Commodities trading

The place to LEARN all about investing in commodities

It’s important to outline the key difference between commodities as an investable asset class, and other asset classes, prior to detailing the commodity categories. As opposed to assets like stocks and bonds which perpetuate only as financial contracts, commodities can be traded in their physical raw form.

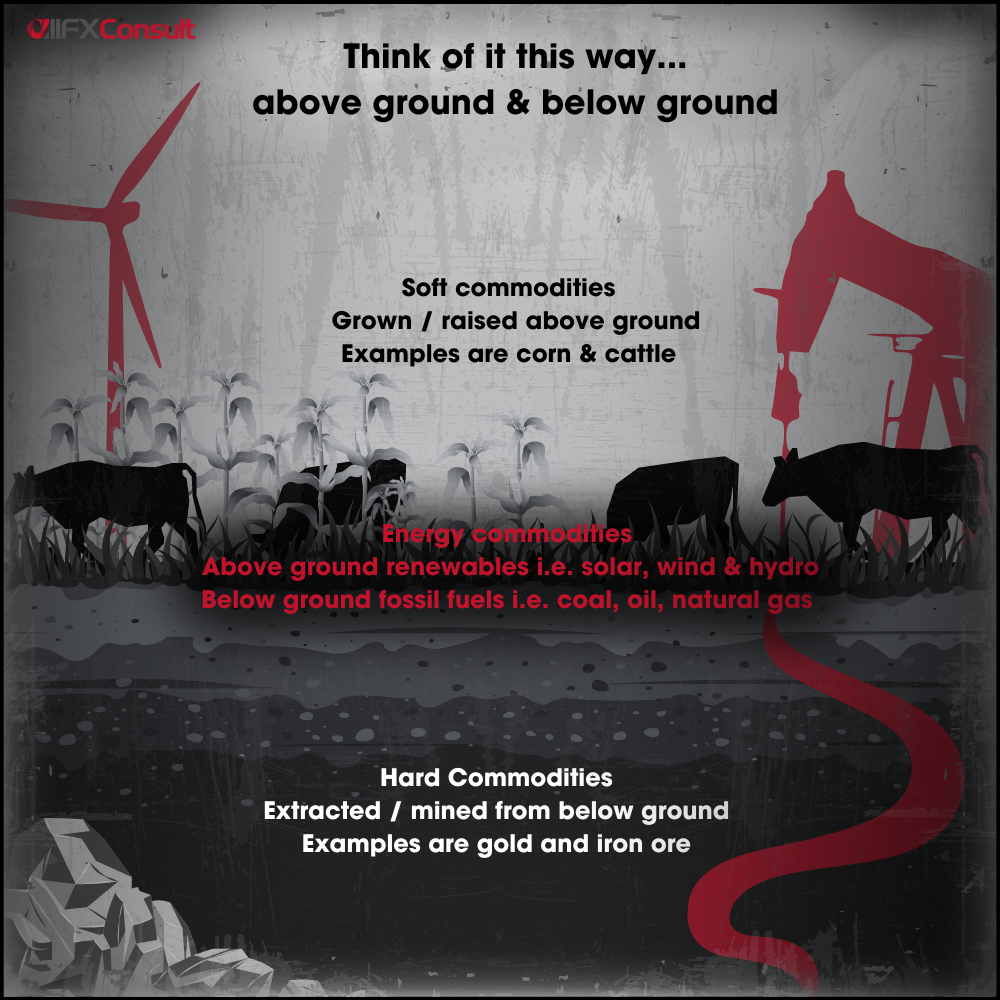

There are many raw materials classified as commodities. They can be categorized according to how they are produced or extracted. The three categories of commodities are Soft (agriculture), Hard (metals) and Energy.

Soft commodities which are cultivated or raised (grains and livestock), can experience price volatility considering the delicate nature of their production cycles. Cases of climate distress like drought, fires, heavy rain, storms, floods, as well as insects, disease, pandemics and other natural elements can all prove catastrophic for crops and livestock.

Due to the above-mentioned factors, as well as the logistics of handling a physical asset such as the complex supply chain, transportation, insurance, special storage, time decay and others, really differentiate trading and investing into this commodity class.

Below we outline 6 categories of soft commodities, with their contract specifications.

Oil seeds

Canola: Abbreviation of Canadian Oil Low Acid. Also known as rapeseed, it’s the 3rd largest source of vegetable oil. Canola is a type of rapeseed bred by Canadians, with low erucic acid (toxic to the heart at high doses). Belongs to the family of Brassicaceae or cruciferous (broccoli, cabbage, cauliflower, radish). Major producers are Canada, India, China, Australia, Russia and the EU.

Cotton: Cottonseed oil is used to make vegetable oil. Accounts for 35% of all fibres (like flax, hemp, bamboo, sisal and jute). Biggest producers are China, India and the US. From 50 cotton plant types, only 4 are domesticated. These are Gossypium Hirsutum (upland cotton – approx. 90% of global consumption, also makes margarine), Gossypium Barbadense (Egyptian cotton Gossypium Arboretum (tree cotton) and Gossypium Herbaceum (levant cotton).

Palm oil (USD Malaysian Crude): An edible oil from the fruit pulp of African (Elaeis guineensis) and American (Elaeis oleifera) palm trees. Palm trees also produce kernel and coconut oil which are different types of oils. Plam oil is the most traded oil in the world, followed by sunflower seed, soybean and rapeseed. Biggest producers are Indonesia, Malaysia, Thailand, Colombia and Nigeria.

Soybeans: Extracted from the soybean (glycine max) seeds. After palm oil, it has the highest consumption (both as vegetable and cooking) oil worldwide. Biggest producers include China, the US, Brazil, Argentina and the EU. Argentina introduced “soy dollar” to promote more production of soybeans, by guaranteeing an above market peso ARS/USD price.

Cereal grains

Wheat: There are 6 classes of wheat in the US (by colour, hardness and growing season). Hard Red Winter and Hard Red Spring (60% of total US produce for raised dough products), Hard White, Soft White (15% of produce), Soft Red Winter (23% of produce for cakes and Durum (premium wheat used for pasta). Biggest producers include China, India, Russia, US and France.

Corn/maize: Corn (sweet corn) is in the same family of maize with a difference in how sweet it is. There are various varieties with differences in sweetness and colour. Corn can be sold fresh, frozen or canned. Biggest producers include the US, China, Brazil, the EU, Argentina and Mexico. Other than food, it is used in beverages, for animal feed, biodegradable materials and fuel ethanol.

Oats: A grain with high soluble fiber content, with anti-inflammatory properties, consumed both by humans and animals. Biggest producers include the EU, Russia, Canada, Australia and the US. South America (Brazil, Chile and Argentina) are also heavy producers. Oats compete with corn in terms of price (when one rises, farmers turn to the other).

Barley: The world’s oldest cultivated grain. EU is the largest producer, followed by Russia and Australia. Still grown but replaced largely by corn although barley is richer in protein. A big portion is produced to create malt for beer, whisky, malted milk, malt vinegar, Maltesers, malt loaf, flour and bagels, while the rest is used for livestock feed.

Rough rice: Rice is classified according to its milling state. Rough (or paddy) rice still has its husk, brown rice doesn’t have a husk but retains its bran layer and germ (pericarp) after milling, semi or wholly milled rice has its pericarp partially or completely removed using special tapering cylinders and broken rice is damaged white rise from the milling process (used for baby formulas, rice cereal and flour). Biggest producers include China, India, Bangladesh, Indonesia and Vietnam who are also the biggest consumers.

Meat

Lean hogs Pigs that reach 120kg (or 250 pounds), which is the minimum slaughter weight. It takes around 6 months to get to this size. Biggest producers are China, the EU, the US and Brazil. A pork “cutout” uses prices paid for wholesale cuts of pork like the loin, butt, picnic, rib, ham, and belly.

Feeder Cattle refers to feeder steers (castrated males) that are small cattle (600-800 pounds) that are fed with corn and other grains, to reach the size of “live cattle”.

Live cattle are steers (male) or heifers (female) cattle that reached a size of 1,200-1,400 pounds (finished product). Byproducts of livestock include the hide (leather, felt), Organs (for food, oil, gelatin), bones/hooves (fertilizers and bone products).

Softs

Frozen Concentrated Orange Juice (FCOJ): FCOJ is the byproduct of an industry challenged with the perishability of fresh orange juice. It was introduced in 1947. Biggest producers include Brazil, Mexico, the US, the EU and South Africa.

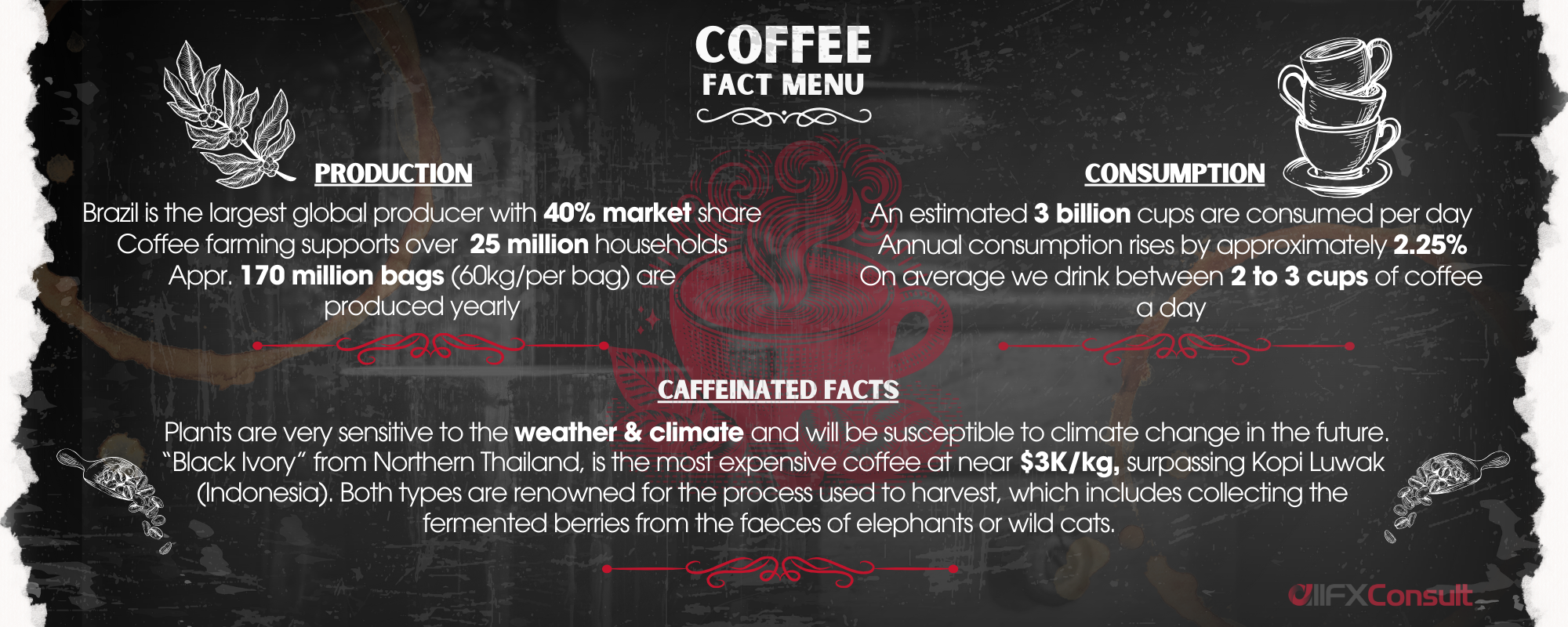

Coffee: From over 120 species of coffee plants, of the family Rubiaceae, the two most prominent are Coffea Arabica (approx. 70% of coffee production) and Coffea Canephora (30% of coffee production). Global production (and consumption) reached 11 million tonnes. Biggest producers include Brazil, Vietnam, Colombia, Indonesia and Honduras.

