Trading on your mind?

LEARN one asset class at a time

or scroll down to understand all about trading and investing

Working tirelessly on bringing you

snippets, videos, editorial on all things trading

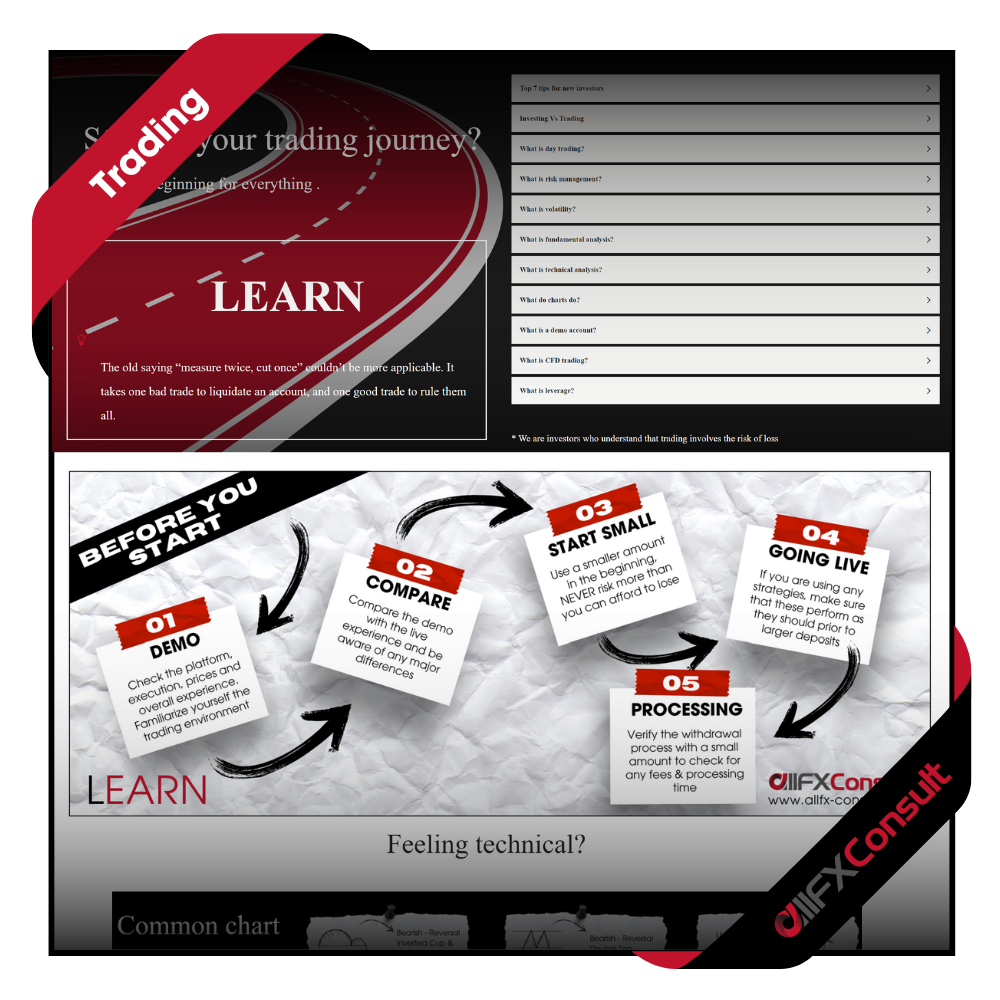

Starting your trading journey?

There’s a beginning for everything .

* We must all be investors who understand that trading involves the risk of loss

Already on the road?

Map your direction

* We must all be investors who understand that trading involves the risk of loss

There are thousands of groups that trade the same way you do. Become part of their environment, exchange ideas and experiences, learn from one another. Find a mentor that has no conflict of interest with your account, and harness their experience.

Not all markets need to be traded. Focus on what’s right for you and your account. Diversification doesn’t mean to trade all instruments. Have your sights on what’s important at the given time and keep things simple.

Technology evolves. Trading evolves. Markets evolve and change behavior depending on the economic conditions. Constant learning and improving, is the difference between a flat account and an active one.

