When is a White Label not the right choice for your Forex Brokerage?

When your client base can’t support it

When you don’t have enough funds to scale

When you don’t have the capacity to grow

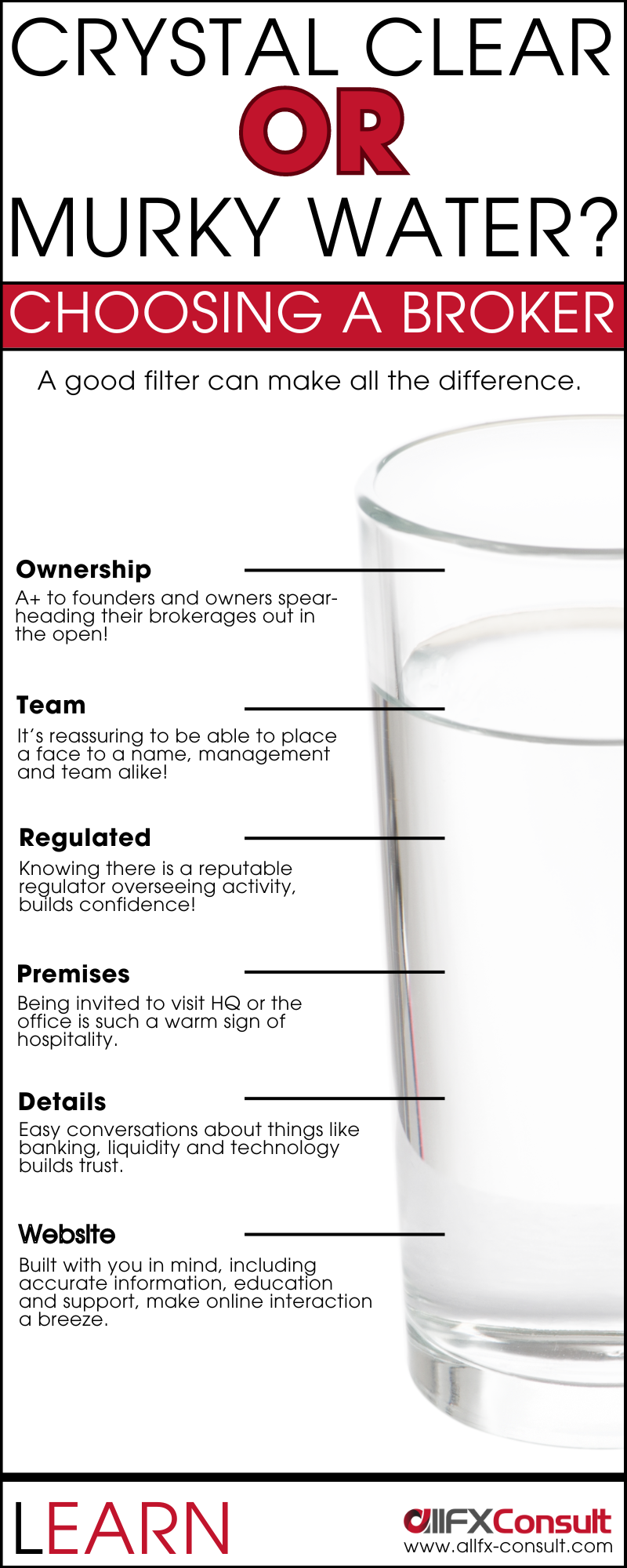

When you don’t have enough information

Is a White Label the right choice for your forex brokerage?

So many options but there can be only one

Partial Vs Full Forex White Label

A double edge sword for any brokerage

A partial Forex White Label is only a brand. Because it holds no regulation it cannot hold client funds, it cannot direct liquidity, it cannot approve compliance functions on its own and it cannot rest data on its own CRM. It’s a great solution for startup businesses, that need low cost, high payouts and time to grow.

Partial Forex White Labels can get better terms of business because the established broker controls the majority of operations. The risk for the WL provider, is limited to the solicitation methods implemented by the PWL.

This is scrutinized heavily by the forex White Label provider, who can discontinue the partnership if the partner is in breach of terms. If the provider doesn’t take action, it faces penalties from its regulators, or even worse, the withdrawal of its license(s).

Good communication is a must from the beginning and its a harder deal to strike than a full Forex White Label. Some forex White Label providers, might opt to give better terms and support through an Introducer Broker program due to its similarities, to avoid the complexities of a partial White Label.

A full forex White Label is not just a brand. To be eligible, it requires regulation that allows the company to hold client funds, it can direct liquidity, it can approve compliance functions and it can rest data on its own CRM with complete anonymity from the WL provider.

It can be a challenge for established brokers to White Label their trading platforms, due to the workload and risk associated, so interested parties should have existing business and a solid plan (already in place) that benefits both parties.

