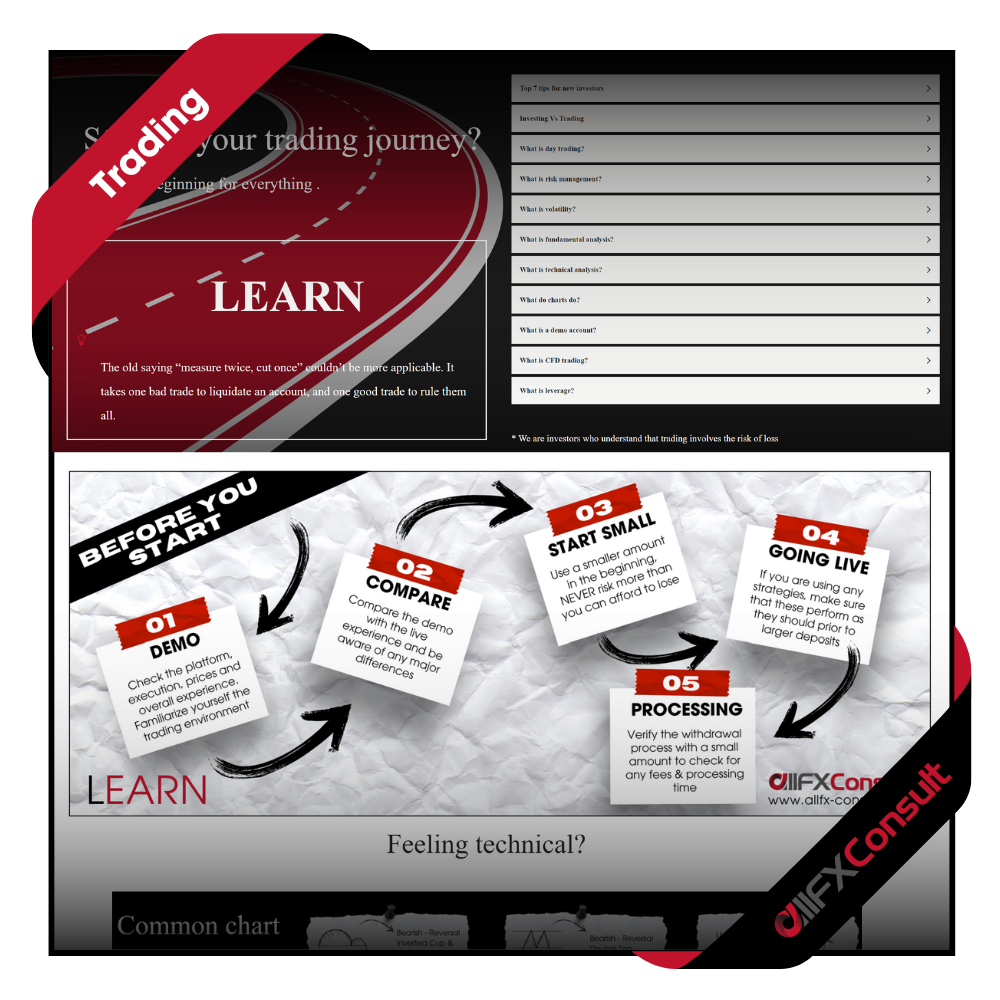

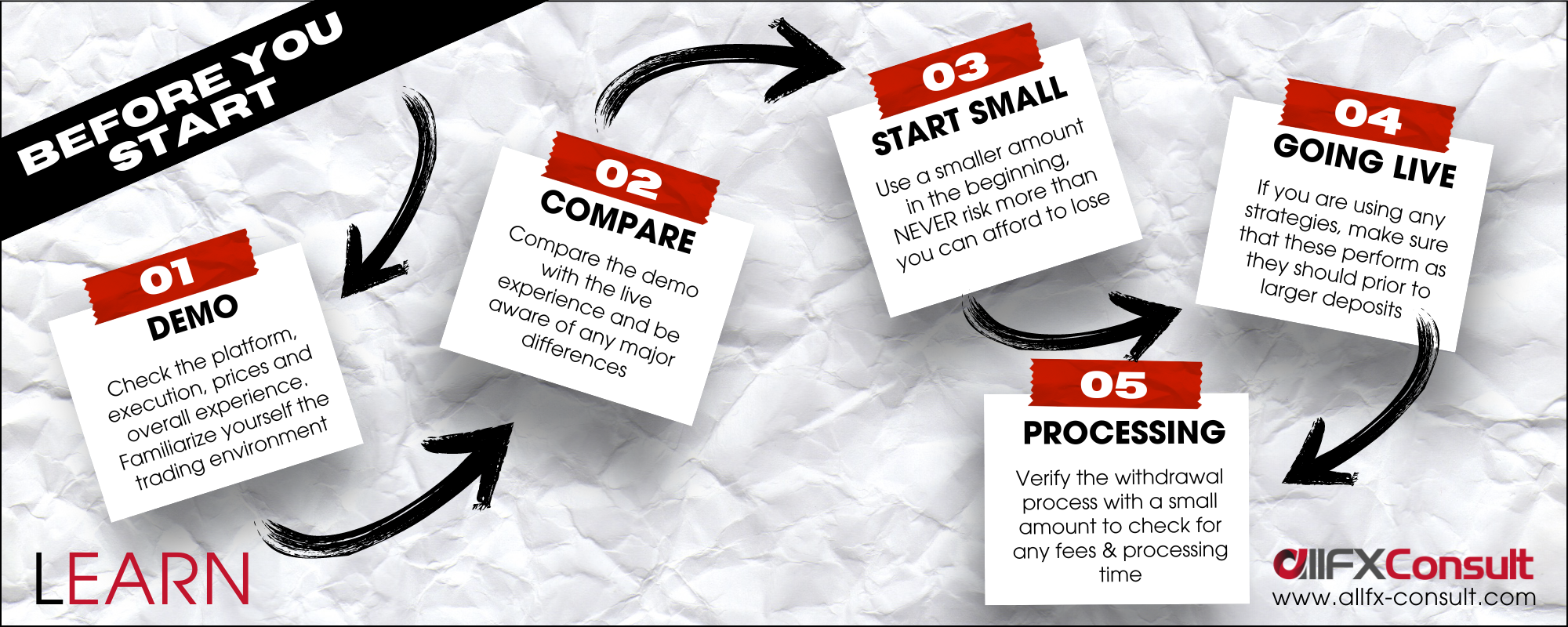

Starting your trading journey?

There’s a beginning for everything .

* We must all be investors who understand that trading involves the risk of loss

Remember

Already on the road?

