Indices (index) trading

The place to LEARN all about investing in indices

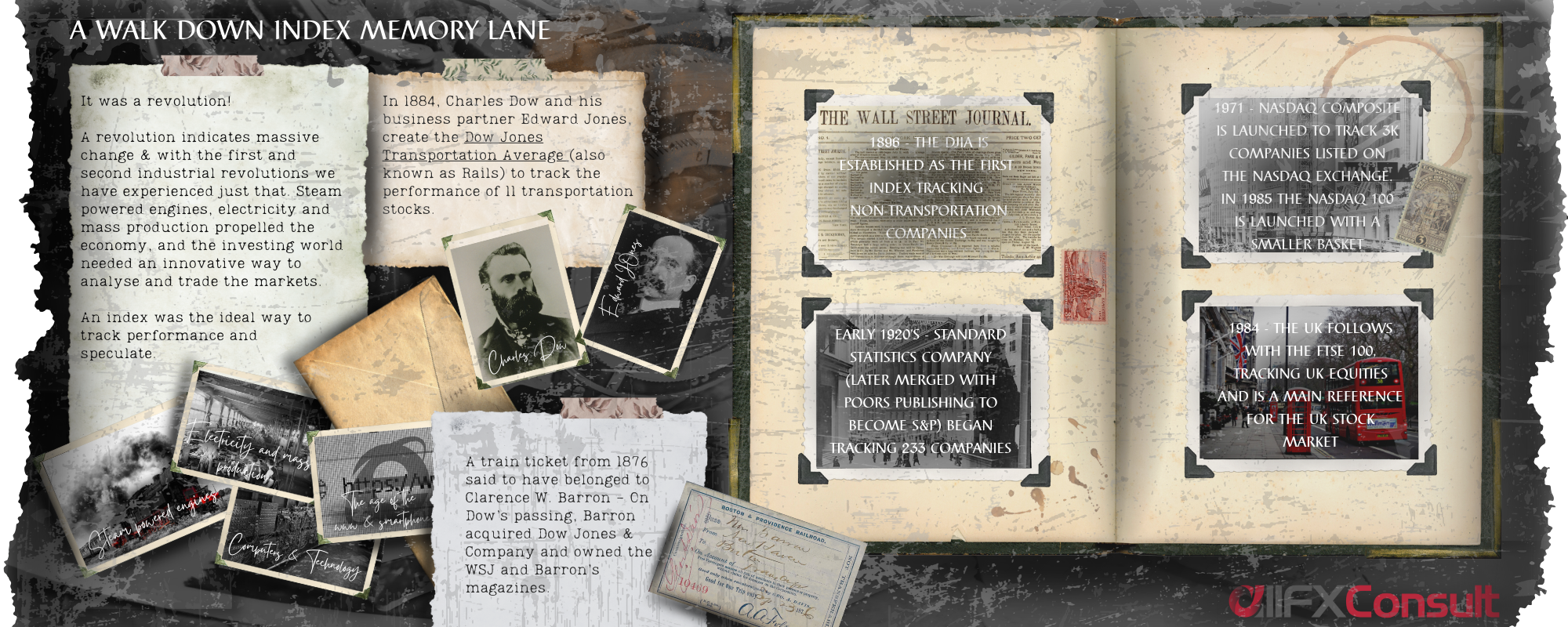

History of Indices

dating back to 1884

The first index created was the Dow Jones Transportation Index. Established in July 1884, the index aimed to trace 11 transportation stocks (9 of which were railway).

Shortly after (1896), the Dow Jones Industrial Average was created, tracing the 30 largest (by market capitalization) companies in the USA.

Standard and Poor begun indexing companies in the 1920s. By 1957 the S&P500 was established, tracing the 500 largest companies in the USA. It is still considered a benchmark for the whole US equity market.

How are indices created?

An index provider is responsible for defining the rules and criteria that govern how an index operates. This includes not just which constituents will be used, but also how the index is weighted, balanced, and rebalanced to mirror changes in companies and overall markets.

Indices by nature are diversified and often used to balance portfolios or hedge against risks of holding individually the constituents. This being said, its important that all constituents are easily tradeable (available to be bought and sold individually), for purposes of rebalancing, as well as to allow the index to be tracked by other investment products (funds and ETFs).

Depending on the index type, rebalancing may happen more or less frequently as needed. Consider equity vs fixed income, where fixed income might require more frequent rebalancing since its pricing is not as visible, and factors like credit rating, coupons and maturity play a role.

Index types

Taking equity indices as an example

the creator of a stock index asks

Characteristics such as where the companies are incorporated, where they are headquartered, which stock exchange they are listed primarily, any secondary exchange listings, where the majority of its assets are based and/or where they derive their revenue from are addressed.

S&P 500, CSI 300, HANG SENG 75, FTSE 100, ASX 100, NIFTY 50, DAX 40

Classifications such as developed or emerging, group markets by characteristics such as economic development, the structure/accessibility of their capital markets (how advanced they are), how large and liquid the market is (is it easy for international investors to invest and withdraw).

