The most comprehensive training

to effectively communicate the markets

or that Terra stablecoin, had a market cap of 18 billion before it crashed?

or that there are leveraged ETFs aiming to multiply values 2 or 3 times?

Now tailored to meet your needs, complete or shorter as required

Capital markets training

past, present and future

“Capital Markets” is a broad categorization of an array of financial instruments. These include (but are not limited to) Currencies, Stocks, Indices, ETFs, Bonds, Commodities, Cryptocurrencies/Tokens etc.

Investment firms, a.k.a. “Brokerages”, facilitate trading of the actual instruments. Others enable trading only on the fluctuating prices of these instruments. They do this through a product called CFD – Contract for Difference.

Is trading a new language for you? Visit our database with basic and advanced definitions

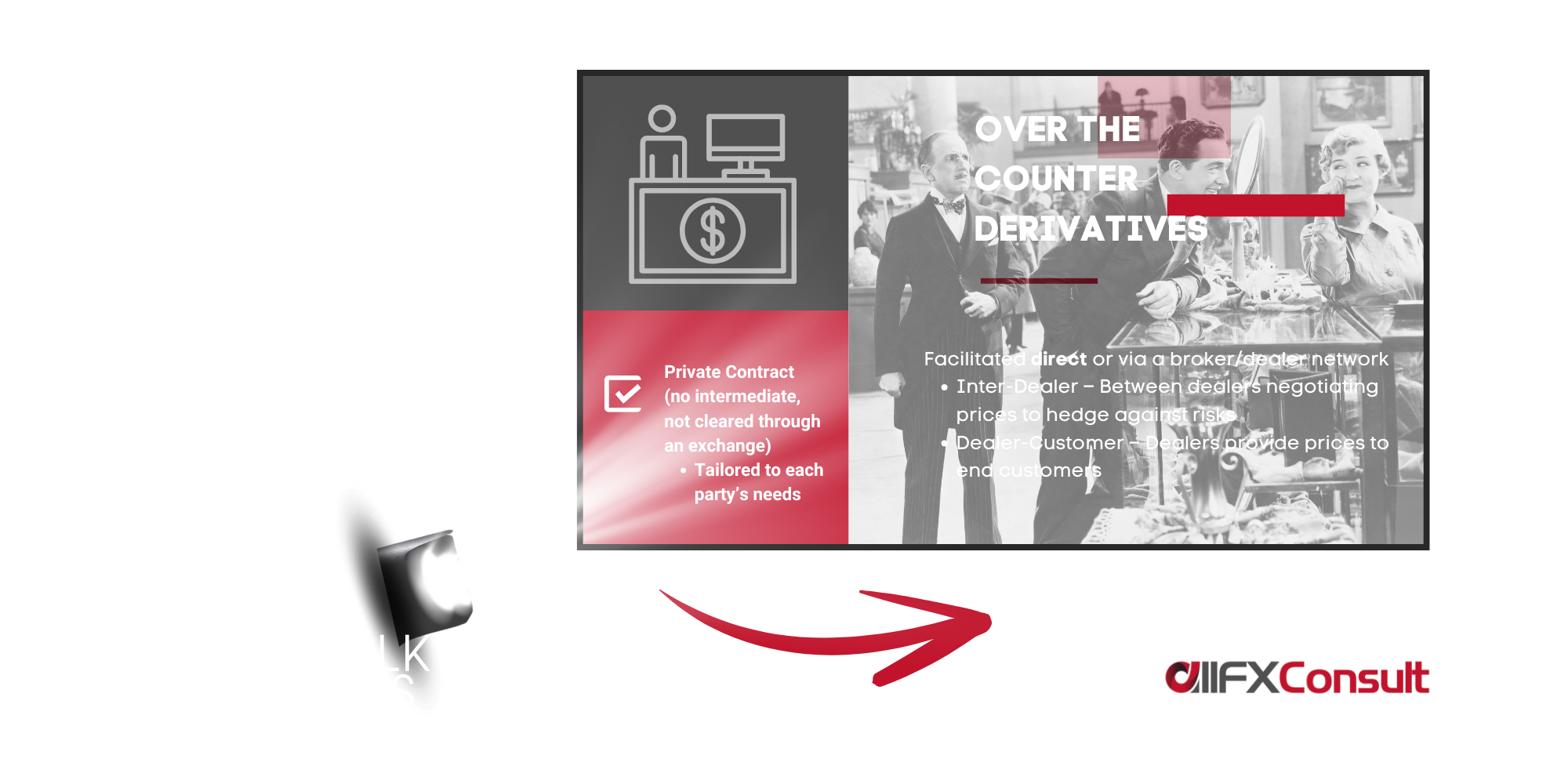

A word about CFDs | Although the CFD price we see moving up and down is what will translate into a profit or a loss for a trader, and although there are various ways to read the possible directions, a CFD price is still only a price derived from an underlying asset (the financial instrument). And its trading over-the-counter.

Many underlying assets are traded on exchanges, and their price is determined by supply and demand. Supply and demand though, are also measurable tools and there are so many reasons that could shift their curves.

What are these reasons? Is investing an option for everyone? Why choose to invest in one asset over another? Can multiple assets be traded and is it wise? Is a CFD product better, worse, or just another option to trade?

You know how hard it is to find talent

you also know how hard it is to keep it

A word about derivatives | CFDs are derivative products. This means that they “derive” their value from the underlying asset, without owning the asset. Financial instruments like forwards, futures and options (among others) are also derivatives.

Spot price Vs futures price, forward Vs futures, futures Vs options, call options Vs put options, vanilla options Vs exotic options, European options Vs American options… They all sound intimidating, but they are really not.

Why are derivative products important? What makes them a special addition for a trader? Should derivatives be traded and what are their benefits/risks?

We teach professionals how to properly communicate the markets. This training is all that you will ever need and more

Limited spaces available per month. We arrange sessions and crash courses abroad when possible so stay tuned

10-500+ people. Designed to distribute knowledge across the board. From entry level to top management.

FAQs

When is the next available training date?

Our in-house Capital Markets Training takes place on a monthly basis. Please contact our administrators at learn@allfx-consult.com for the next available dates.

How long does the training take?

A complete training requires 30 hours in total. Daily, on 3 hour intervals, morning or evening, the choice is yours.

Custom courses are also available on demand, with various time lines and course details.

Contact our administrators at learn@allfx-consult.com with your preference.

I was informed there are no more seats available.

Reserve your seat now for the next round. Individual training is delivered morning or evening, in-house and on a monthly basis.

How much does the training cost?

Depending on individual, group or corporate bookings, various rates apply. Our administrators will be happy to provide all information regarding costs, schedule and any additional details required for your Capital Markets Training.

I would like to refer a friend or two...

You know of people possibly interested to attend our training? Great!

Special discounts/referral fees are offered across the board. Reach out to learn@allfx-consult.com and become an active partner with perks.

Looking for more answers?