Cocoa: Cocoa beans are grown on the Theobroma cacao tree (native to the Amazon rainforest). The beans are cut through the middle and examined for mold, slate, insect damage and other defects and are graded as Good Fermented (GF), Fair Fermented (FF) and Fair Average Quality (FAQ). Cocoa is traded on ICE US, ICE Europe and CME Europe. 50% of cocoa comes from Cote d’Ivoire, Cameroon and Togo and 30% is processed in the EU, so futures contracts are now also denominated in Euro (other than GBP and USD).

Sugar #11: Sugar is extracted from sugarcanes and sugar beets. After the initial processing (crushing canes/slicing beets), the product is raw sugar that is unfit for human consumption until processed. Sugar #11 refers to raw sugar trades with some impurities. This is measured by polarization (or pol). Pure sugar measures at 100degrees, and the lower the pol, the more impurities it has. #11 has a pol of 96 degrees. Anything above that, is paid at a premium. Biggest producers include Brazil, India, the EU, China and Thailand.

Other softs

Rubber: Can be produced naturally (40% of global consumption) from the Havea Brasiliensis tree (the Para Rubber tree native to the Amazon), or synthetically (60% of consumption) using petroleum sources. The use of tapping (like with Maple trees) cuts the tree from where the milky sap comes out of. Biggest producers include Thailand, Indonesia, Vietnam, India and China.

Wool: One of the oldest textiles, derived from the fleeces of animals (primarily sheep),. Production starts with shearing, grading, cleaning, carded for imperfections, yarning, weaving, dyed and finished. The Australian Stock Exchange has 2 types of futures contracts, greasy (21 micron) and fine (19 micron). Microns measure the thickness of the wool. Merino is a sheep breed that is used as a standard quality wool, known for strength and durability.

Lumber: Wood processed into beams and planks (can be any length). It is graded as first/second (hardwoods), select (high grade softwoods and some hardwoods) and common (lowest grade). Lumber is a leading economic indicator due to its many uses in construction. When prices rise, its either due to stimuli like falling interest rates, or strong economic conditions that increase the construction sector demand.

If we had to choose one of the above soft commodities to pay special tribute to via an infographic, it goes without saying that it would be coffee.

Hard commodities, come second in hierarchy, in terms of how important they are for life, our societies and human survival all together. After soft commodities that secure our basic needs for food, hard commodities facilitate our way of life, protect us against the elements since they are needed in construction/housing, and they form the foundation of modern infrastructure (roads, bridges, transportation even space exploration).

When the demand for hard commodities increases, it’s typically an indication that an economy is doing well for all the reasons mentioned above i.e. industrial, manufacturing, construction, automobiles etc). Precious metals at the same time serve as a safe haven investment with applications across multiple sectors.

As a raw material, hard commodities also require handling such as complex supply chains, transportation, insurance, special storage, time decay and others, which also differentiate trading and investing into this commodity class.

Below we outline 11 types of hard commodities, with their contract specifications.