EUROSTOXX 50, S&P Asia 50, S&P Latin America 40, MSCI GCC 87

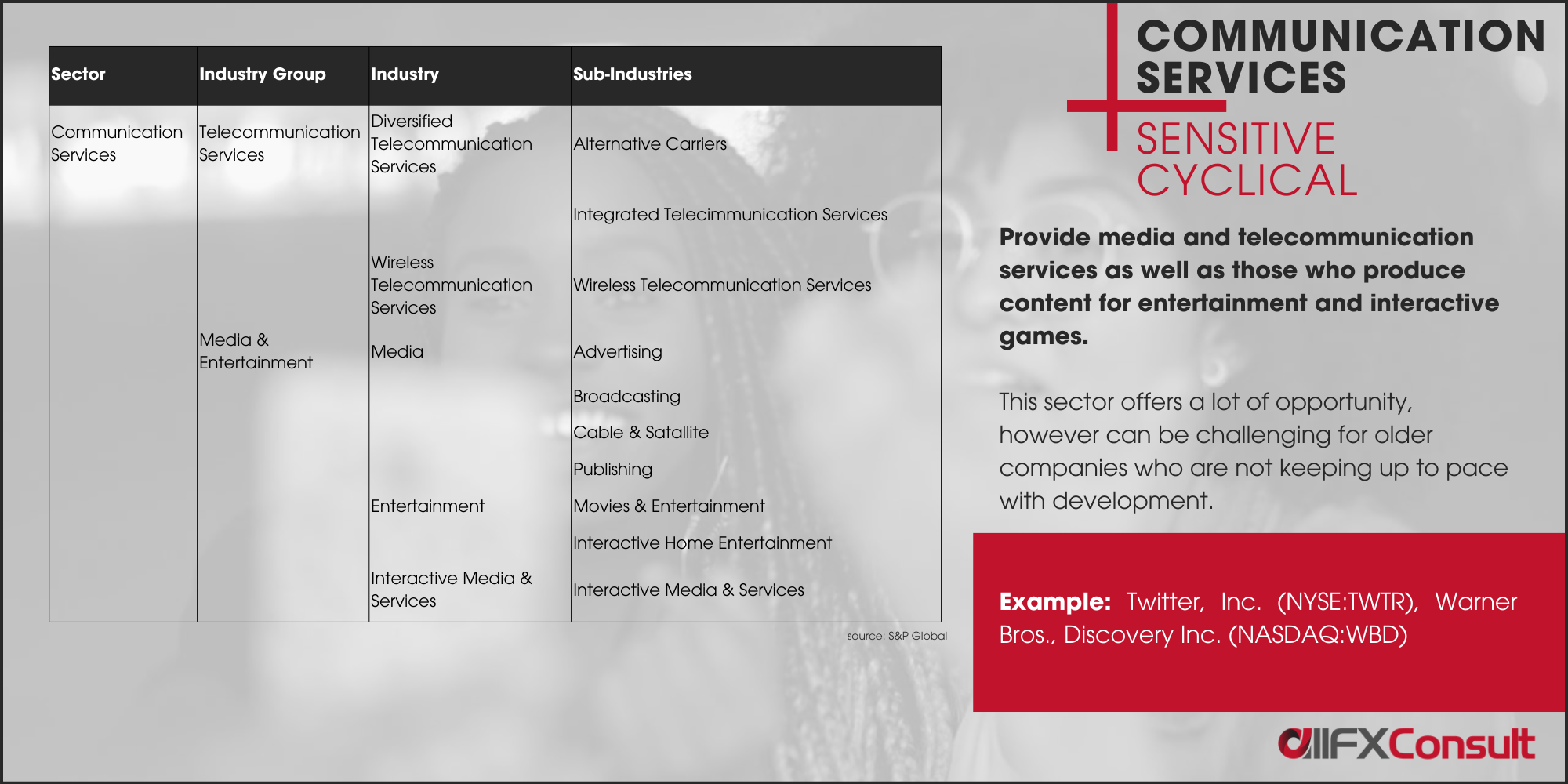

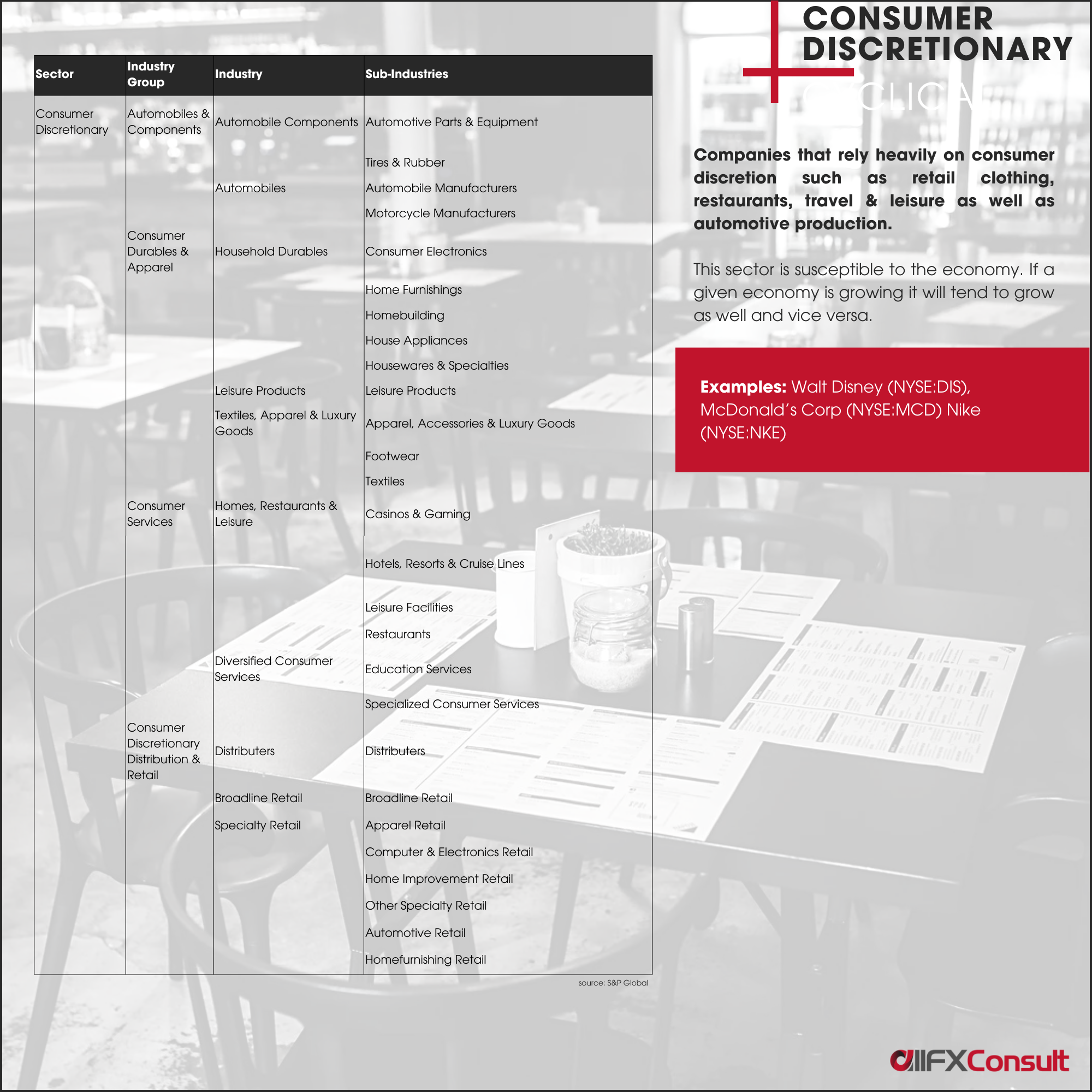

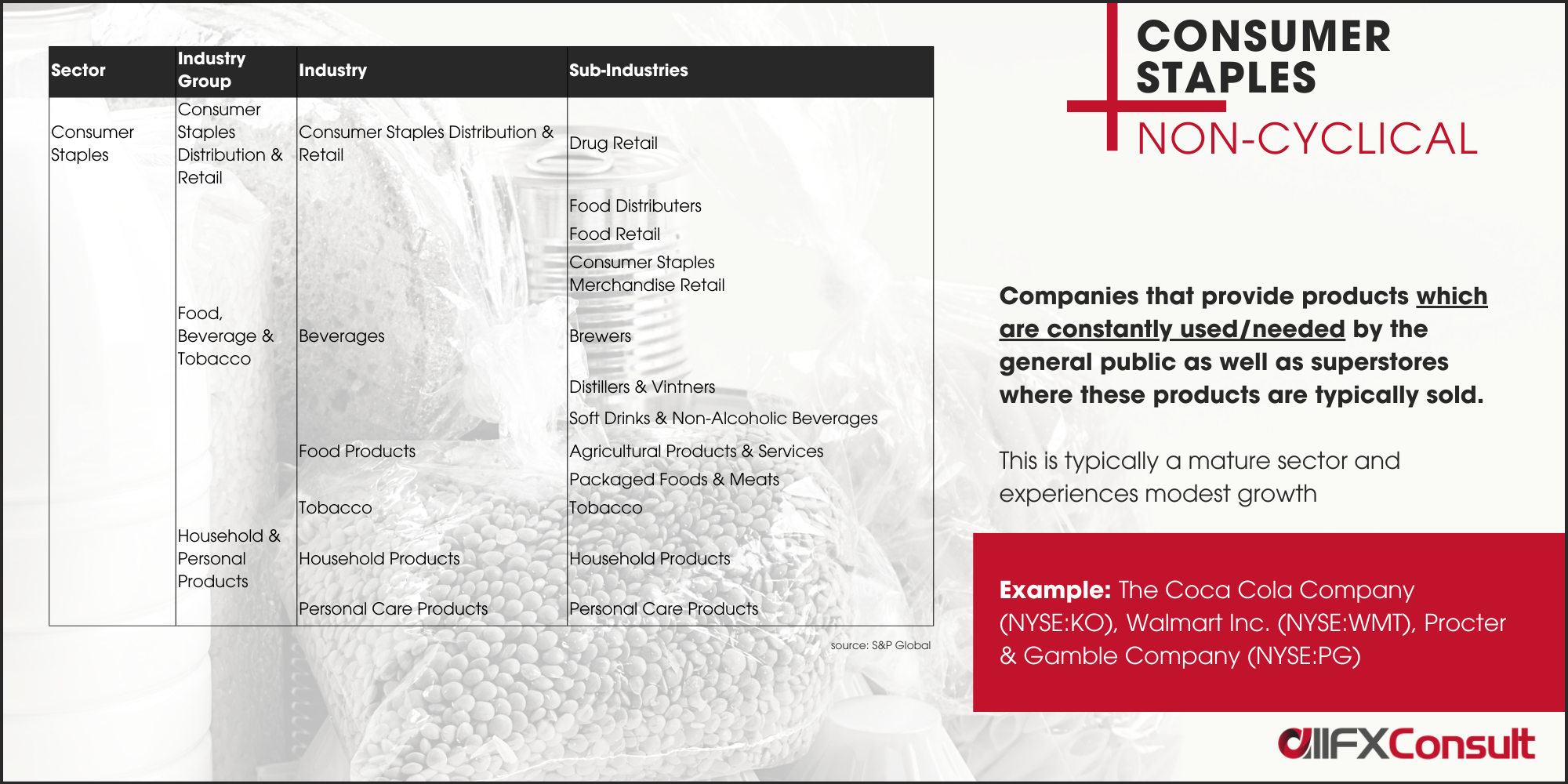

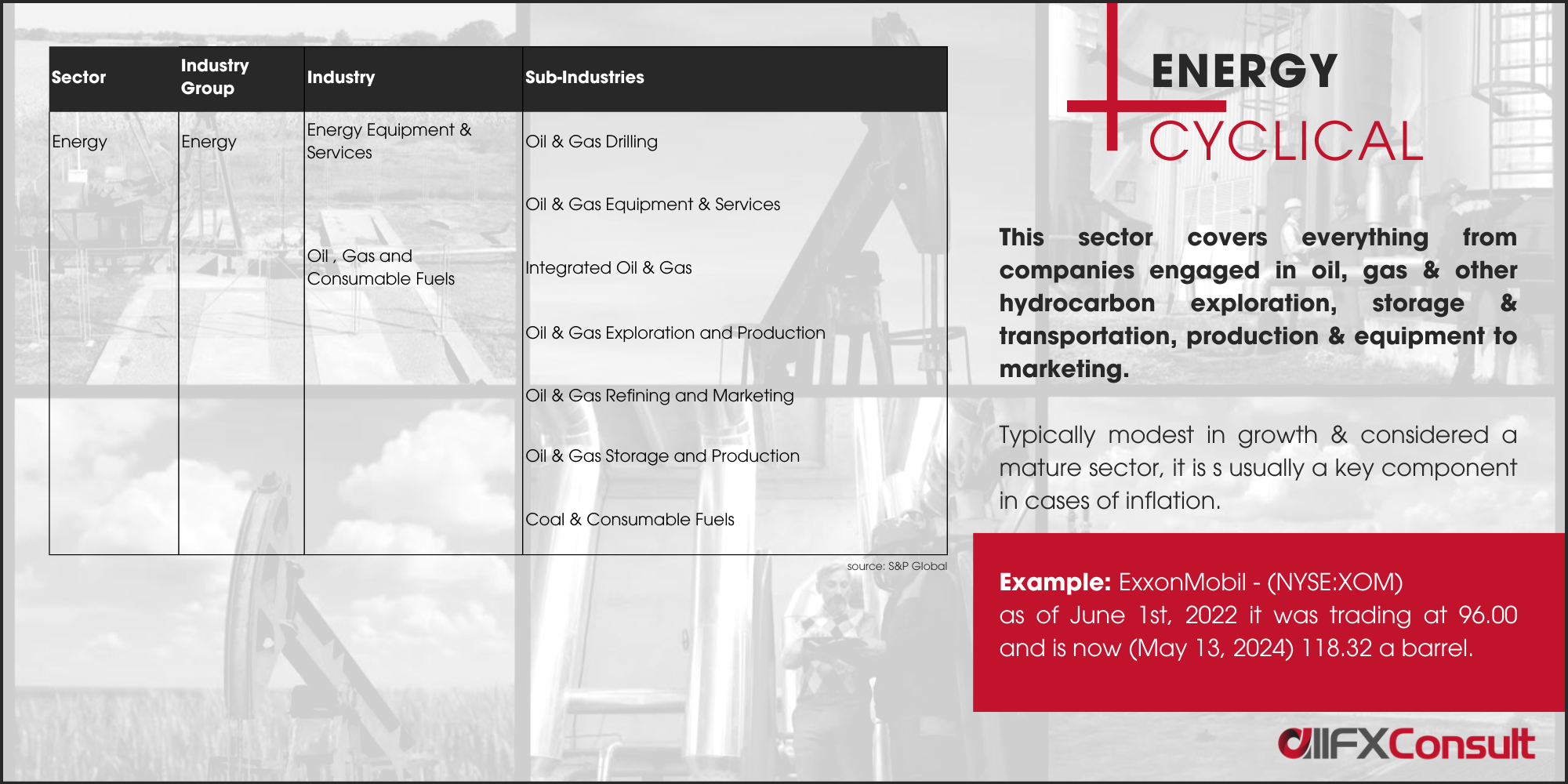

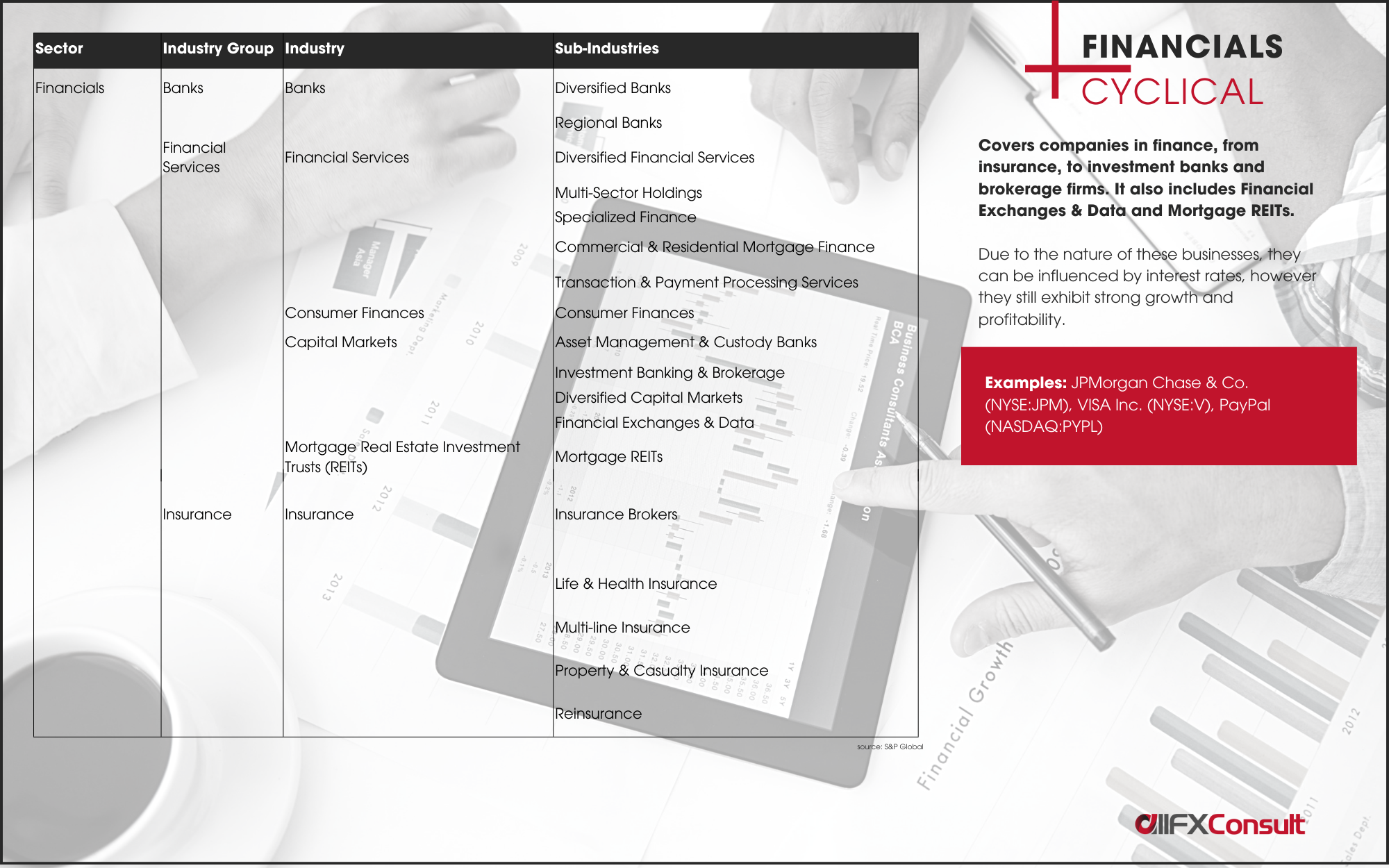

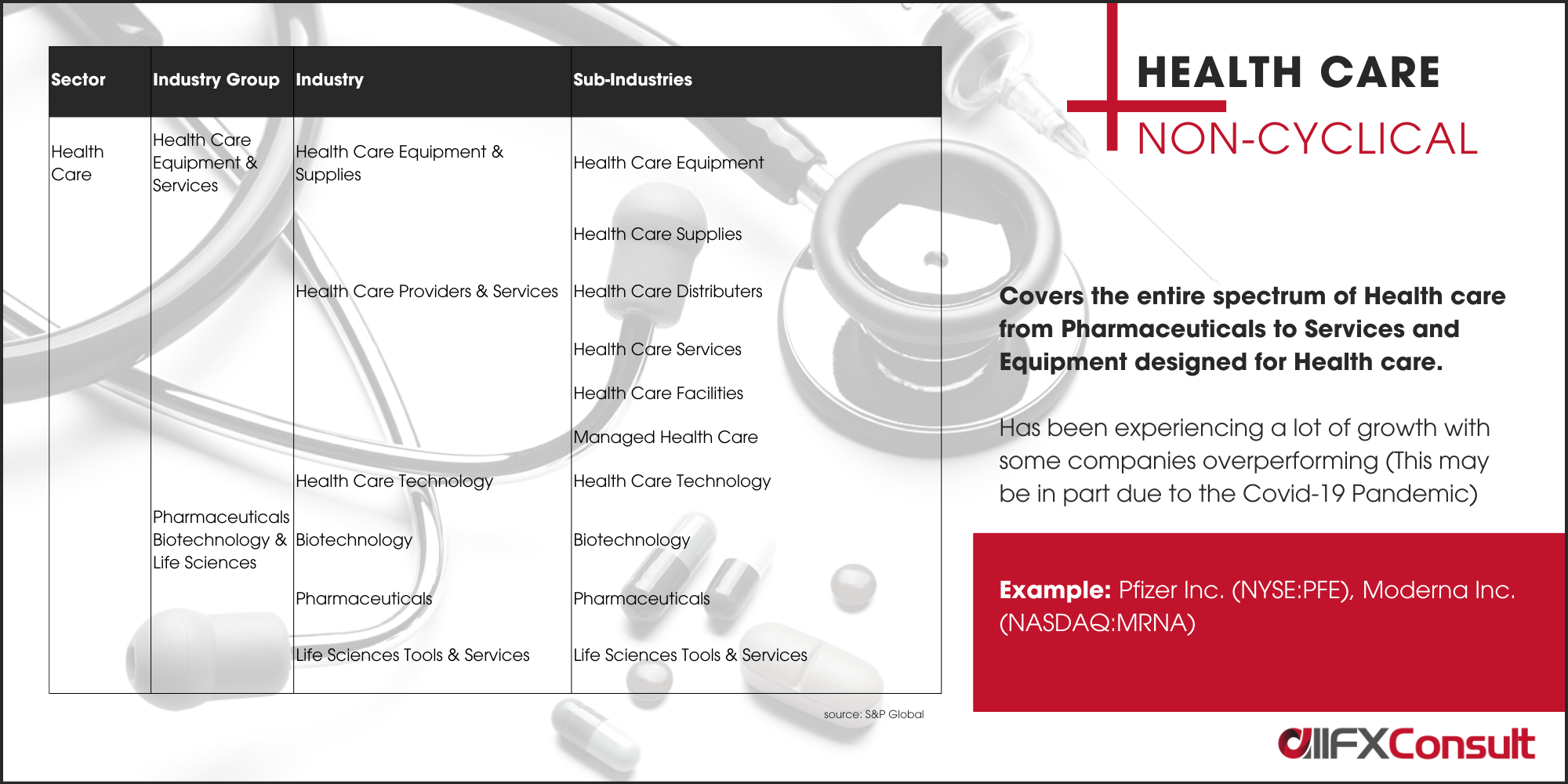

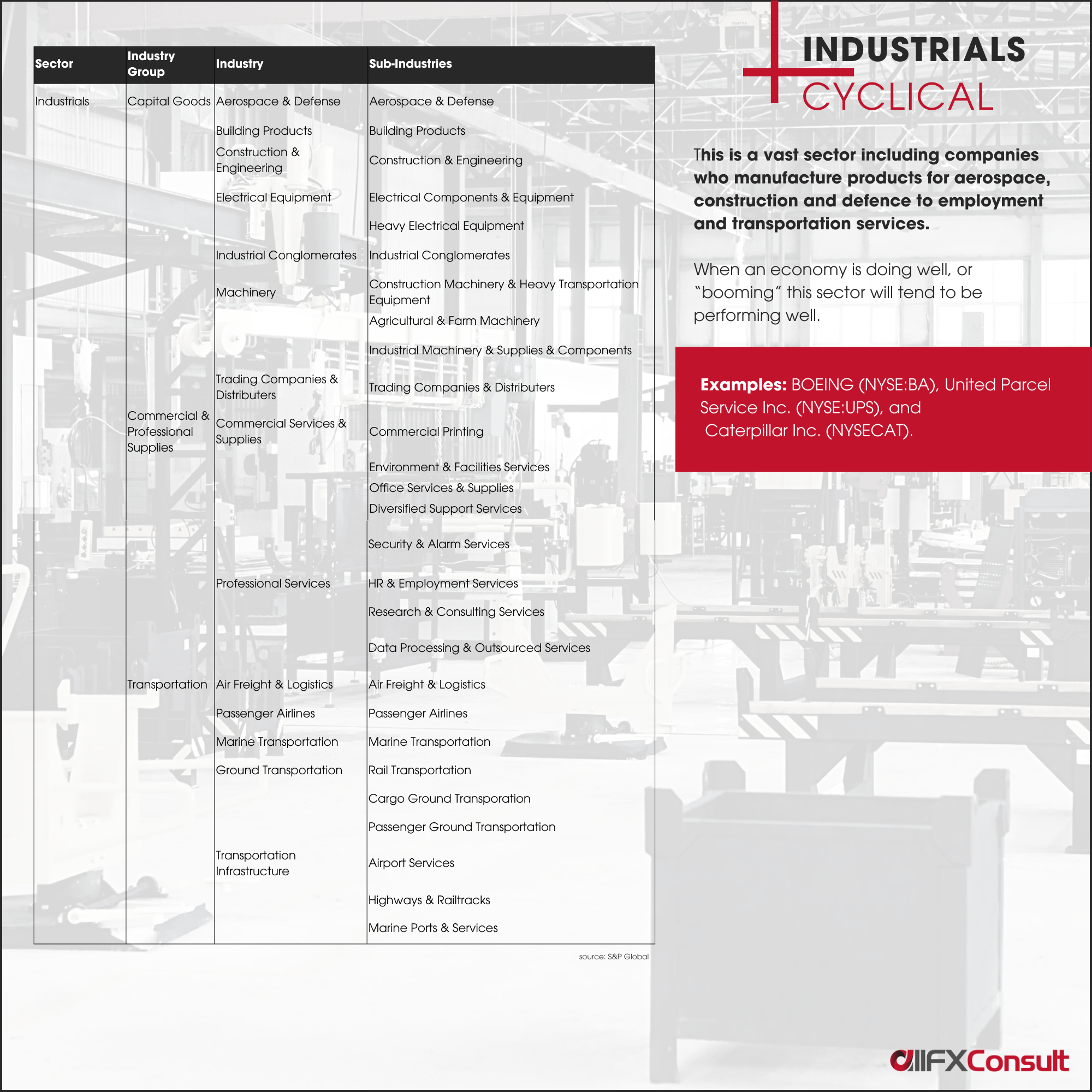

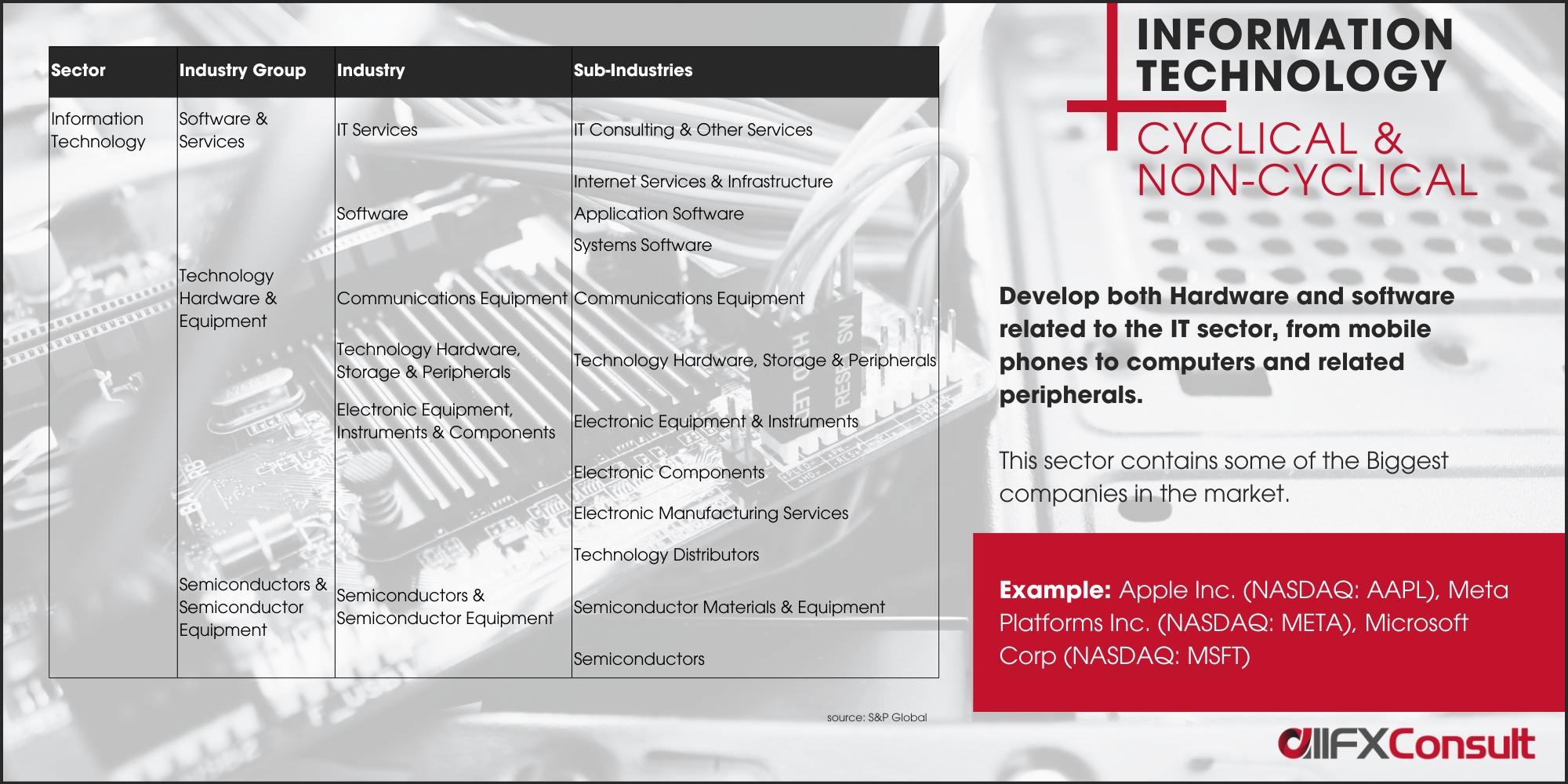

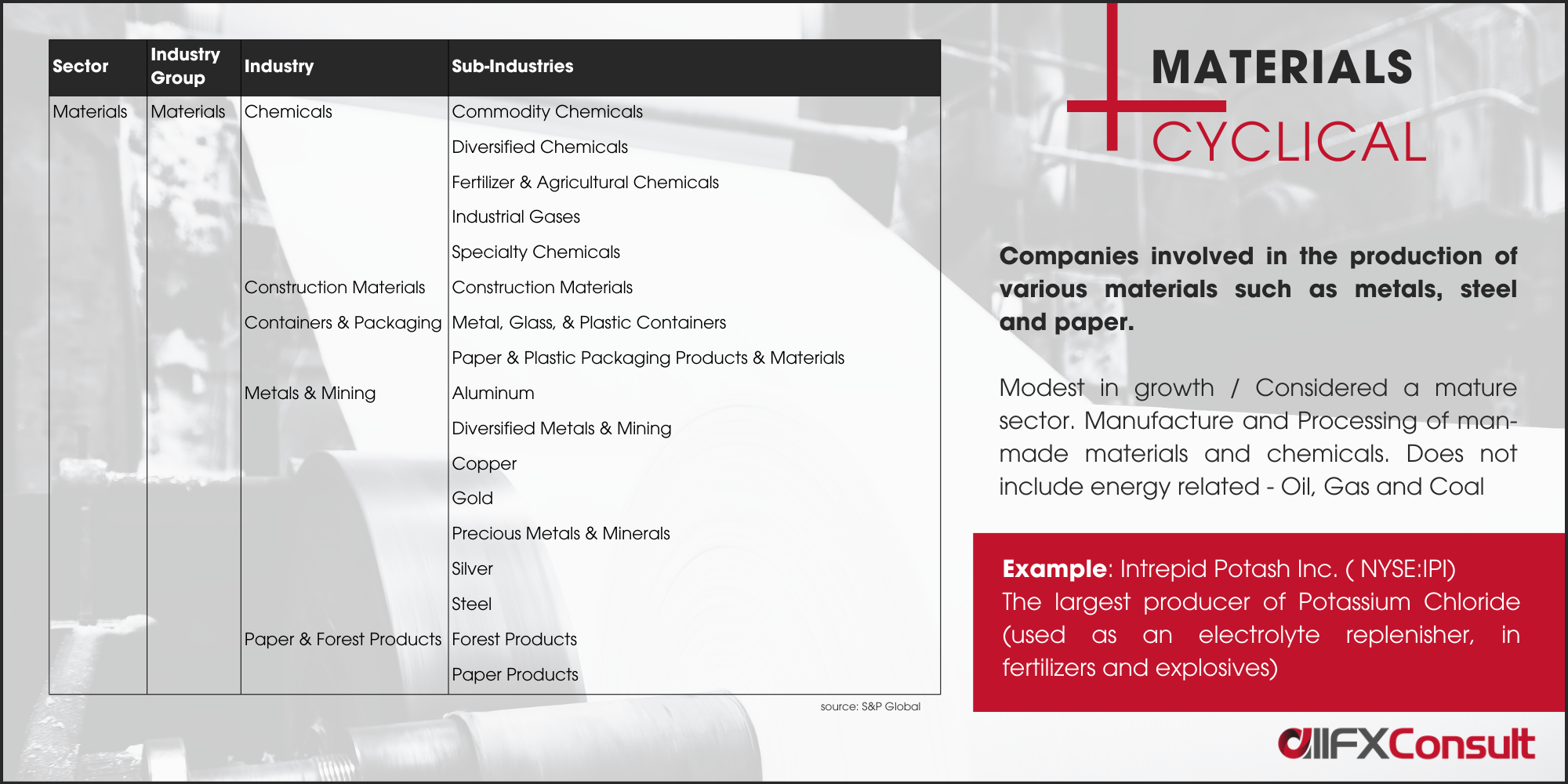