Map your direction

* We must all be investors who understand that trading involves the risk of loss

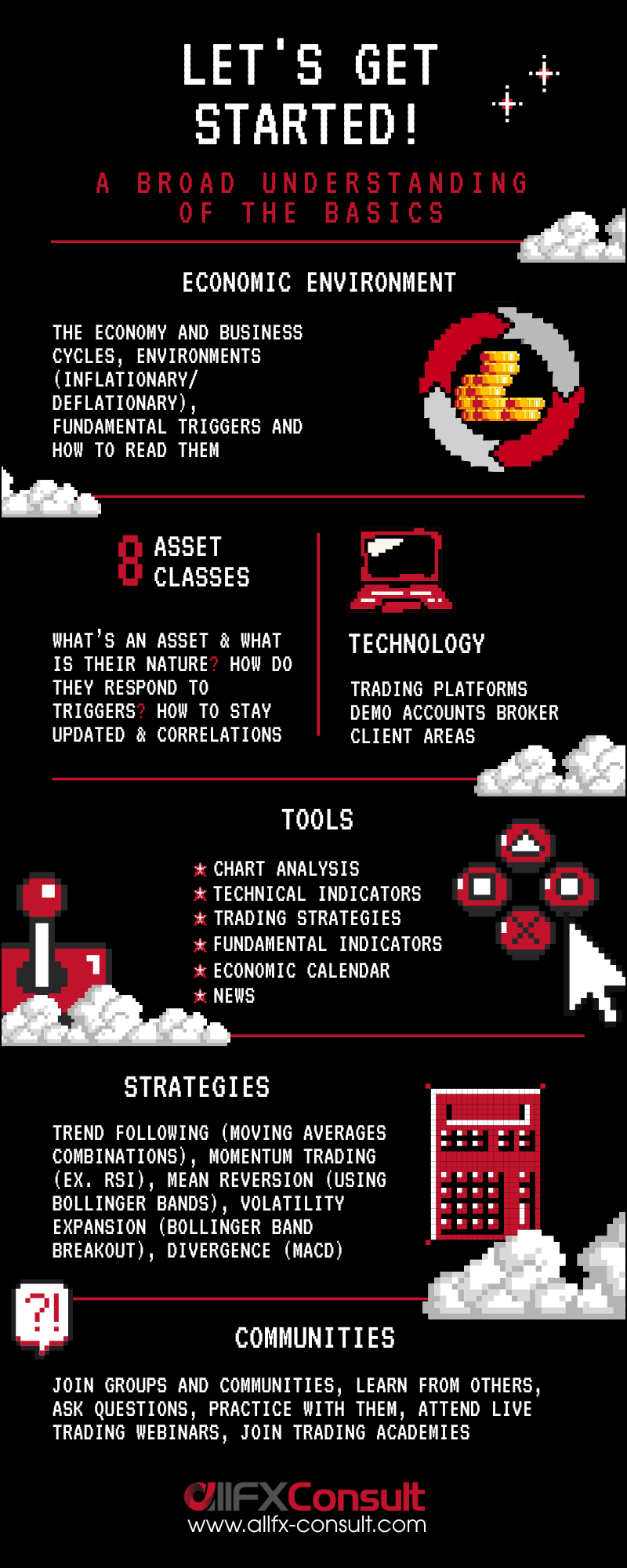

There are thousands of groups that trade the same way you do. Become part of their environment, exchange ideas and experiences, learn from one another. Find a mentor that has no conflict of interest with your account, and harness their experience.

Not all markets need to be traded. Focus on what’s right for you and your account. Diversification doesn’t mean to trade all instruments. Have your sights on what’s important at the given time and keep things simple.

Technology evolves. Trading evolves. Markets evolve and change behavior depending on the economic conditions. Constant learning and improving, is the difference between a flat account and an active one.