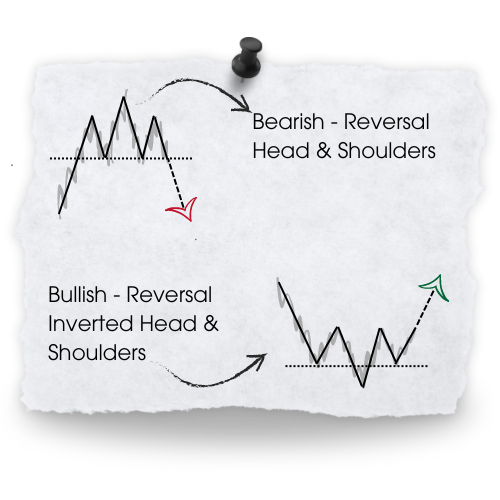

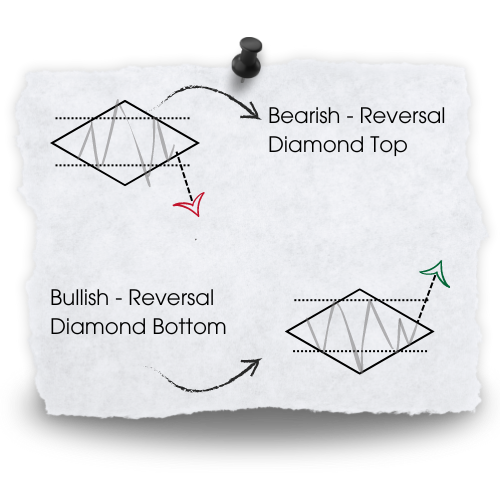

Feeling technical?