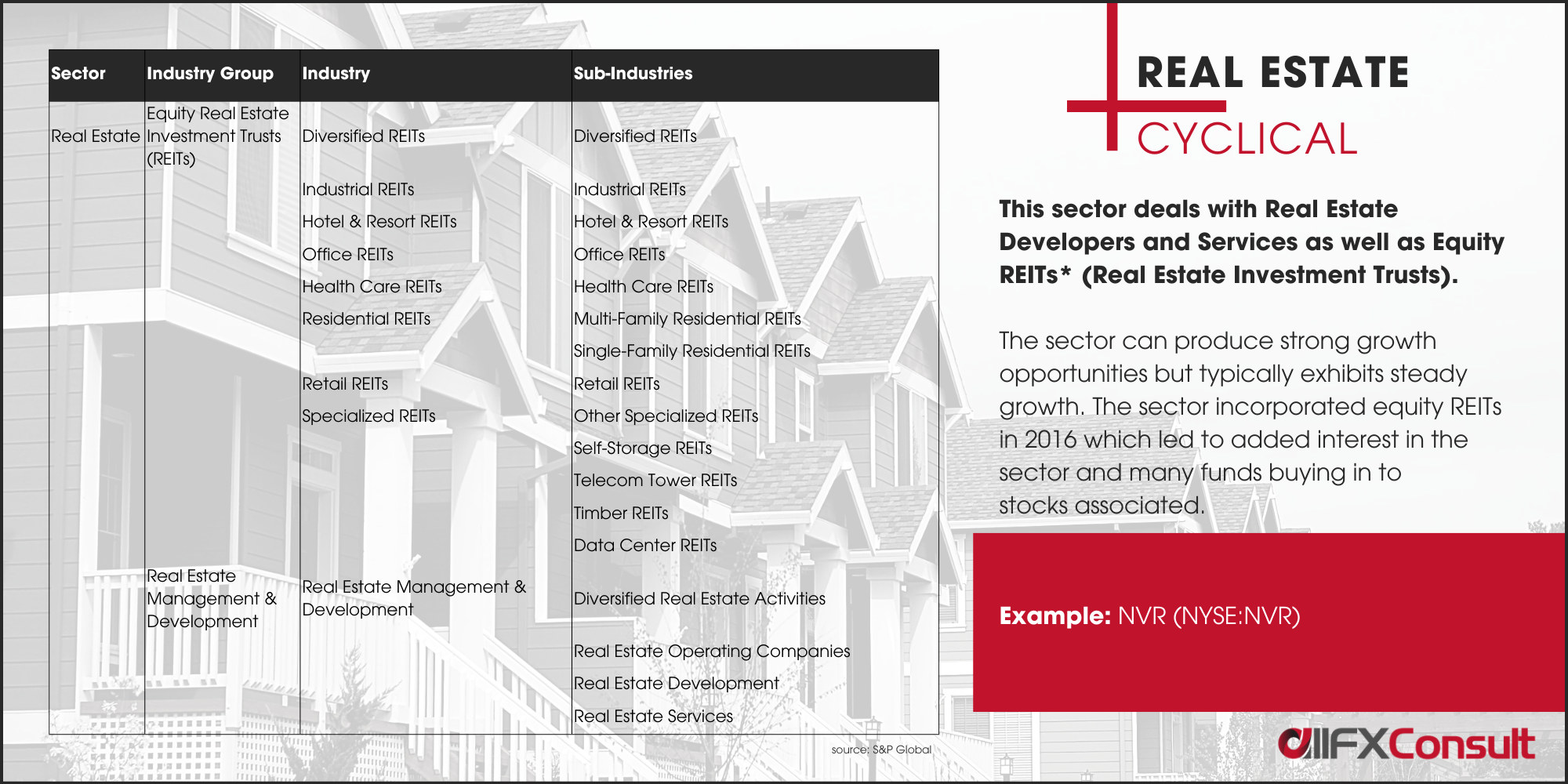

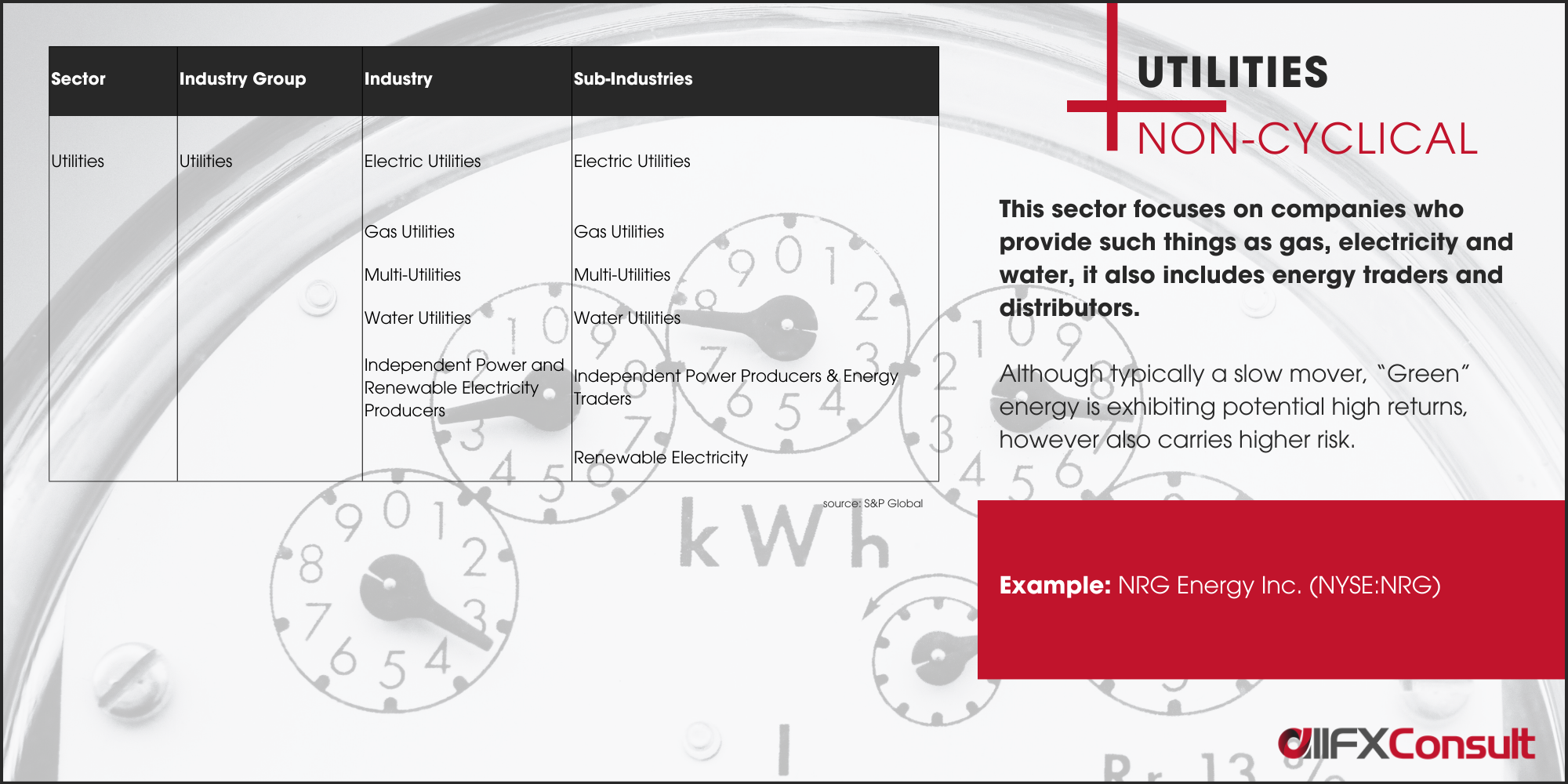

Classification examples include financials, healthcare, industrials, staples, discretionary, energy, communications, IT, materials, real estate, utilities. These are important because they indicate where revenue is derived from, and the impact of economic cycles on potential investments.

Indices that track sectors/industries (ex. NASDAQ Industrial, Telecom)

When creating a sector-focused stock index