Trading essentials

that secure a good start

A broader understanding

A broker with a platform

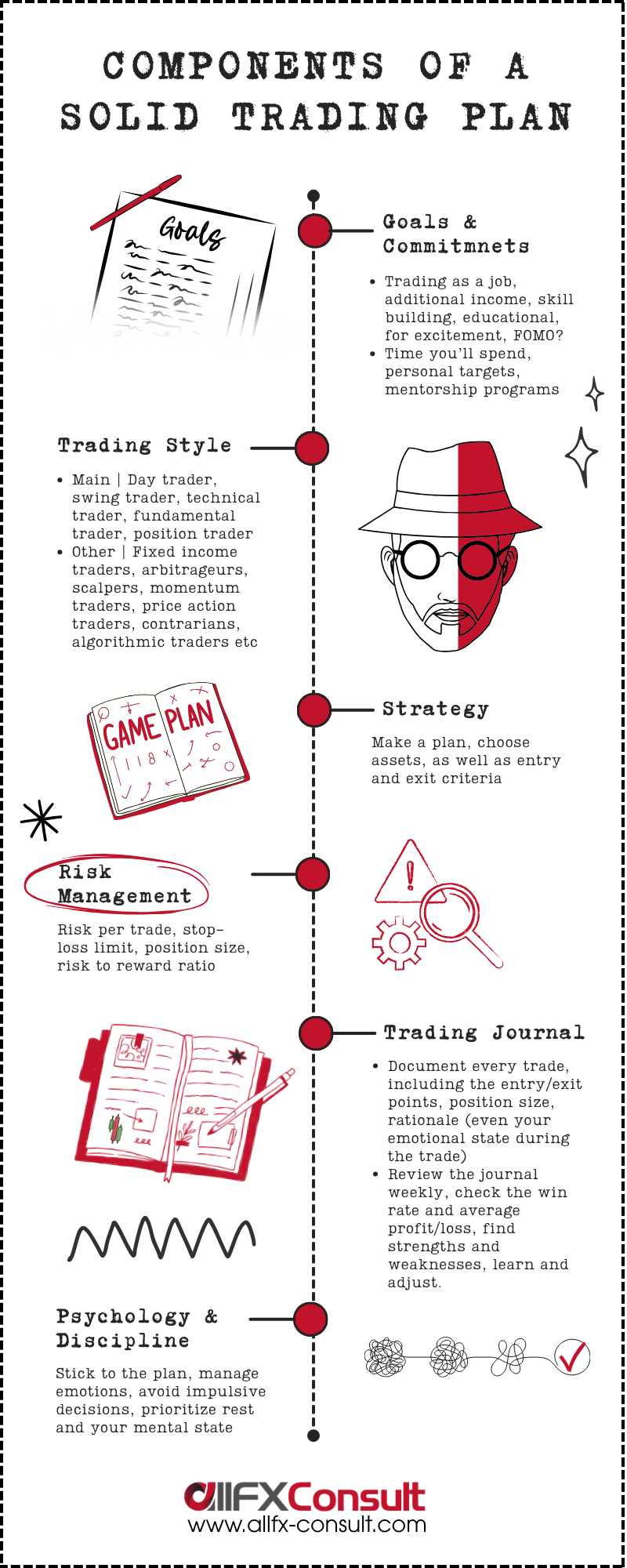

A solid trading plan

What is risk in trading

the possibility of losing some or all of the invested capital

Demo account

Practice before going live

Risk per trade

1-2% of capital

Risk on all open trades

5% of capital

Risk to reward

1:2 or 1:3

Daily/weekly loss limits

If reached, stop trading

Stop-Loss

Automatic close (at loss)

Take-Profit

Automatic close (at profit)

Leverage

Higher risk/reward

Impulse, avoid

Overtrading, revenge trading

Stay current

News, alerts, reports

Hedging

Offset positions

Diversification

One loses, another gains

Market risk

Markets can be affected by a variety of exogenous reasons, causing sudden moves and spikes. Uncertainty triggers volatility, and the result might not allow a strategy to perform as expected.

Liquidity

The trades are affected by the volume of transactions at any given time. Not enough liquidity, increases commissions, increases volatility due to sudden spikes, and slows the environment.

Leverage

Speculated trading has leverage in its core. Many traders favour higher leverage, since it allows bigger position sizes with smaller margins. The higher the leverage, the higher the risk (or reward).

L&D

Trading the markets is comprised by multiple elements. Since no one can predict with 100% accuracy what will happen next, the least we learn and develop, the worse our chances to do well.

Operational

Trades are executed over an online trading platform, that sits with a broker. Platforms themselves might encounter issues, there could be internet connectivity problems, or human error.

Impulse

10+ stages of emotions have been recorded to understand trading psychology. Fear and greed are the biggest culprits of impulsive decisions and they are very difficult to control lowering results.

Regular stop-loss

Predetermined limit to automatically close a position at the expected loss.

Problem: Doesn’t guarantee the close, exactly the set limit (because of slippage).

Slippage: When markets move faster than a requested price, the market gap fills the trade at the next available option (can be positive or negative).