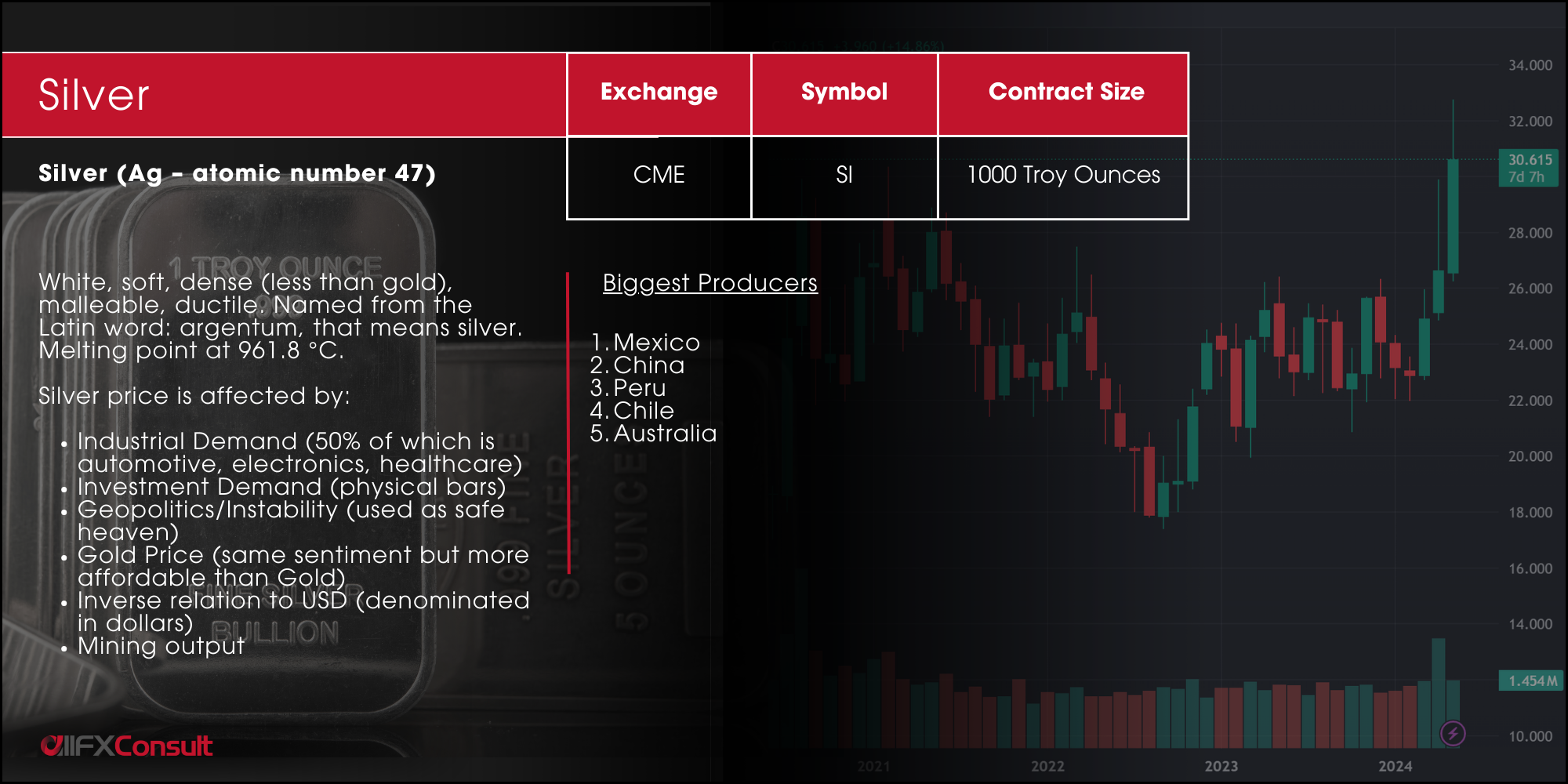

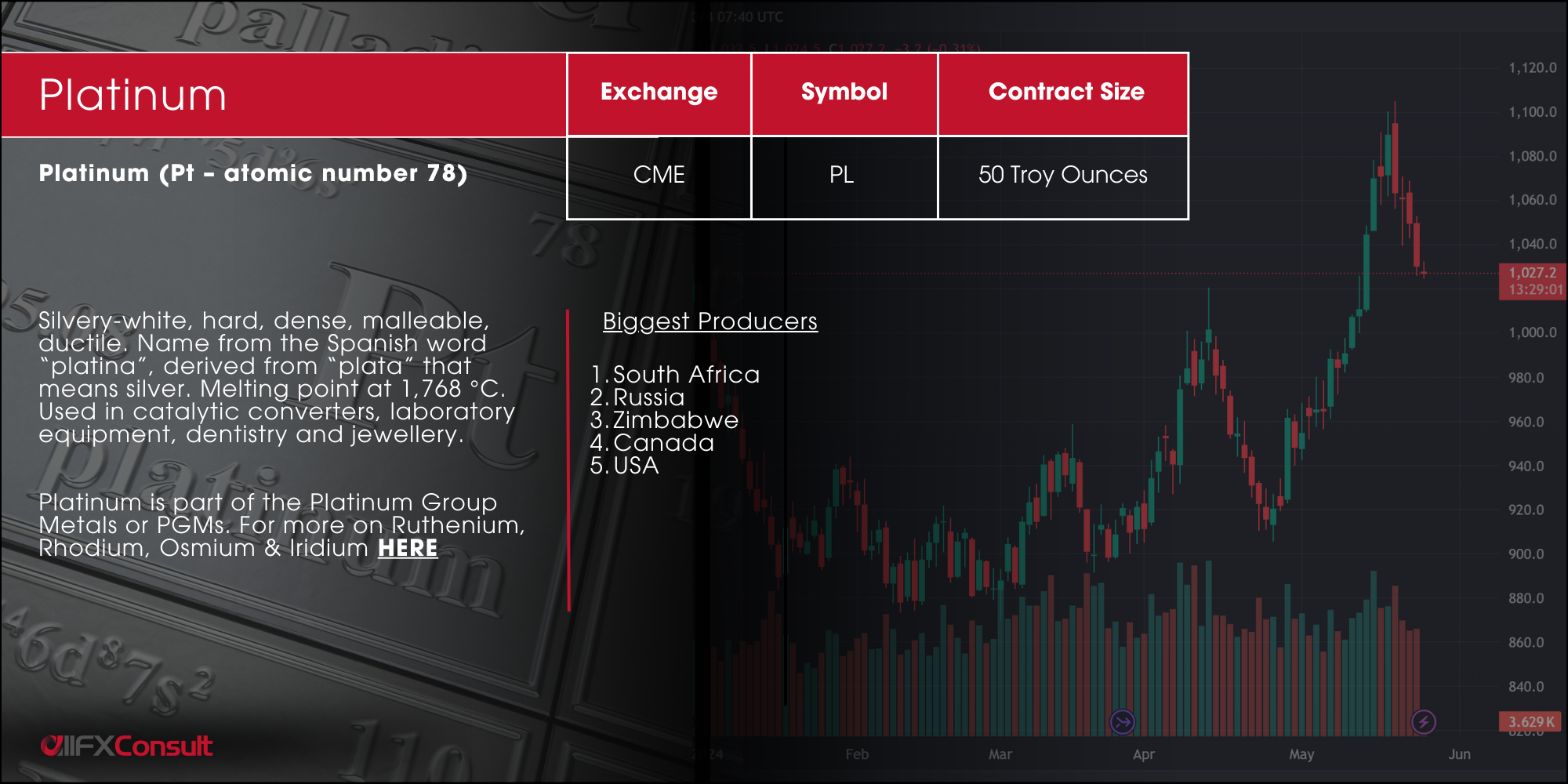

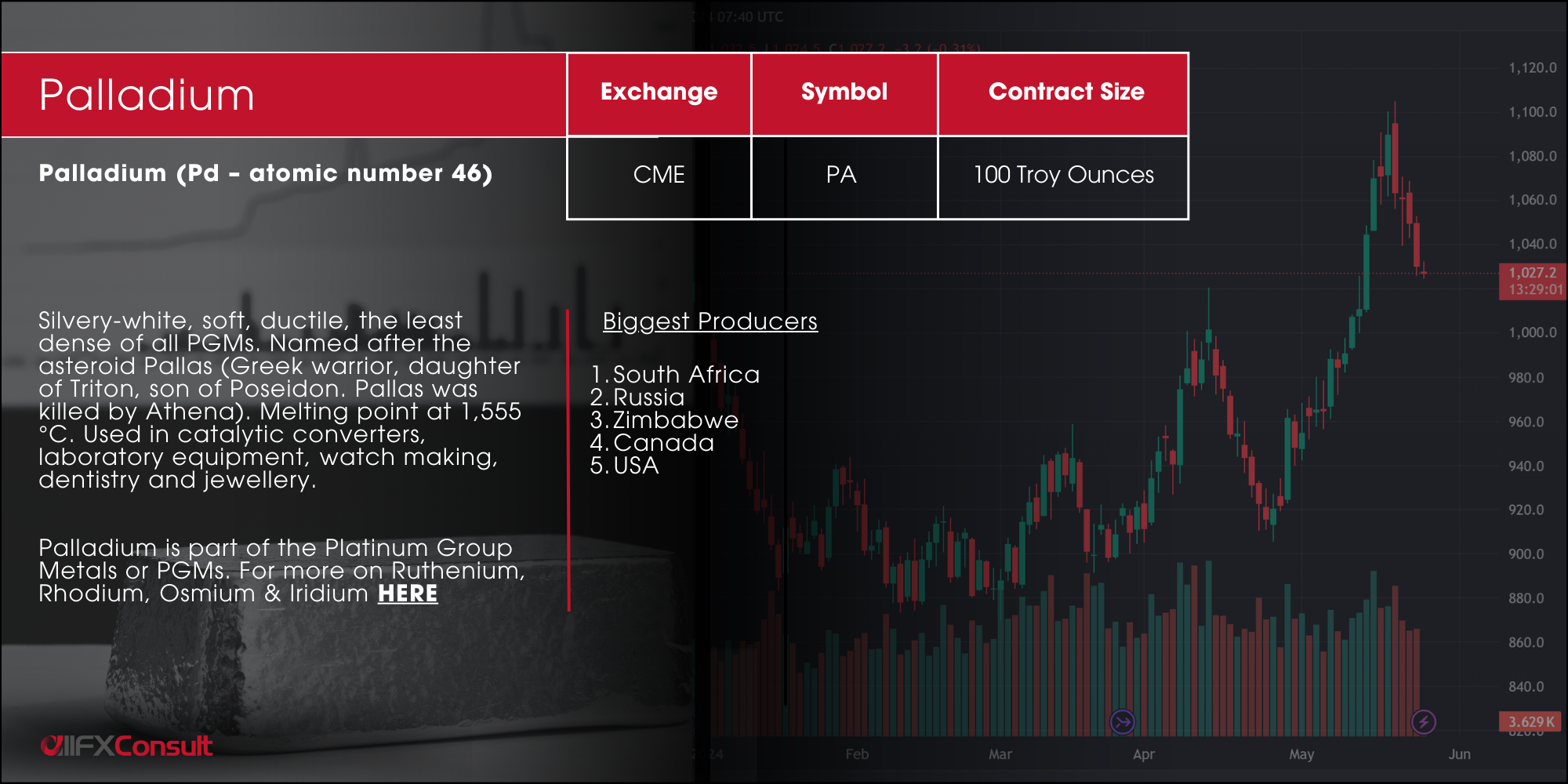

Precious Metals

Rare, highly valuable – economically – metals. Characterized by high demand as safe heaven investments as well as their applications in various industries.

Precious metals are classified as “noble” since they are corrosion resistant and found in nature in their raw form (except silver that can be found with sulphur).

Precious Metals

Rare, highly valuable – economically – metals. Characterized by high demand as safe heaven investments as well as their applications in various industries.

Precious metals are classified as “noble” since they are corrosion resistant and found in nature in their raw form (except silver that can be found with sulphur).

Precious Metals

Rare, highly valuable – economically – metals. Characterized by high demand as safe heaven investments as well as their applications in various industries.

Precious metals are classified as “noble” since they are corrosion resistant and found in nature in their raw form (except silver that can be found with sulphur).

Precious Metals

Rare, highly valuable – economically – metals. Characterized by high demand as safe heaven investments as well as their applications in various industries.

Precious metals are classified as “noble” since they are corrosion resistant and found in nature in their raw form (except silver that can be found with sulphur).

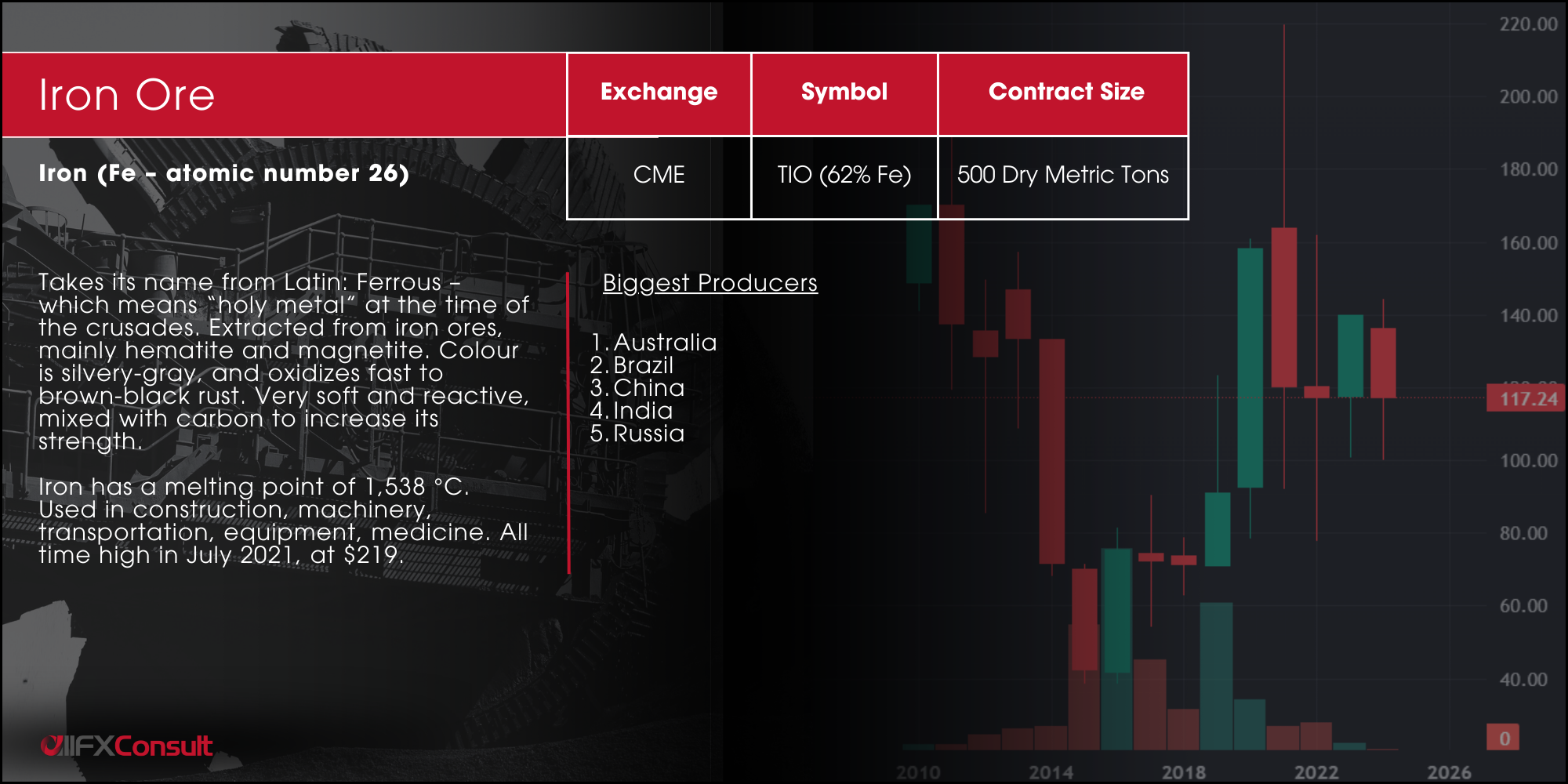

Iron ore

98% of iron ores are converted into “pig iron” used in steelmaking.

The term “pig iron” was coined when hot metal was cast into ingot moulds that were laid out in sand beds. The iron was fed from a channel connected with the moulds, and it resembled a sow (female pig) with her litter of feeding pigs.