Here’s what charts look like

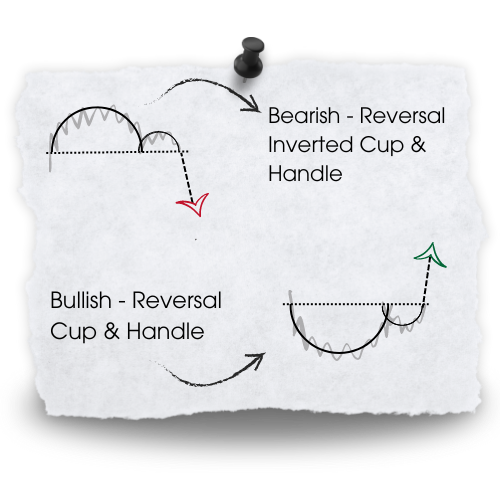

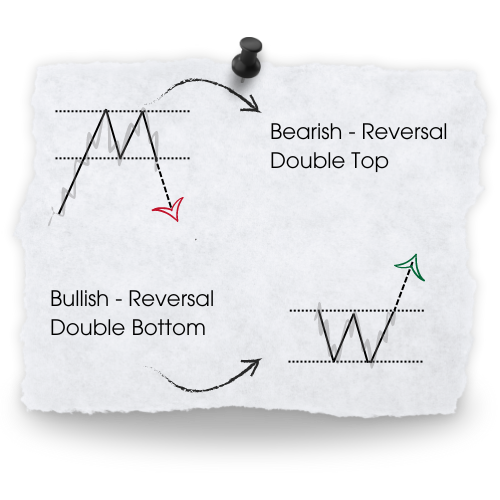

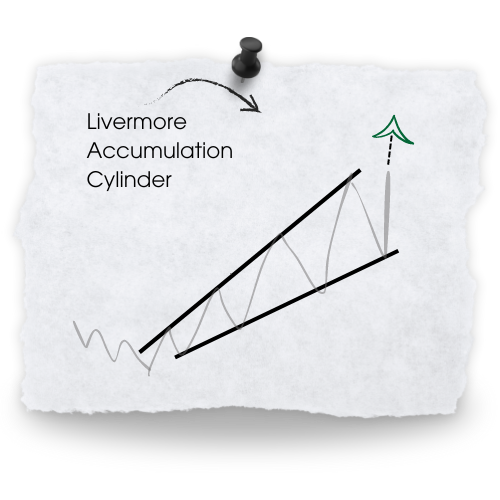

Common chart patterns

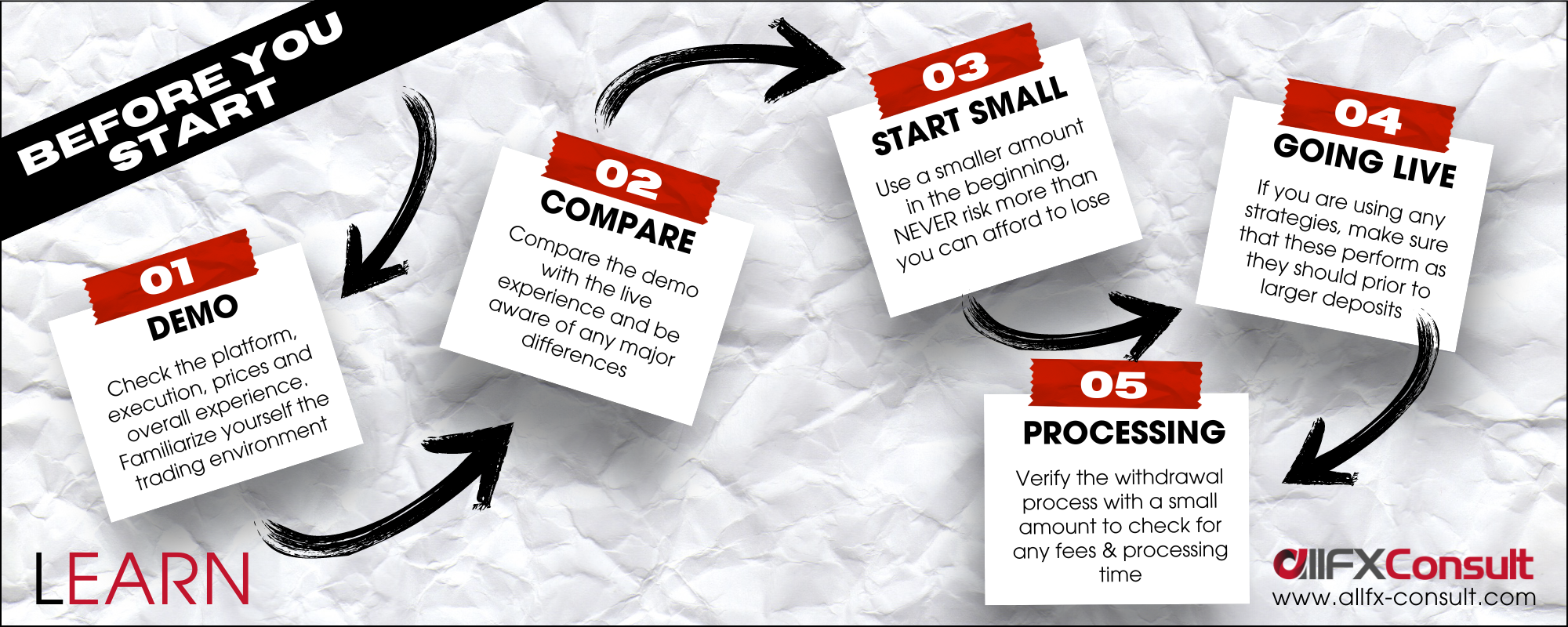

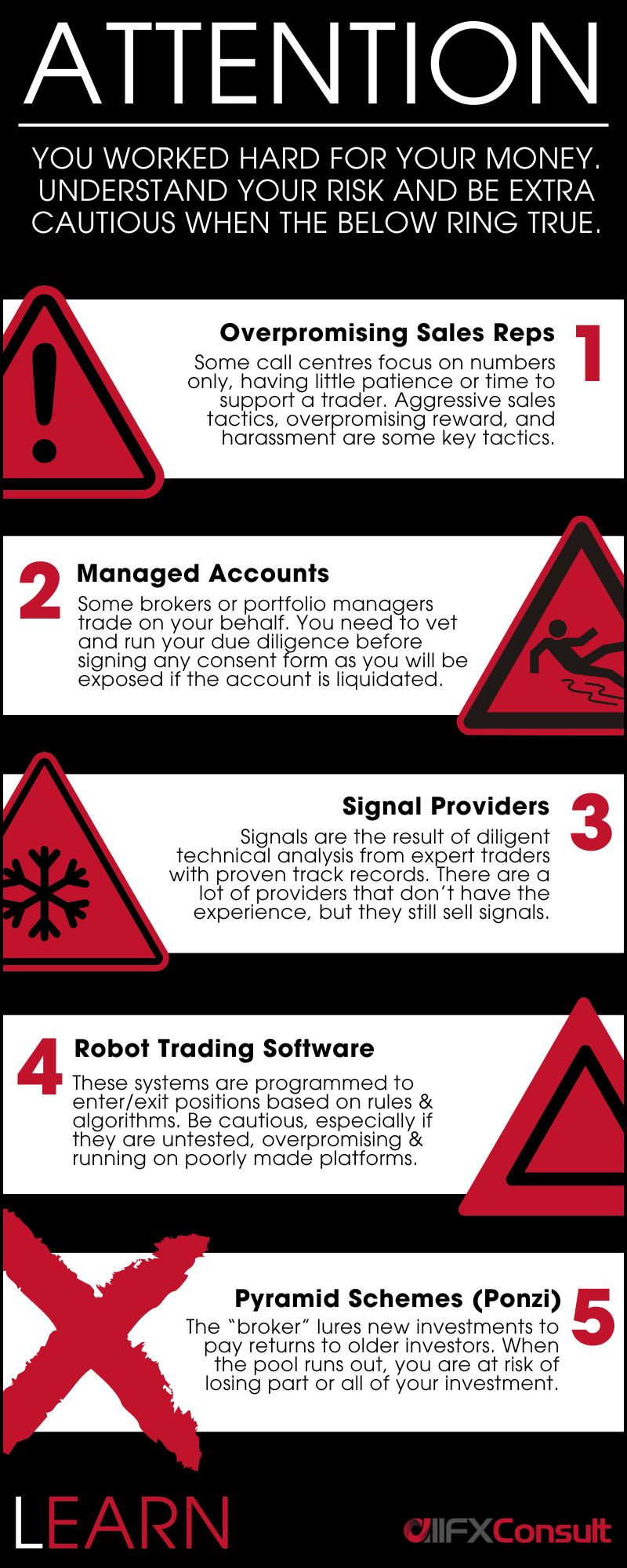

Finding the right broker is not so simple

But when the match is found, the possibilities are endless

Thinking of monetizing your network?

For any questions or concerns

Our team is available 24/7