Guaranteed stop-loss

Same as the normal stop-loss, but limit is guaranteed. Slippage doesn’t matter when stop-loss is guaranteed by the broker.

Problem: Broker might charge a fee for the tool.

Trailing stop-loss

Predetermined distance from the current price. Moves together with the price.

Problem: No problem here. The stop-loss can result in a profit if the market moves in the direction of the trade.

How do traders analyze the markets?

Technical and Fundamental analysis

Technical analysis

Technical analysis is the way traders study markets, to predict future price movements using past price data and patterns, by focusing on charts, price trends, and technical indicators.

This method is useful for all asset classes (stocks, forex, cryptocurrencies, and commodities). Beginners can start by learning basic charts, then move to indicators, patterns, and more advanced strategies.

It’s important to note that, technical analysis considers that all element are already factored in the current price, that trends are your friends and that history tends to repeat itself.

Technical analysis does not guarantee profits. It is a tool that increases probabilities. Combining it with risk management and trading discipline, it becomes a powerful tool.

Tools used:

-

Charts: Candlestick, line, bar, heikin ashi

-

Indicators: Trend, Volatility, Momentum, Volume

-

Support and resistance: Identify concentration zones (supply/demand)

-

Patterns: Double tops, head & shoulders, triangles for reversals or breakouts

Fundamental Analysis

Fundamental analysis is the way traders analyze factors other than price action, to examine an asset’s “real value”, to help them predict their influence on future price moves.

Instead of looking at charts and historical prices, fundamental analysts look at external events (politics, geopolitics, economic indicators, industry trends, as well as the financial statements of companies.

Top-down fundamental analysis: Taking the bigger picture first, a broader view of the economy before narrowing it down to a specific company.

Bottom-up fundamental analysis: Taking a company’s news and financial statements, and broadening out to exogenous factors that could affect the price.