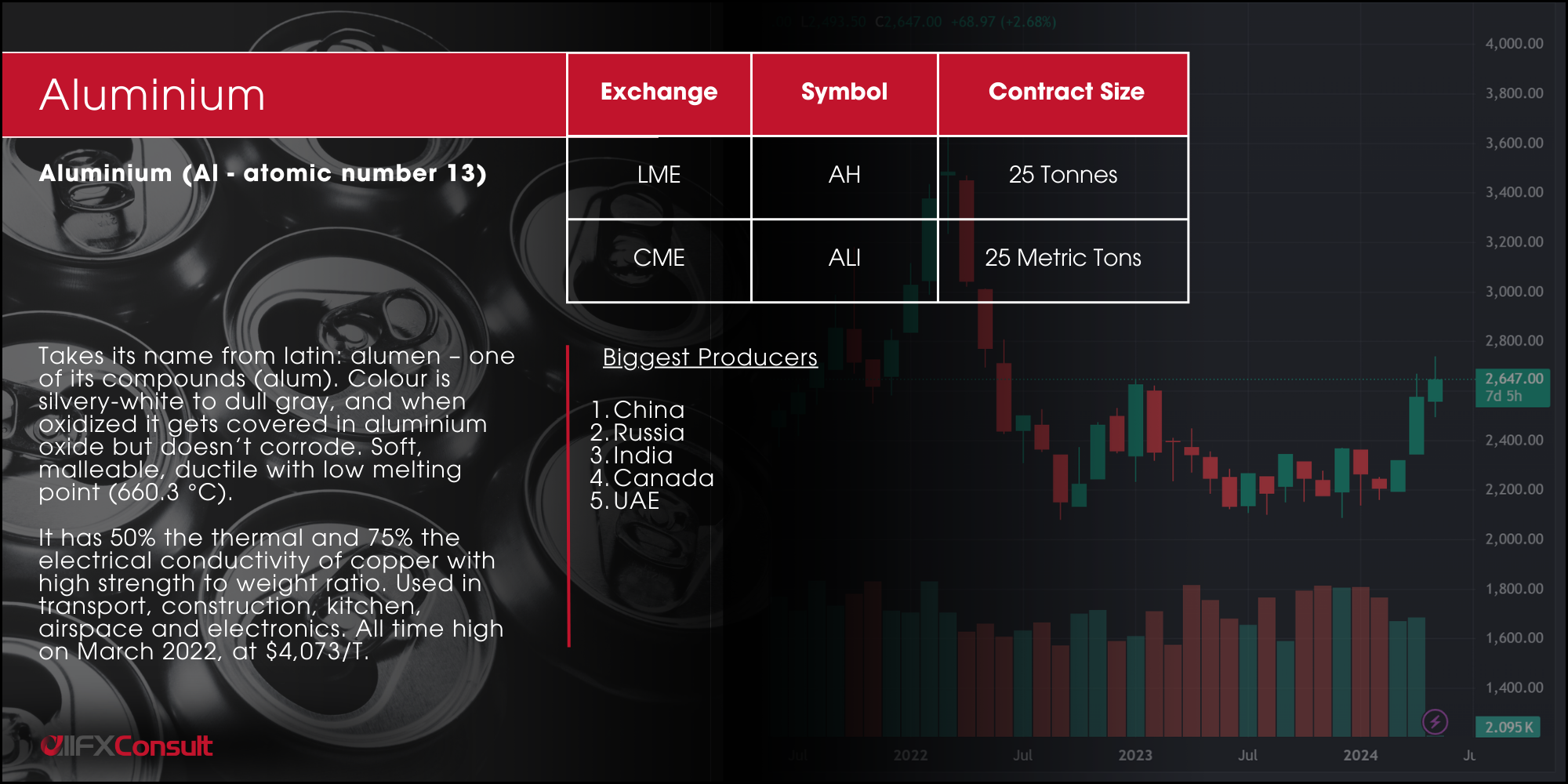

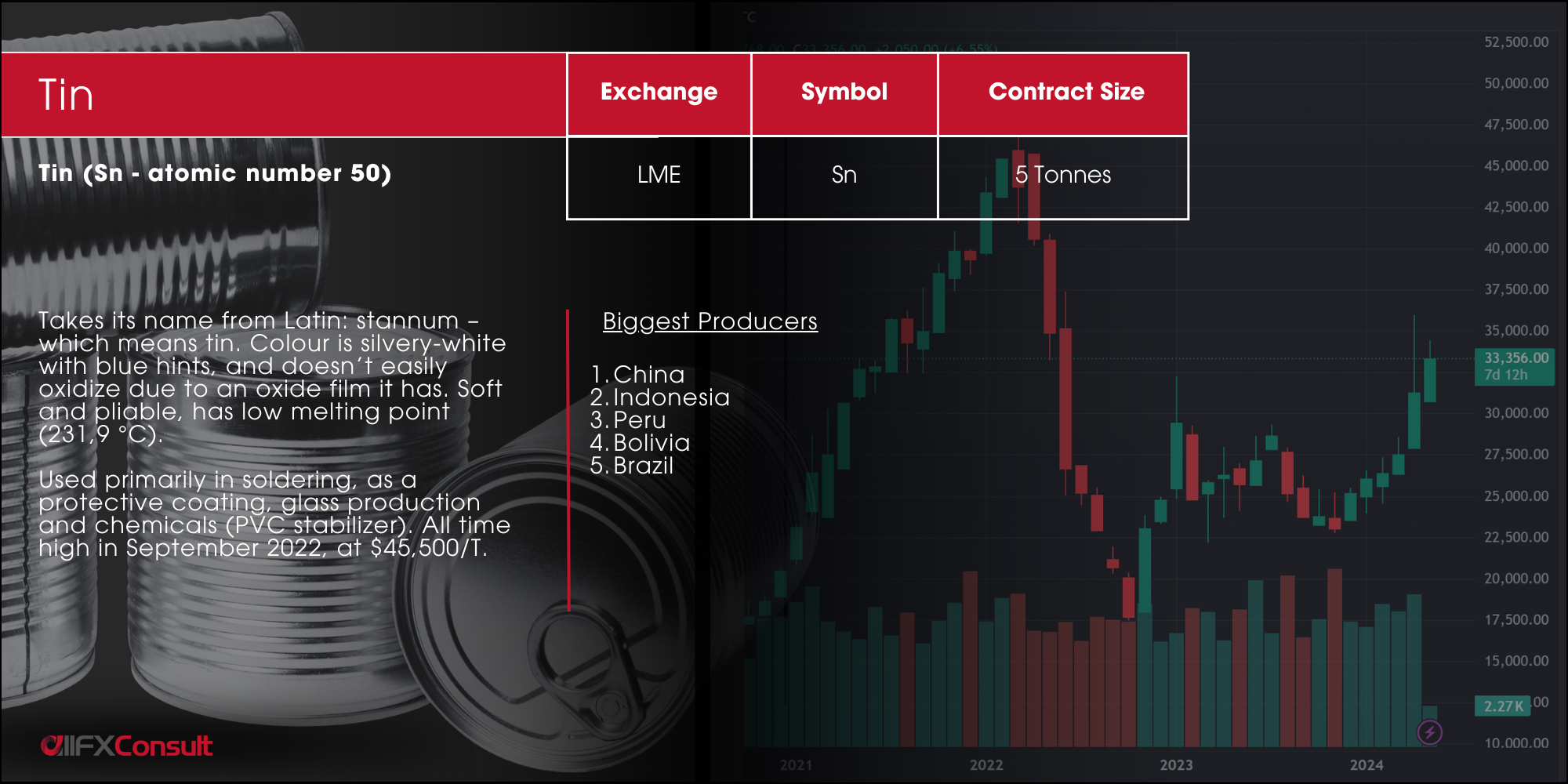

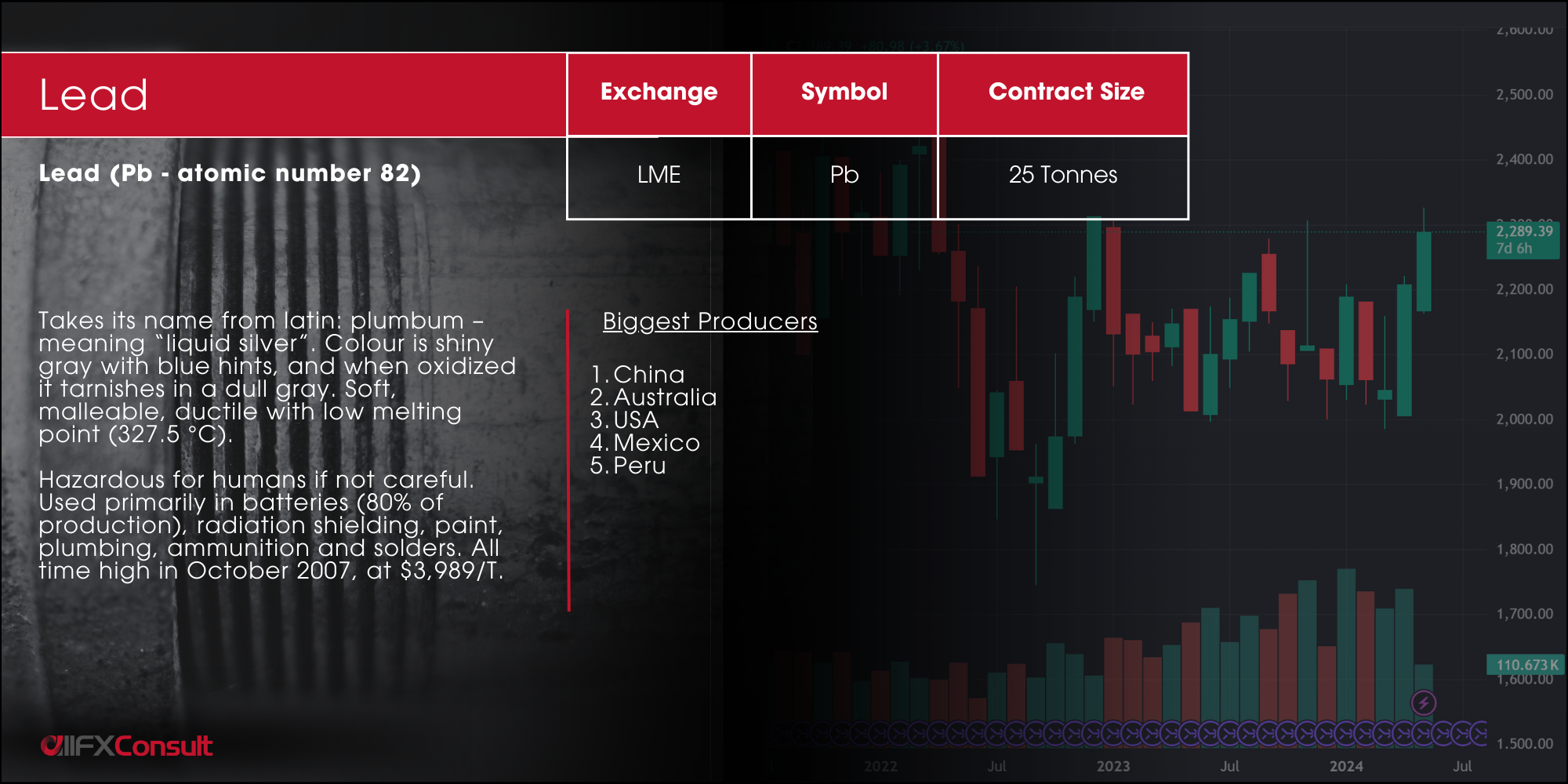

Base metals

Common, industrial, non-ferrous metals (they contain no iron). Nickel is the only ferromagnetic material (magnetized, even though its non-ferrous) (like cobalt).

Base metals are inexpensive relative to precious metals due to their abundance, but invaluable for global infrastructure, machinery and construction.