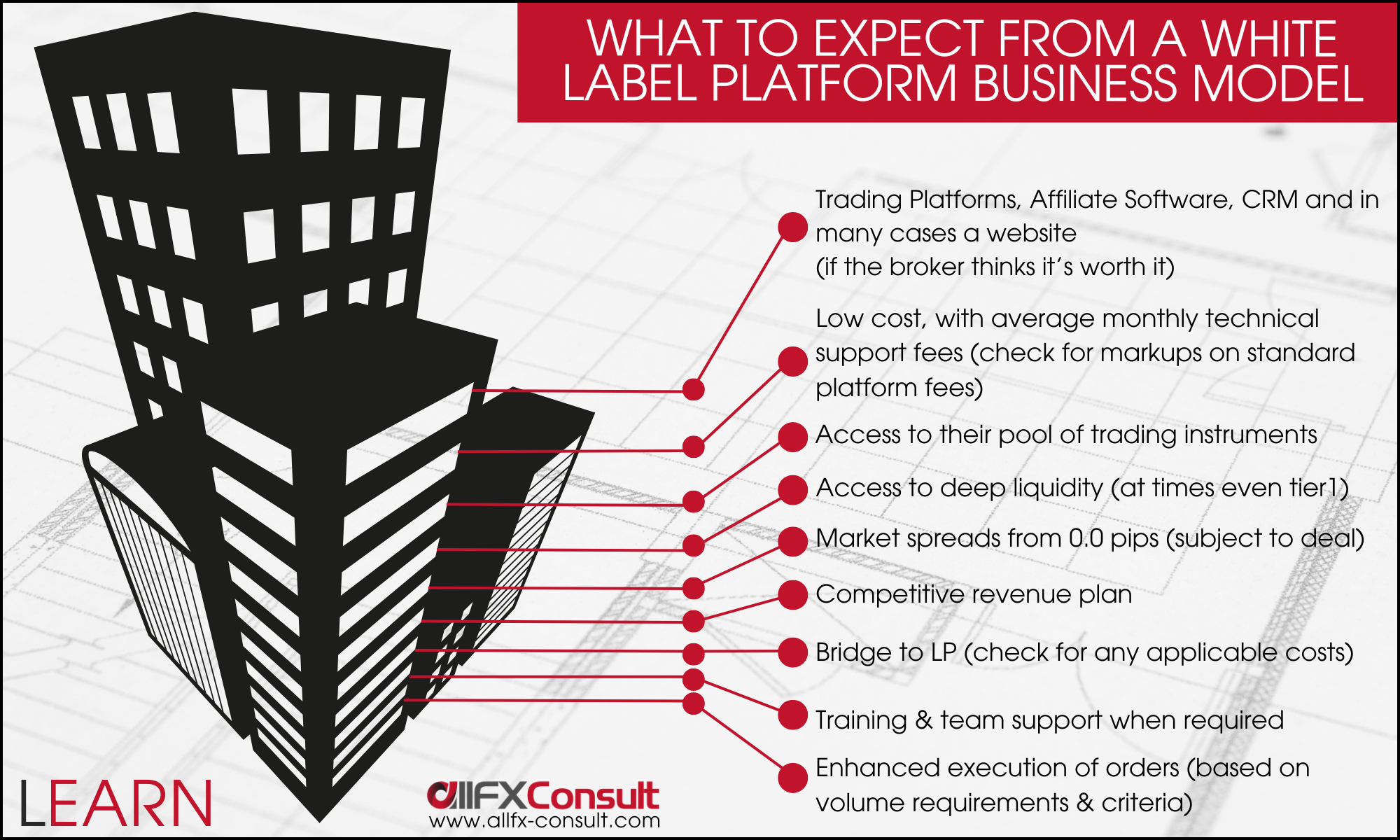

In a nutshell, the full White Label forex broker will receive a branded trading platform, price feed for instruments required, support with functions such as liquidity, back end systems, order processing, payment methods, even marketing and sales in a mutually beneficial deal.

Last but not least, any interested party should learn all about legal and compliance, search for expert partners (internally or outsourced), choose carefully for the right partner, decide on technology that caters to their specific market (region) and understand the costs of both setup and maintenance of the business.

What added costs should worry a forex White Label?

What costs does a Forex White Label have?

The cost depends on the provider, sometimes from the platform developers themselves such as the case of Metaquotes. At the time being, Metaquotes has 3 packages and charges a fixed monthly fee that ranges between $7,500 - $20,000.

Technology

The scope of business, the target market, all other costs, the profitability and feasibility needs to be accounted prior to deciding where to setup the business.

Regulation

To deliver a message that is associated with a specific brand, takes time, resources and the right channels. In-house professionals or outsourced agencies come at a much needed cost that also needs to be accounted for.

Marketing

Risk Management tools and expert dealers to take good care of order processing are essential but also come at a cost that needs to be taken into account.

Liquidity

Each provider, whether credit card or e-wallet, has procedures and costs for onboarding that need to be accounted for in the business plan and depend greatly on the region of planned business.

Payments

Outsourcing is also an option, and allows for specialized support on specific functions like marketing, business development, compliance, training and administration.

HR

White Labeling removes hurdles, allowing you to focus on all-things income

Thinking of monetizing your network?

Our team is available 24/7