creators use the benchmark classifications of GICS and ICB

Companies that have similar products/ services are categorized under a specific sector. See below cards with the classifications, based on the GICS system

How are stock indices weighted and valued?

Main stock indices are weighted by the constituent’s market value, or their current price, or none of the above and allow equal representation of them all.

To find the market value of a constituent also known as market capitalization/market cap, the outstanding shares are multiplied by the current price. Depending on this value, weight is assigned accordingly.

Typically, stock indices categorize constituents by market cap sizes known as large cap (over $10 billion), mid cap (between $2-$10 billion) and small cap (between $300 million to $2 billion).

Note: Fixed income weighting takes into consideration the outstanding debt of the constituent. Other factors such as payable coupons may be considered as well.

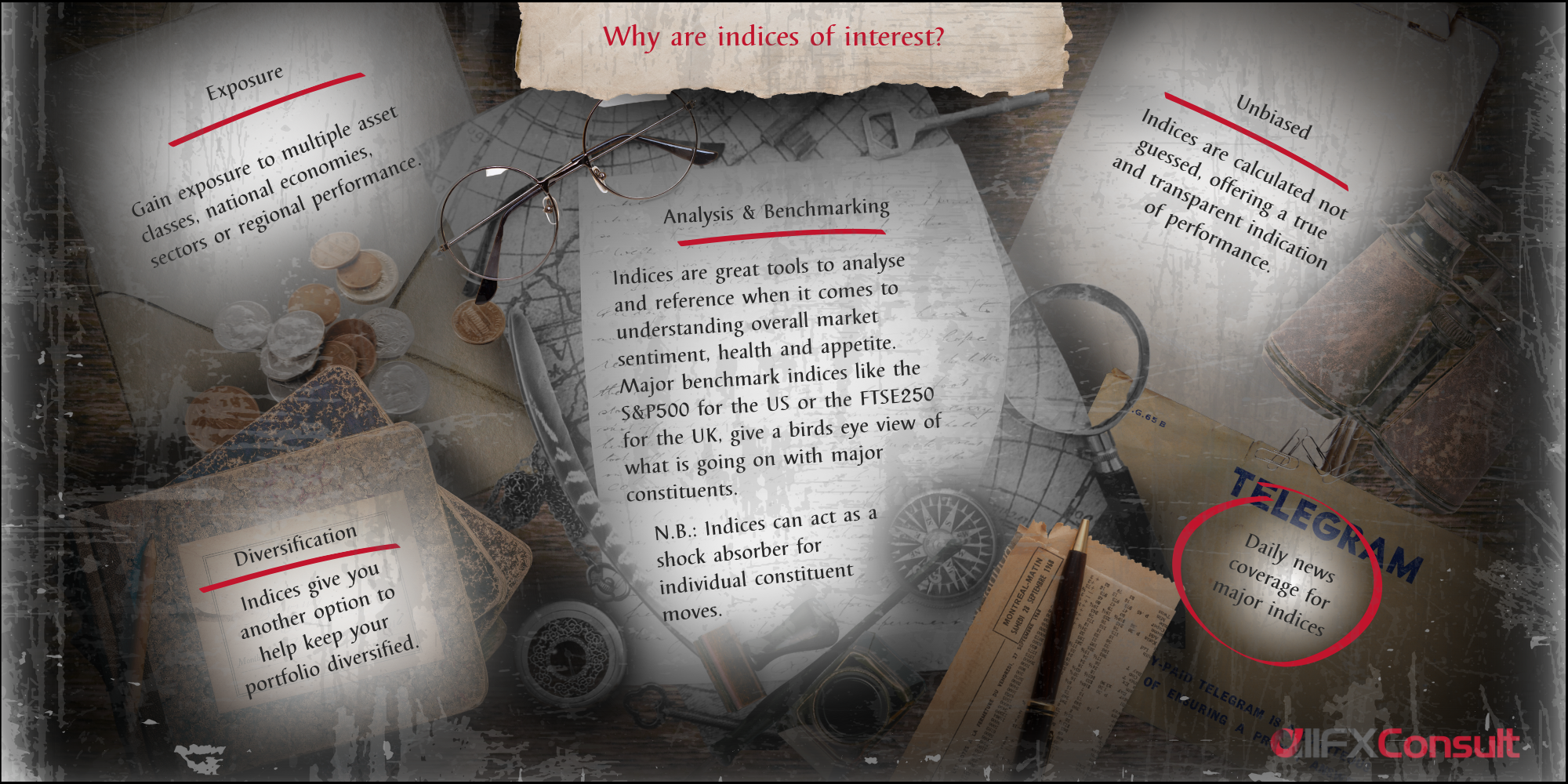

Why trade indices?

Exposure to multiple asset classes

Diversification of any portfolio

Shock absorbers of sudden moves

Constant coverage by media

Unbiased, true activity gauges

Factors that affect index prices

The values of indices can be affected by all the reasons that affect their individual constituents. Since due to their nature indices don’t significantly move when a constituent moves, they tend to follow investor sentiment based on general economic conditions

National policies, global relationships

Changes to the composition of the index

Economy and fundamental indicators

Commodity price fluctuations

Company fundamentals, earnings reports

Volume, liquidity, buy/sell pressures

Natural disasters, disease, pandemics

Especially multinational companies

How to trade indices?