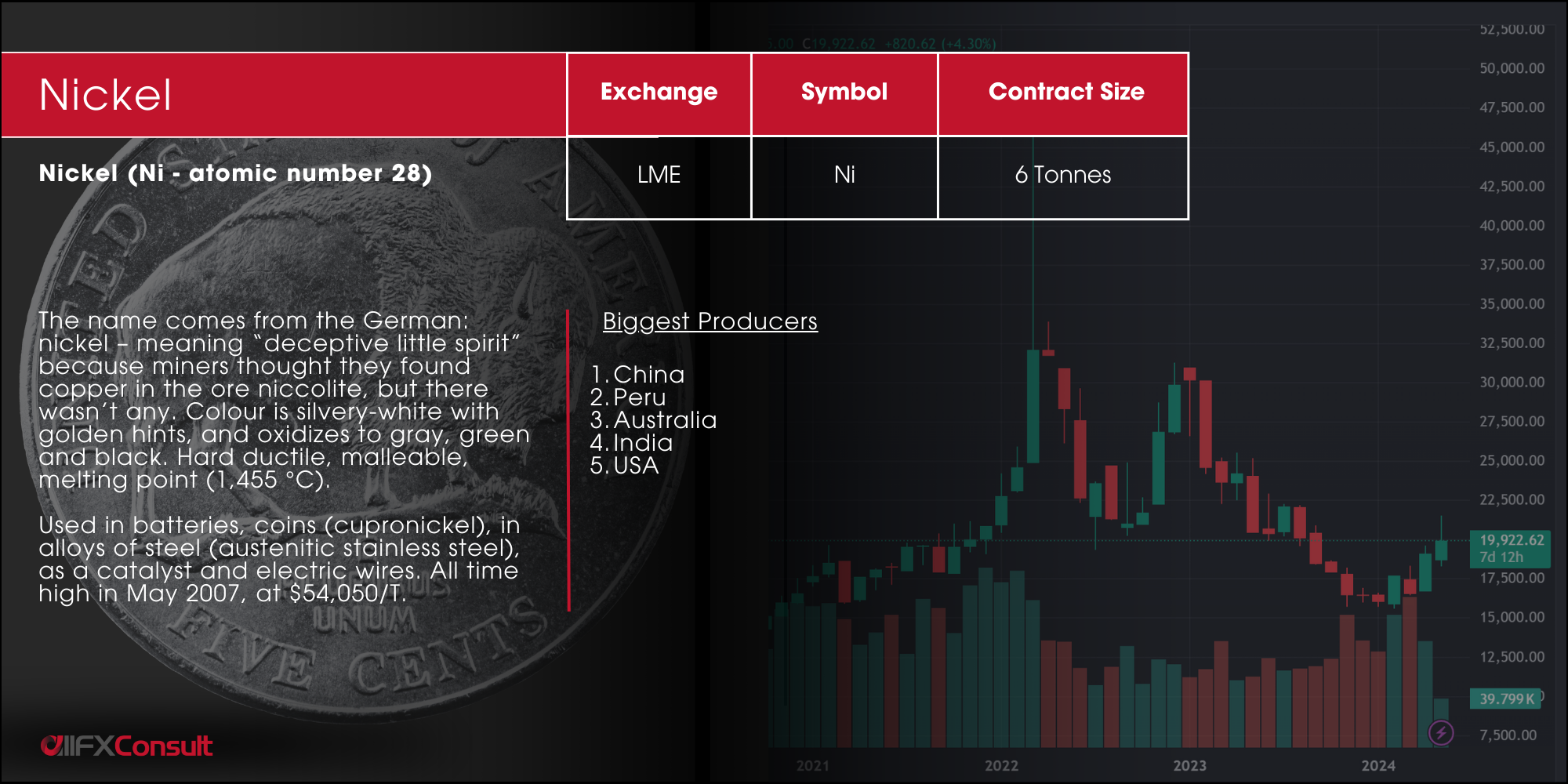

Base metals

Common, industrial, non-ferrous metals (they contain no iron). Nickel is the only ferromagnetic material (magnetized, even though its non-ferrous) (like cobalt).

Base metals are inexpensive relative to precious metals due to their abundance, but invaluable for global infrastructure, machinery and construction.

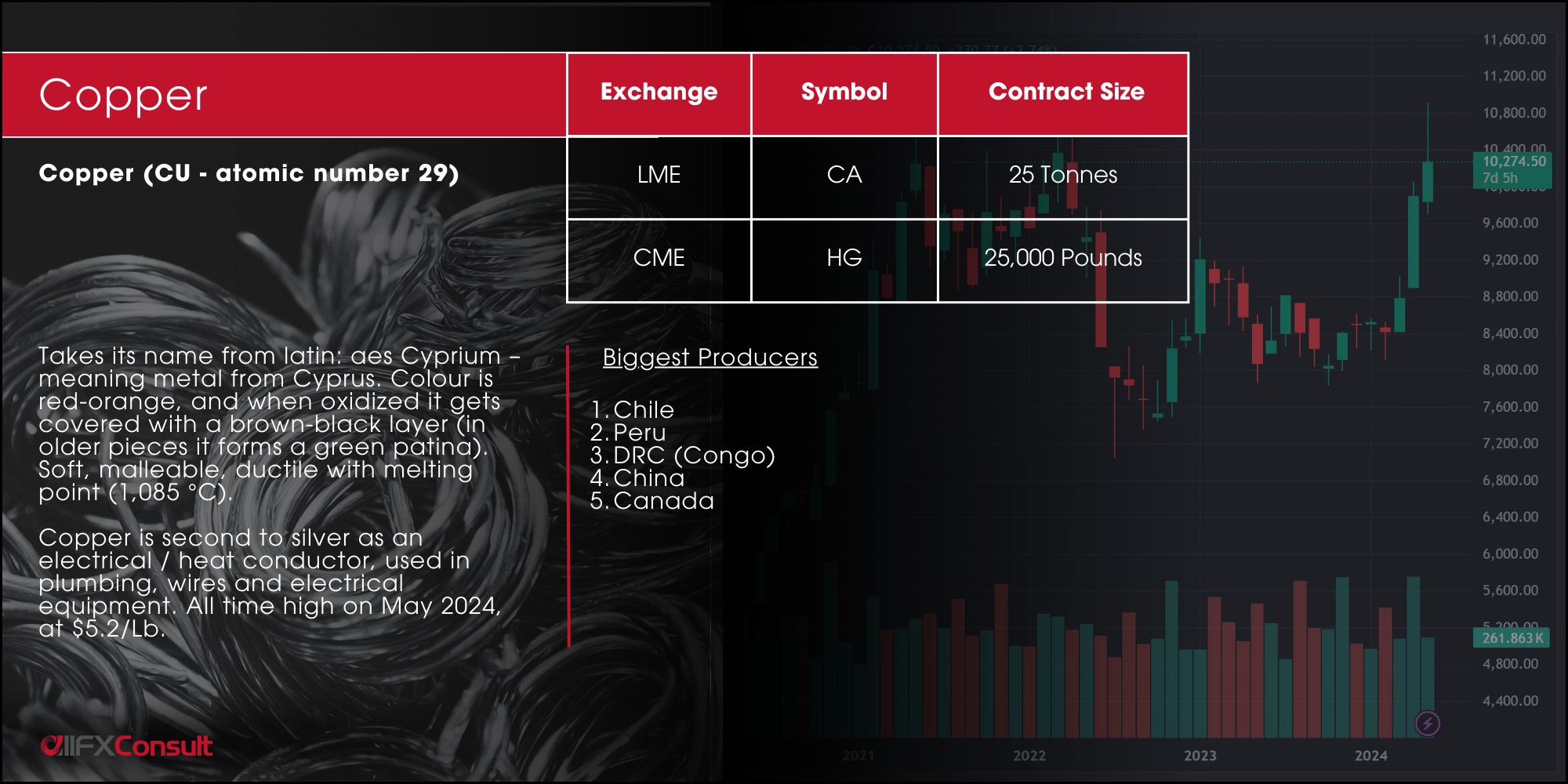

Base metals

Common, industrial, non-ferrous metals (they contain no iron). Nickel is the only ferromagnetic material (magnetized, even though its non-ferrous) (like cobalt).

Base metals are inexpensive relative to precious metals due to their abundance, but invaluable for global infrastructure, machinery and construction.

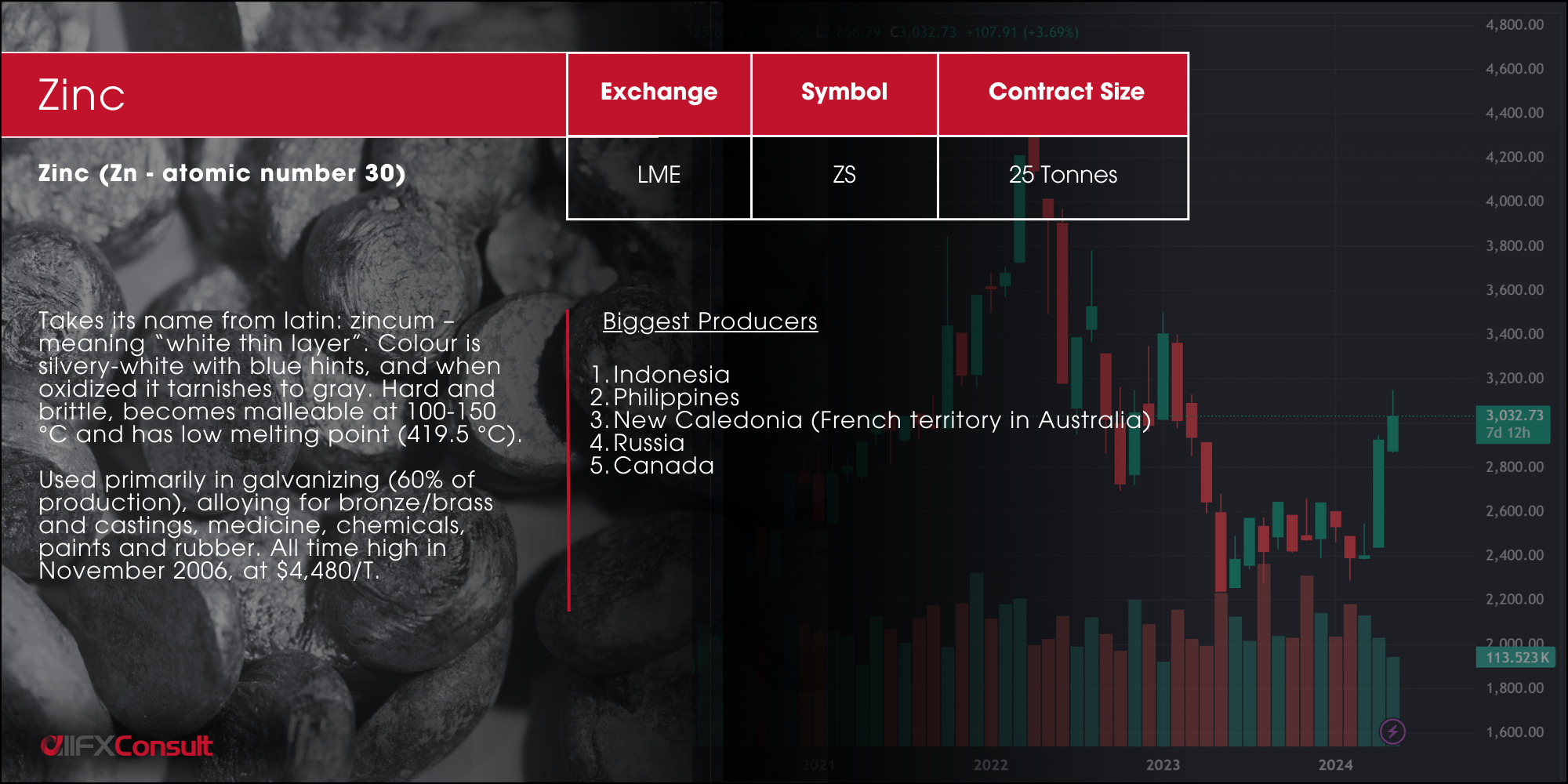

Base metals

Common, industrial, non-ferrous metals (they contain no iron). Nickel is the only ferromagnetic material (magnetized, even though its non-ferrous) (like cobalt).