Tools used:

-

Financial statements: Balance sheet, income statement, cash flow, top/bottom line

-

Valuation metrics: Revenue, Price-to-Earnings, Debt-to-Equity, Free Cash Flow

-

Macroeconomic data: Interest rates, inflation, GDP, retail sales, PMI

-

Governance: Ownership, leadership, ESG, innovation, risk management

Technical analysis

Historical data are used to forecast future price moves. All market information, is already reflected in the price

Uses mainly past market data, on price and volume

Mostly forecasts short to medium-term outlooks

Technical tools like charts, technical indicators and patterns

Mostly used by day traders or swing traders

Fundamental analysis

External (politics, geopolitics, economy) as well as internal (financial statements) factors analyze an asset’s real value

Uses mainly economic calendar and company statements

Mostly forecasts medium to long-term outlooks

Metrics (P/E, D/E), earnings reports and economic data

Mostly used by position traders and growth investors

Here’s how it all looks like

charts, calendar, market watch

Wondering how to read the calendar, and what all these indicators mean? Visit our large database of fundamental indicators

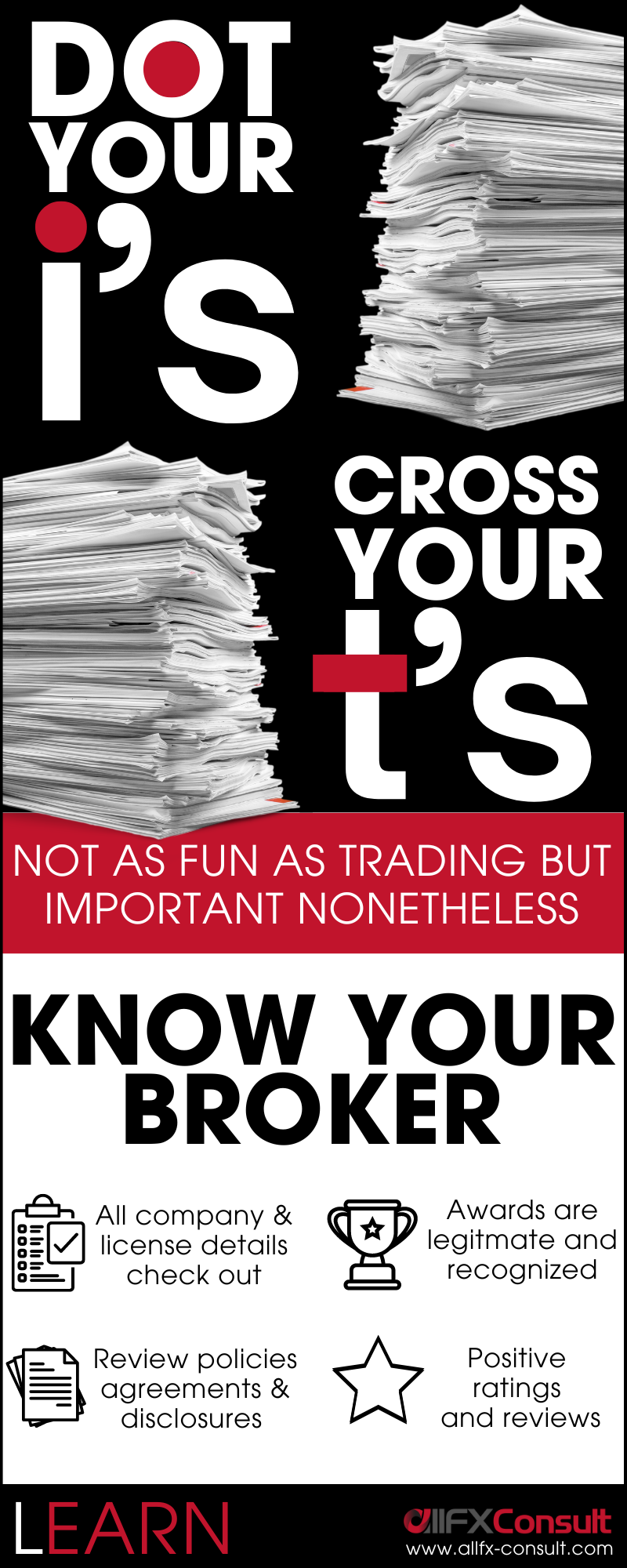

Finding the right broker is not so simple

But when the match is found, the possibilities are endless

Thinking of monetizing your network?

Questions, thoughts, support?

Our team is available 24/7