What are indices, their structure, trading hours, CFDs

Symbols, bid/ask, pips, spread, price movers

Margin, margin call, stop out, leverage, lots, rollovers

Stop loss, trailing stop, take profit, pending orders

Fundamental, technical, sentimental analysis

Trader types, risk tolerance, start small, pick direction, test

Strict selection process, open a/c, KYC, funding, trade

Trading log, review, evolve, socialize, use technology

Start with demo accounts, move to live but small

Profitability, how to choose a broker, what to trade?

Settlement

Index trading can only be cash settled.

To deliver the underlying asset, one would need weight the delivery of each stock with exact reference to their weights on the index. It would be a logistical nightmare.

Cash settlement through Mark to Market allows for settlement of profits and losses daily. On expiry of futures contracts, settlement is based on the spot price.

The underlying index is only a statistical value, and cannot be traded directly. Investors can gain exposure to indices through derivatives and funds.

Indices can be traded with short term positions through cash contracts that settle intraday. They can be rolled over to the next day with a small fee, they have tight spreads and they are priced very close to the index value.

Indices can also be traded through derivatives such as futures and options. They have wider spreads than cash contracts and expire further into the future. They are suitable for long term positions and traders speculate on a future price of the index. Other index derivatives include CFDs.

Indices can also be traded through basket products like funds and ETFs that track an index. They invest in the index constituents in same proportion and weight.

Pros of index trading

Cons of index trading

Hedging – can offset transactions on individual securities. A stock heavy portfolio can be offset via investing in index derivatives

Low cost – in comparison to trading individual securities, investments in indices incur lower transaction costs from a single position

Diversification – spreads investments across many instruments within the same asset class, reducing individual risk of components

Broad exposure – investors can target/gain access to multiple asset classes, sectors, markets, economies that suit their investment goals

Flexibility – indices come in all shapes and sizes so depending on the risk profile and end goal of investors, they can cater to most needs

Tracking errors – index funds may not replicate exactly their indices due to fees and transaction costs resulting in discrepancies in returns

Lack of downside protection – indices can reduce the impact of declining constituents, but they are still susceptible to overall market risk

Not meant to beat the market – Limited upside potential due to its nature as a market tracker. Might not see big returns in the short term

Missed opportunities – individual constituents may experience notable positive results that won’t reflect in a basket index product

Passive investments – The job of the index is to track the underlying in a passive way. Traders might miss benefits of active investing by pros

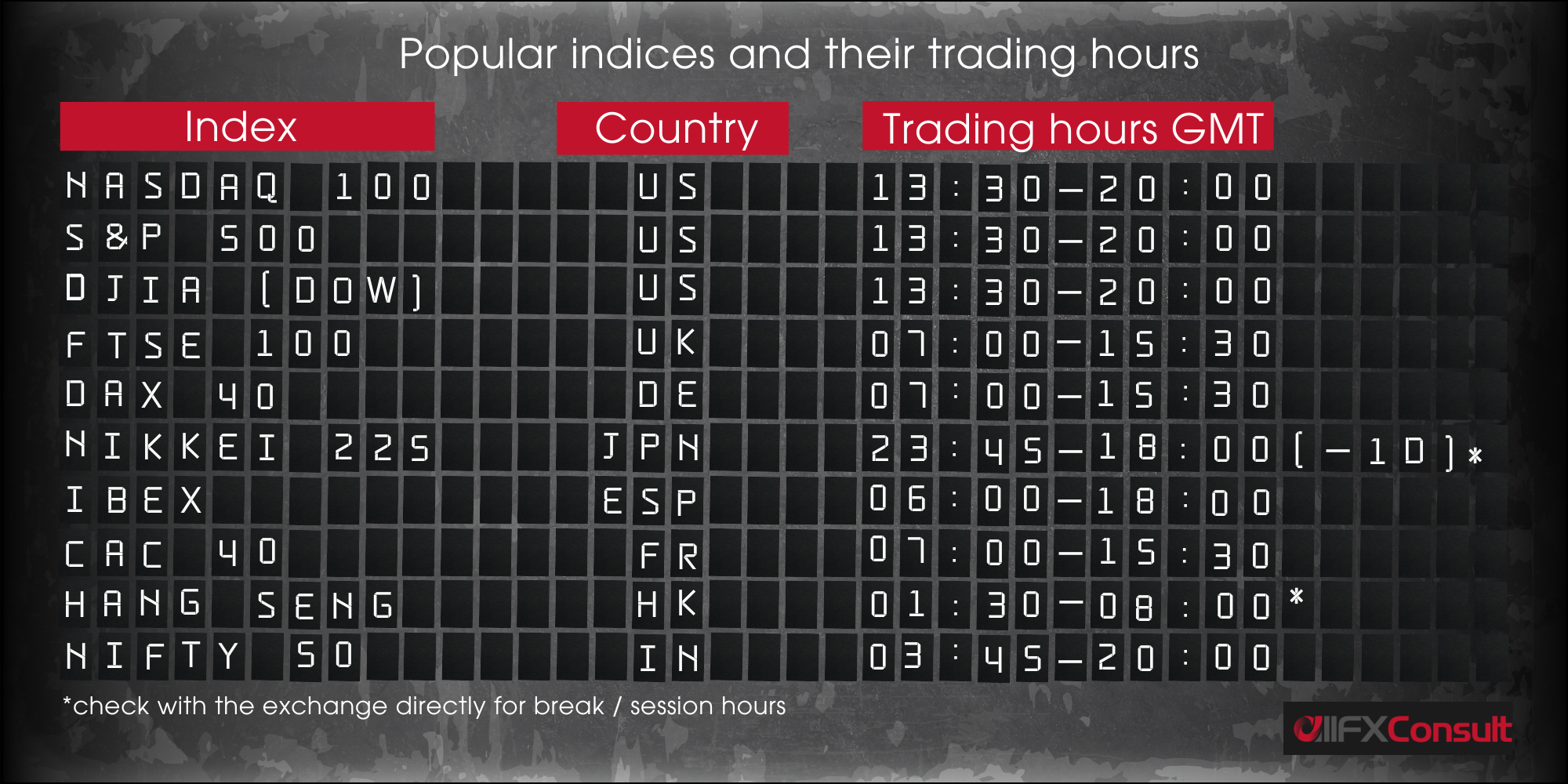

Index trading hours

Index FAQs

What are sentiment indices?

If index trading becomes an option, a trader must spend some time analyzing the price movements and volatility. Opening and closing sessions might experience more moves than other times, but nothing is to be taken for granted. Indices have their own price movers, and its always advisable to understand the environment prior to active trades.

Is it better to trade stocks or stock indices?

Both investment types have their pros and cons. This being said, each investor must know their individual goals, preferences and risk vs reward ratio. Stock indices tend to be more suitable for passive portfolios, whereas direct stock trading requires active management and screening.

What’s the difference between indices and indexes?

There is no difference whatsoever, except how they are spelled. For all intends and purposes trading indices is the same as trading indexes.

Which are the most traded indices?

The US index benchmarks are the most widely followed and recognized indices. Many derivative products have been derived by their values and given their size and popularity, they remain the best documented indices in the world. This being said, major economies around the world are also benchmarked and followed. Examples are the S&P500, DJIA 30, NASDAQ 100, RUSSEL 2000, FTSE100, DAX40, CAC40, NIFTY 50, NIKKEI 225 and others.

How to calculate contract specifications when trading indices?

Online brokers are obliged to publish a Key Identification Document (KID) that outlines how a product can be traded with profit and loss scenarios. Its very important for traders to go through these documents and understand leveraged products, margin requirements and the trading environment of the asset.

Thinking of monetizing your network?

For any questions or concerns

Our team is available 24/7