Base metals are inexpensive relative to precious metals due to their abundance, but invaluable for global infrastructure, machinery and construction.

Base metals

Common, industrial, non-ferrous metals (they contain no iron). Nickel is the only ferromagnetic material (magnetized, even though its non-ferrous) (like cobalt).

Base metals are inexpensive relative to precious metals due to their abundance, but invaluable for global infrastructure, machinery and construction.

Base metals

Common, industrial, non-ferrous metals (they contain no iron). Nickel is the only ferromagnetic material (magnetized, even though its non-ferrous) (like cobalt).

Base metals are inexpensive relative to precious metals due to their abundance, but invaluable for global infrastructure, machinery and construction.

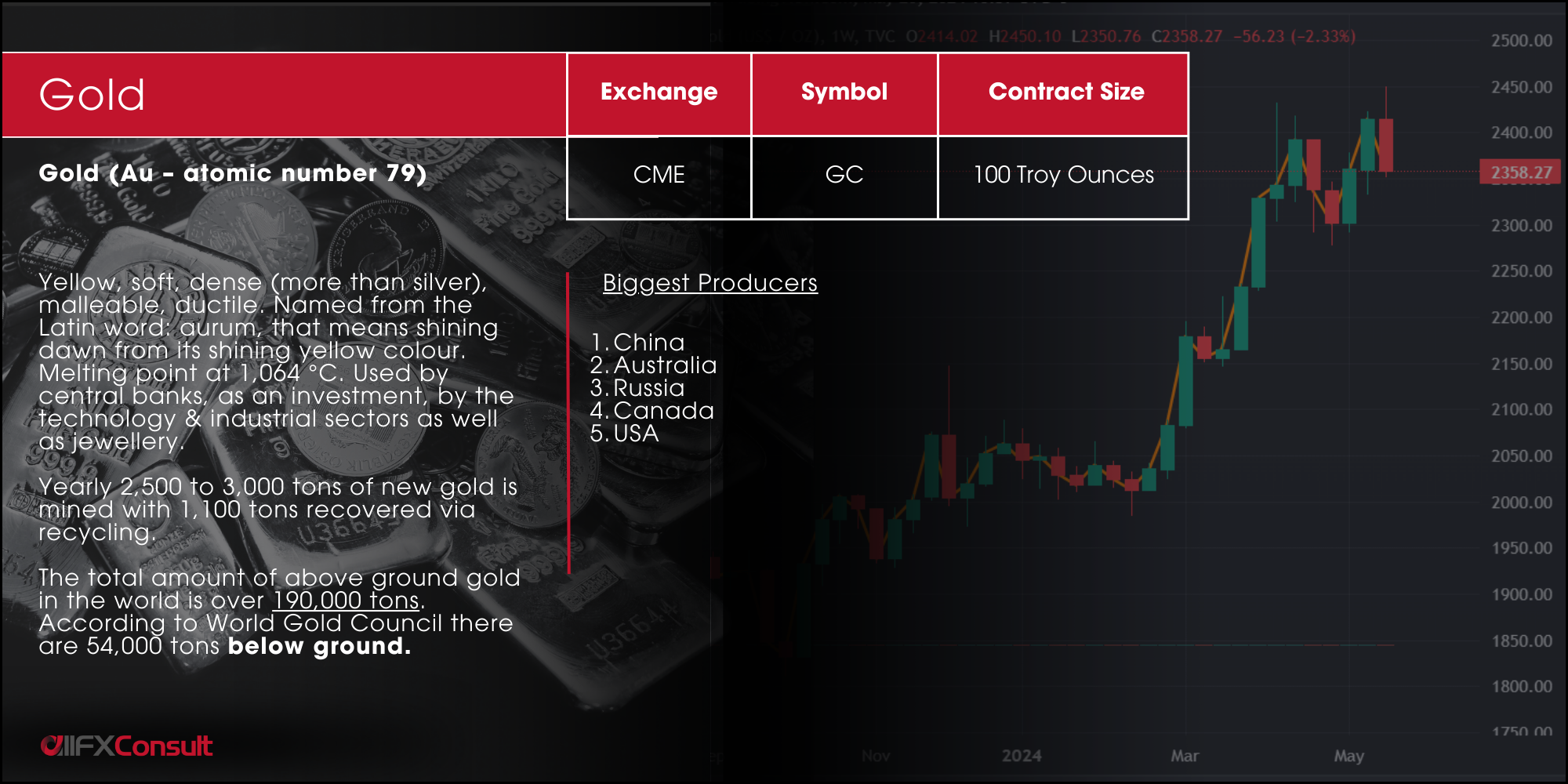

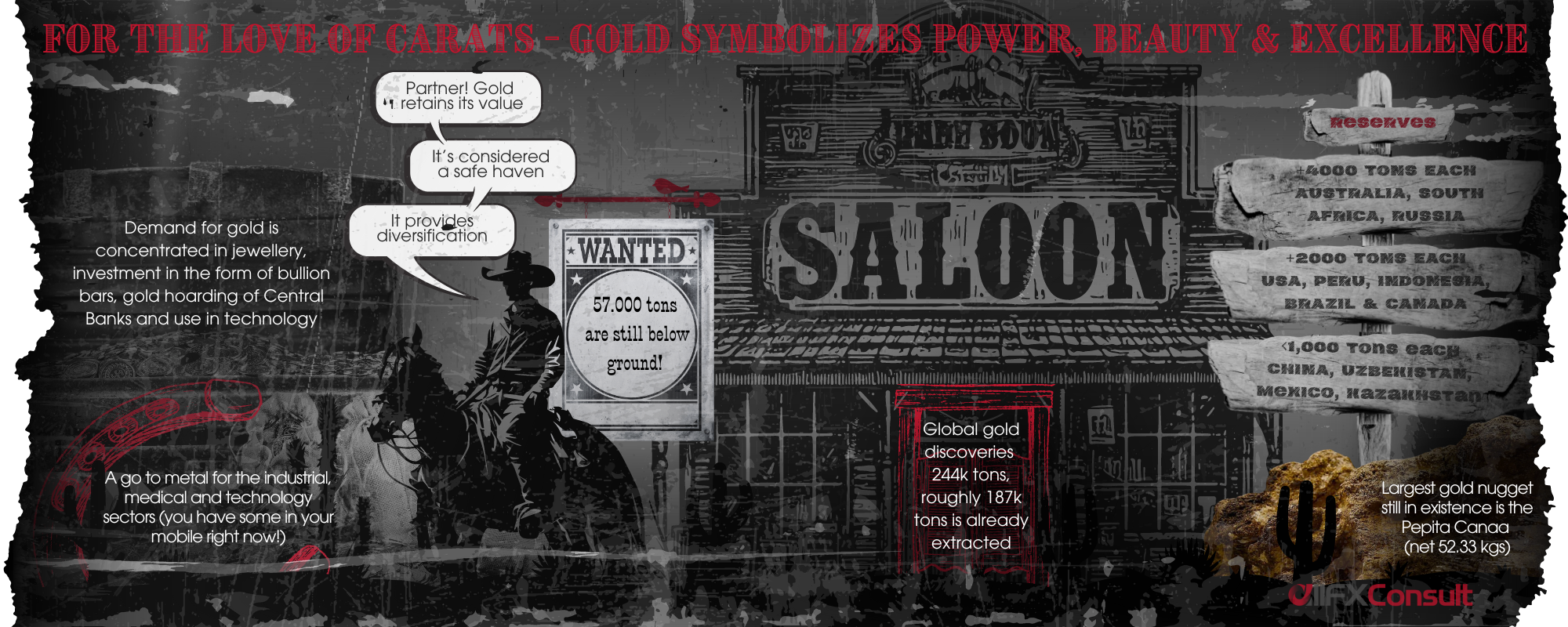

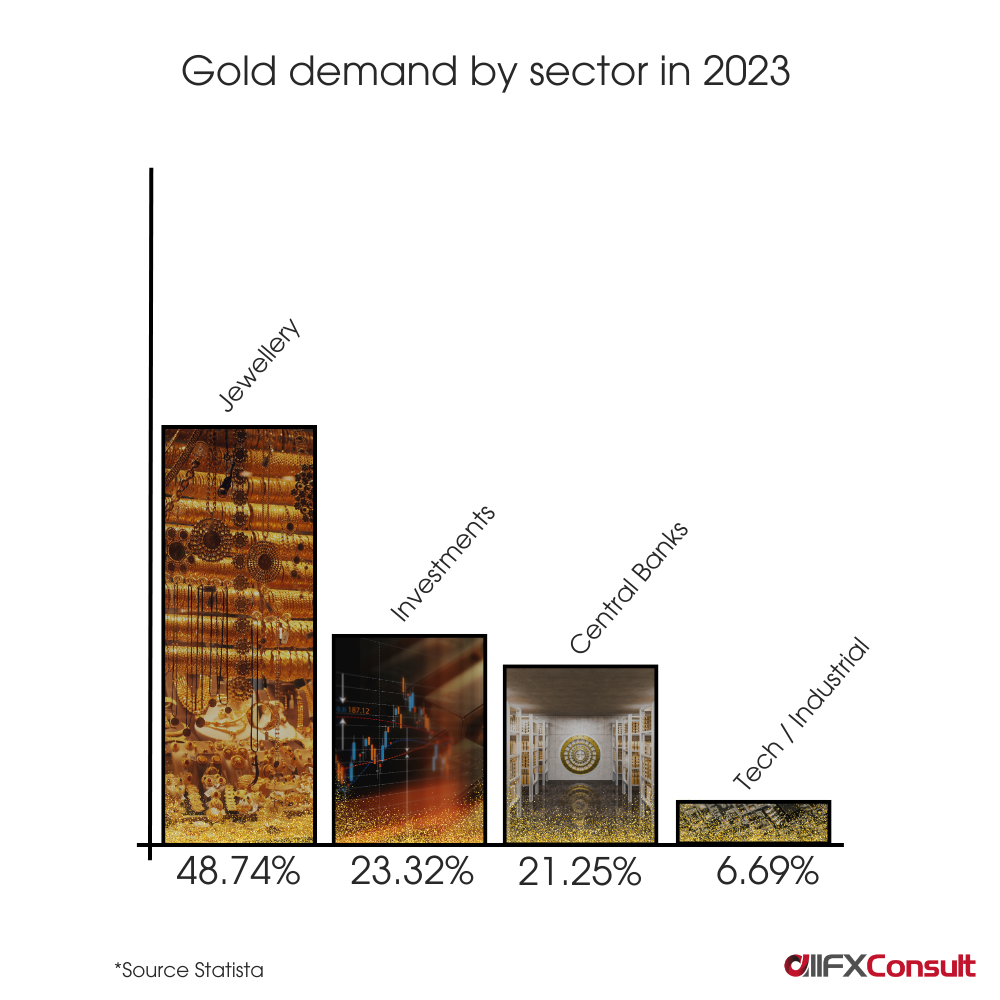

All that glitters, should always be gold. Then again, Mr. Buffet argued gold’s utility, and pointed to Martians scratching their heads when they see us digging it out of the ground, then digging another hole only to bury it again, and pay people to stand around watching it.

How to trade gold

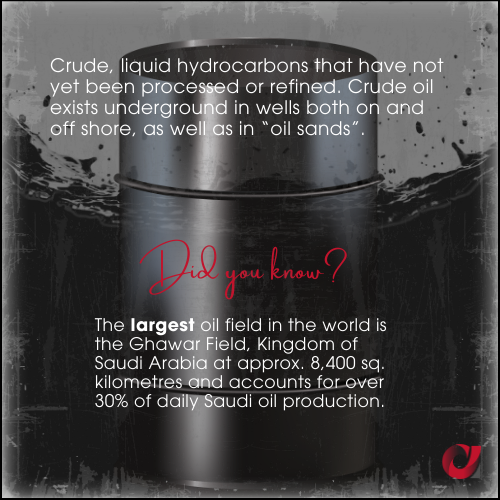

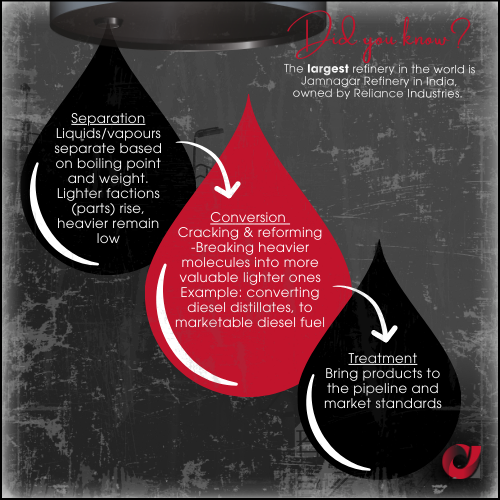

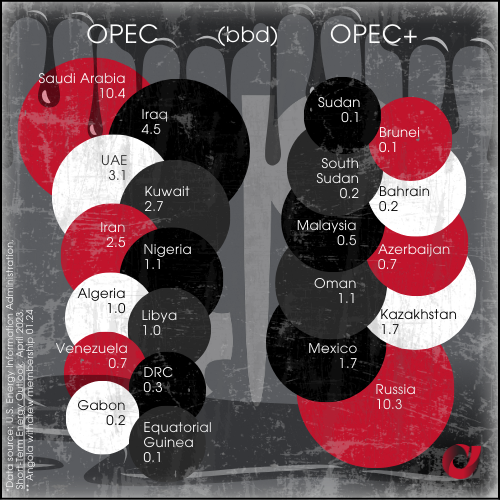

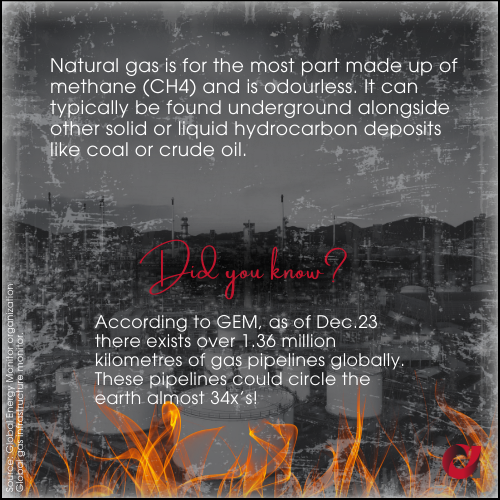

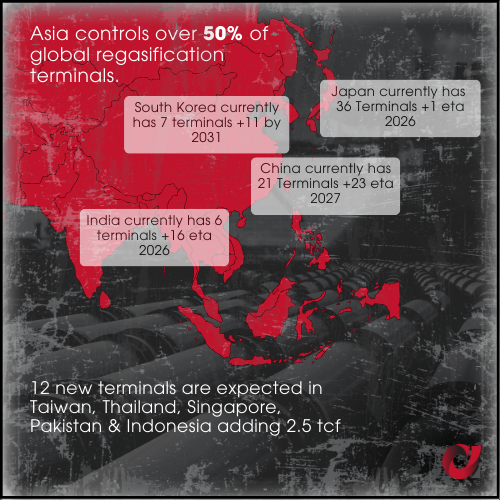

Energy commodities restructured our modern way of life. From heat source, to light and transportation, energy has played a significant role in the evolution of our daily lives. Debates around what is the most important commodity category revolve around their real importance in our daily lives Vs their impact as investment vehicles and their domino effect on other markets.

Notwithstanding the fact that food is our number one basic need, and metals provide the framework within which we live, energy literally fuels it all. Energy prices impact almost any other price of consumables globally including the other two categories of soft and hard commodities.

As a raw material, energy commodities also require handling such as complex supply chains, transportation, insurance, special storage and others, which differentiate trading and investing into this commodity class.

Below we outline the 3 main types of energy commodities based on fossil fuels, as well as nuclear and renewable energy sources.

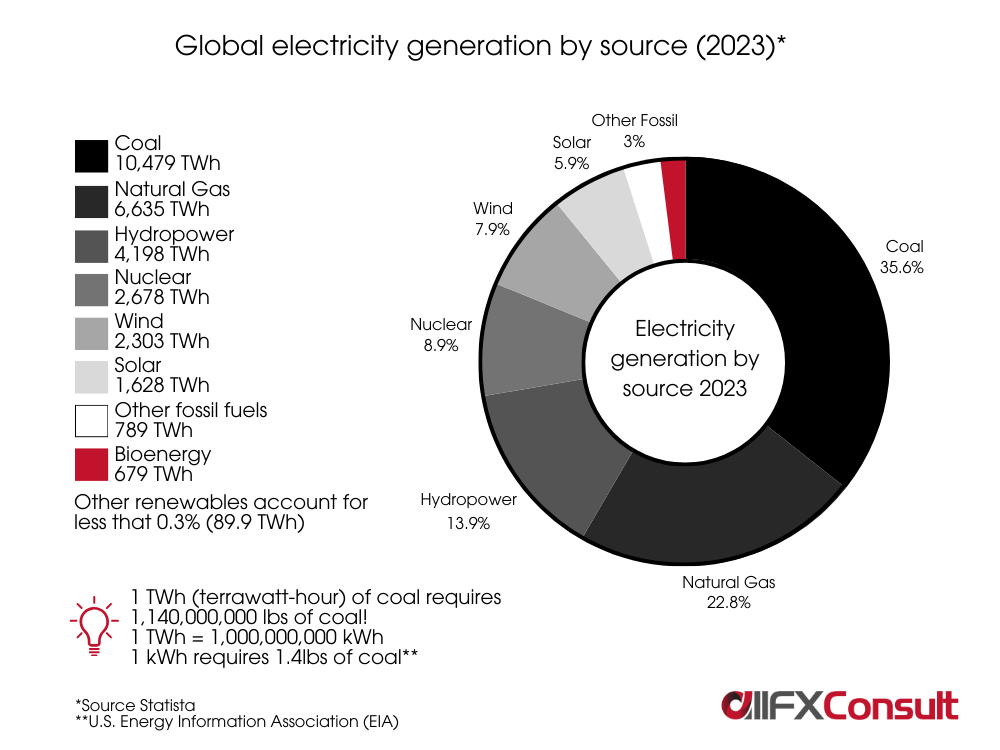

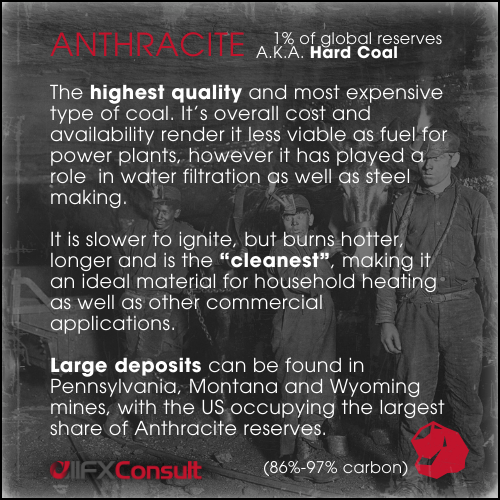

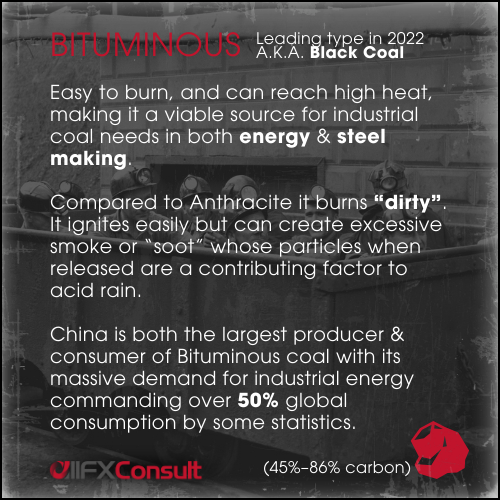

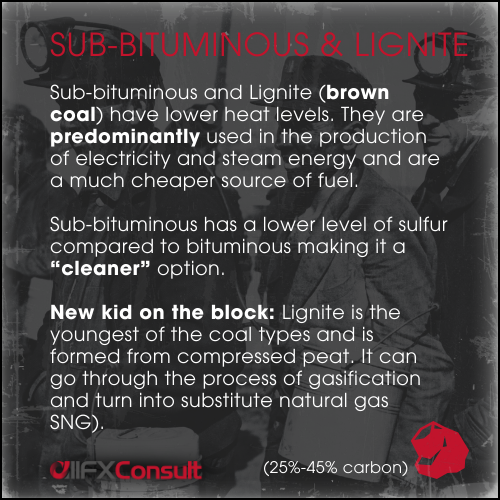

Part 3 | Coal

Part 4 | Nuclear Energy

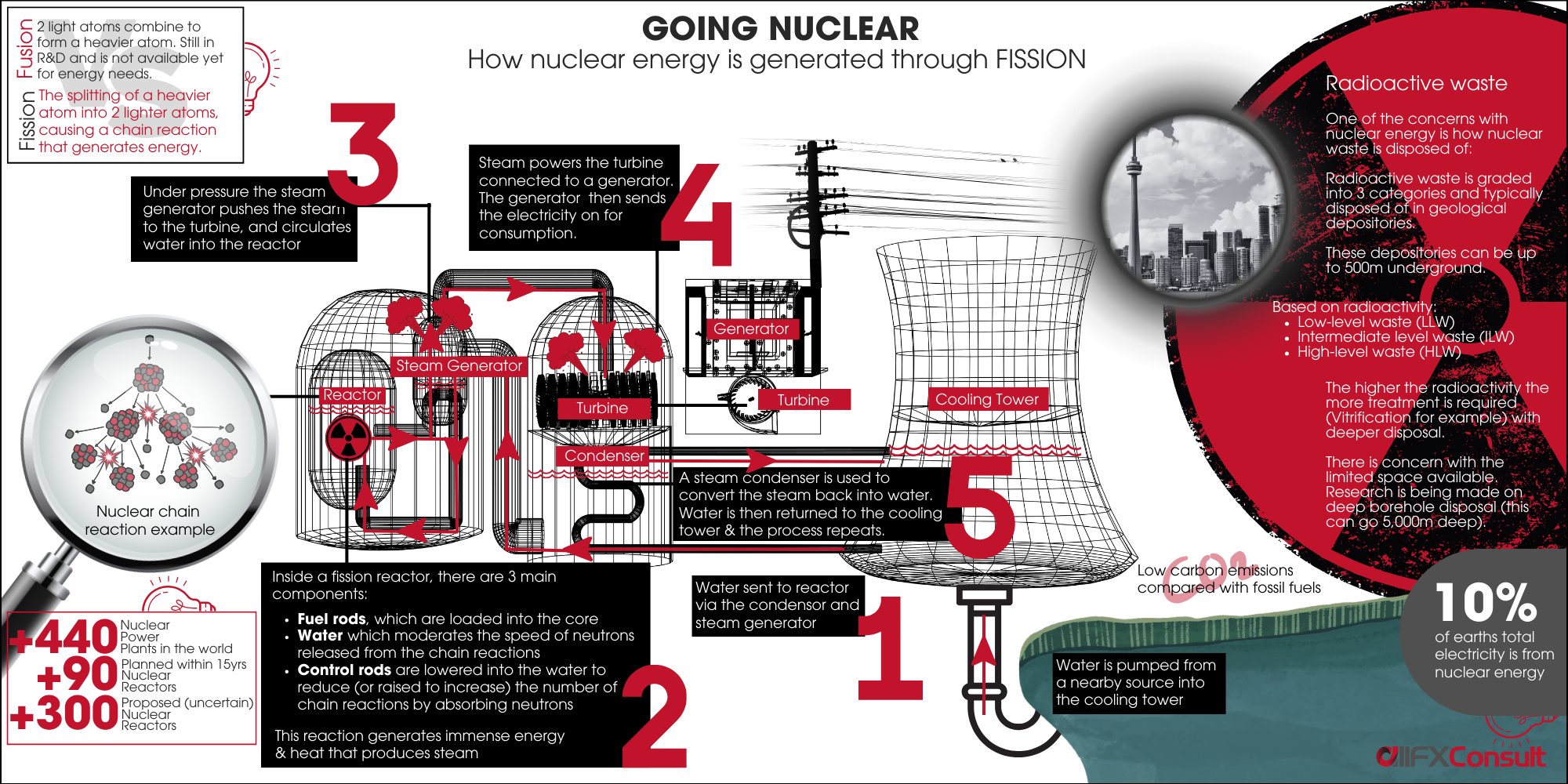

Not all nuclear associations are bad. Considering the fact that 10% of the earth’s total electricity is sourced form nuclear energy, it is prudent to understand more about this energy source.

The fuel needed to power nuclear reactors is uranium 235, with the top 3 uranium producing countries being Kazakhstan, Namibia and Canada. There is a complex process associated to uranium 235, since in its natural ore state, it is actually uranium 238. The u238 isotope needs “enrichment” because it is not fissile (all reactors use fission which splits heavier atoms in lighter ones, causing a chain reaction that generates energy).

See image to the right, from extraction of uranium and the “enrichment” process, to a fuel-rod ready for use by nuclear reactors.

There are over 440 nuclear power plants in the world, with over 90 planned to be developed in the next 15 years and more than 300 in proposal status. Due to the risks involved with nuclear energy (radioactivity, accidents, waste) it is a highly regulated and monitored sector.

A simplified process of generating electricity through a nuclear reactor, involves water being sent to the reactor through a steam generator, the reactor generates immense energy and heat through the fission process which in turn generates steam, which powers the turbine connected to a generator that produces electricity. From then on, it is sent to the grid for consumption.

See below image for specifics as well as how radioactive waste is handled.

Part 5 | Renewable Energy

Various sources like the International Energy Association – IEA, forecast the expansion of renewable energy sources, overtaking fossil fuels for electricity production.

What are renewable sources and how do they work?

Solar

Solar panels are series of panels that have photovoltaic cells (PV), and are made of the chemical element crystalline silicon. Each silicon atom contains 14 electrons.

The light from the sun has very small particles called photons. When the sunlight hits the PV cells, the photons kick the electrons off the atoms of the silicon, sending them into a frenzy. They flow through the positive and negative charges present in the cells, all the way to an inverter that converts the Direct Current (DC) to Alternating Current (AC) that we use for our electricity needs.

Wind

The strongest winds are produced in the middle of the oceans. This doesn’t stop us though from installing wind turbines on land and harness the power of the wind.

Normally found on hills with strong winds, wind turbines have massive blades (can be horizontal axis or vertical axis designs) that spin when the wind hits them. These blades are connected with a rotor that spins a generator. The generator produces electricity through electromagnetic induction that runs through a transformer and converts it to the appropriate voltage we use.

Water

Did you ever hear of hydrogen bonding? Bonds form between neighboring hydrogen and oxygen atoms of adjacent water molecules helping them to stay tight to one another, making water a mighty ally or enemy depending on the situation.

Through controlled flows, water is allowed to spill onto blades of turbines that spin and produce the electricity. Water can be sourced from a dam, river canals or man-made reservoirs depending on the place of the plant.

Geothermal

Tectonic plates are not only associated with bad situations like earthquakes. Near their boundaries, plants are built to extract geothermal energy from the earth’s crust. It is found mostly around volcanoes, hot springs and geysers

The process is as simple as injecting water deep underground where its hot, and receive back compressed steam to turn a turbine that produces electricity. 90% of Iceland’s energy is geothermal and more than 26 countries adopted its use.

Will renewable energy ever be traded?

How to trade commodities?

Commodities can be traded by purchasing the physical asset (think of bullion bars and coins). If an investor can handle transportation and storage, more difficult commodities can be looked into as well.

Commodities can also be traded through derivatives such as futures and options. They have wider spreads to account for the future expiry since they expire further into the future. They are suitable for long term positions and traders speculate on a future price of the commodity. Other commodity derivatives include CFDs.

Commodities can also be traded through basket products like funds and ETFs that track single or multiple commodities.

Factors that affect the price of commodities

The nature of commodities as physical raw materials, differentiate them a lot from their counterpart asset classes like stocks and bonds.

National policies, global relationships

Growing seasons, winter energy needs

Economy and fundamental indicators

Transportation, storage issues

Company multiples (commodity stocks)

Volume, liquidity, buy/sell pressures

Natural disasters, disease, pandemics

Commodities are quoted in fiat

Pros of commodity trading

Cons of commodity trading

Transparency– Contrary to the chaotic ways of trading commodities in the past (pit trading), today’s e-trading platforms allow fair price discovery.

Inflation protection – commodities are positively correlated to inflation. By default, when inflation rises, prices of raw materials rise as a result.

Diversification from stocks/bonds – Commodities serve as a hedge against stocks and bonds in a portfolio, due to their negative correlation.

Volatility – The demand and supply factors associated with commodity prices are relatively inelastic (price changes but quantity stays the same).

Supply shocks – Commodities are the most affected by natural events such as heavy rain, hail, storms, hurricanes, floods, drought, fires, earthquakes.

Excess production – Unusually abundant harvest of crops, or overproduction (like it happens with oil from net exporters), can oversupply the market.

Commodity FAQs

How to trade commodities?

Commodities can be traded in multiple ways, either through physical transactions (think of gold bullion) or derivative contracts such as futures, options and CFDs. Basket products like funds and ETFs are also gaining popularity due to their diversification into multiple assets in one go. Commodity stocks are related to companies engaged in the commodity sector and they are another popular way of gaining exposure to commodities.

What are the most traded commodities?

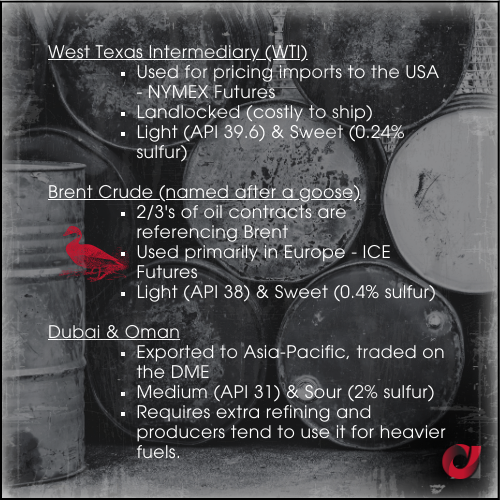

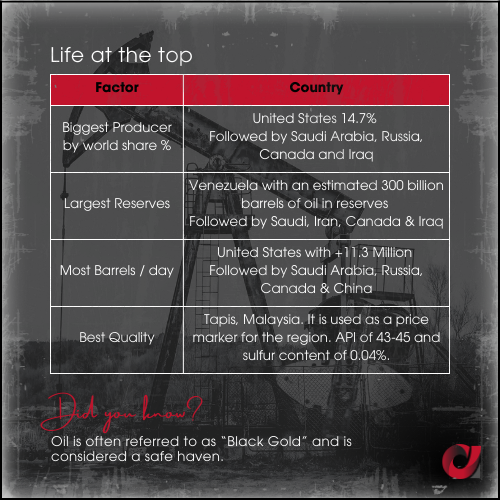

Commodity prices are affected by various factors. Depending on these, some commodities might have more trading activity than others. This being said, major commodities traded include crude oil (WTI and brent), gold, silver, natural gas, corn among others.

Why trade commodities?

If there is one asset class that is very different to the rest, it would be commodities. Their negative correlation to stocks and bonds ensure diversification in any portfolio. At the same time, their seasonality, and logistic requirements of extracting, harvesting, transporting, storage, time decay, create a volatile environment that is usually reflected in the price.

Is physical trading better than derivative trading?

Each type of trading serves specific types of traders and investors. There is no one rule fits all, and depending on various factors, either trade can meet expectations. Trading 100 barrels of oil physically, although possible, can be a logistical nightmare. Same with gold bullion and safety storage issues. Derivative contracts provide exposure to the assets without owning the underlying, but caution should be exercised since such products use leverage making them very risky.

Is commodity trading difficult?

Every financial instrument must be considered complex and requires time and diligent research. Commodities are no different. The difficulty level, depends on the investor/trader, their plan, the end goal and understanding of the environment. Commodities are volatile and prone to demand and supply shocks that affect their prices. At the same time, they are tools against inflation and their diversification qualities make them a good addition to any well balanced portfolio.

Thinking of monetizing your network?

For any questions or concerns

Our team is available 24/7