Choose a forex jurisdiction

to see broker lists, economic data and license details

How to start a forex brokerage

simplified operational chain

1 of 7

Research/plansBudgets/Targets

2 of 7

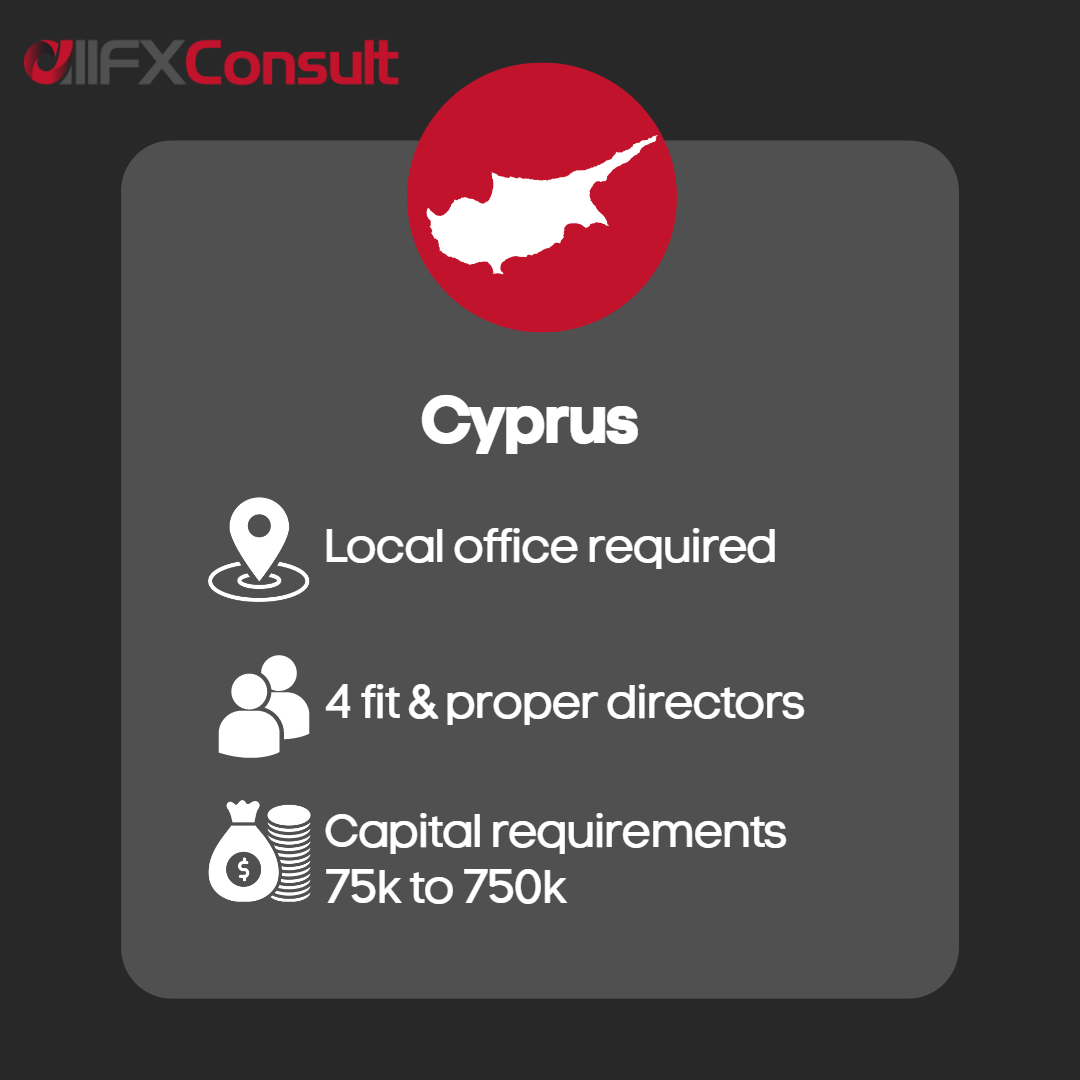

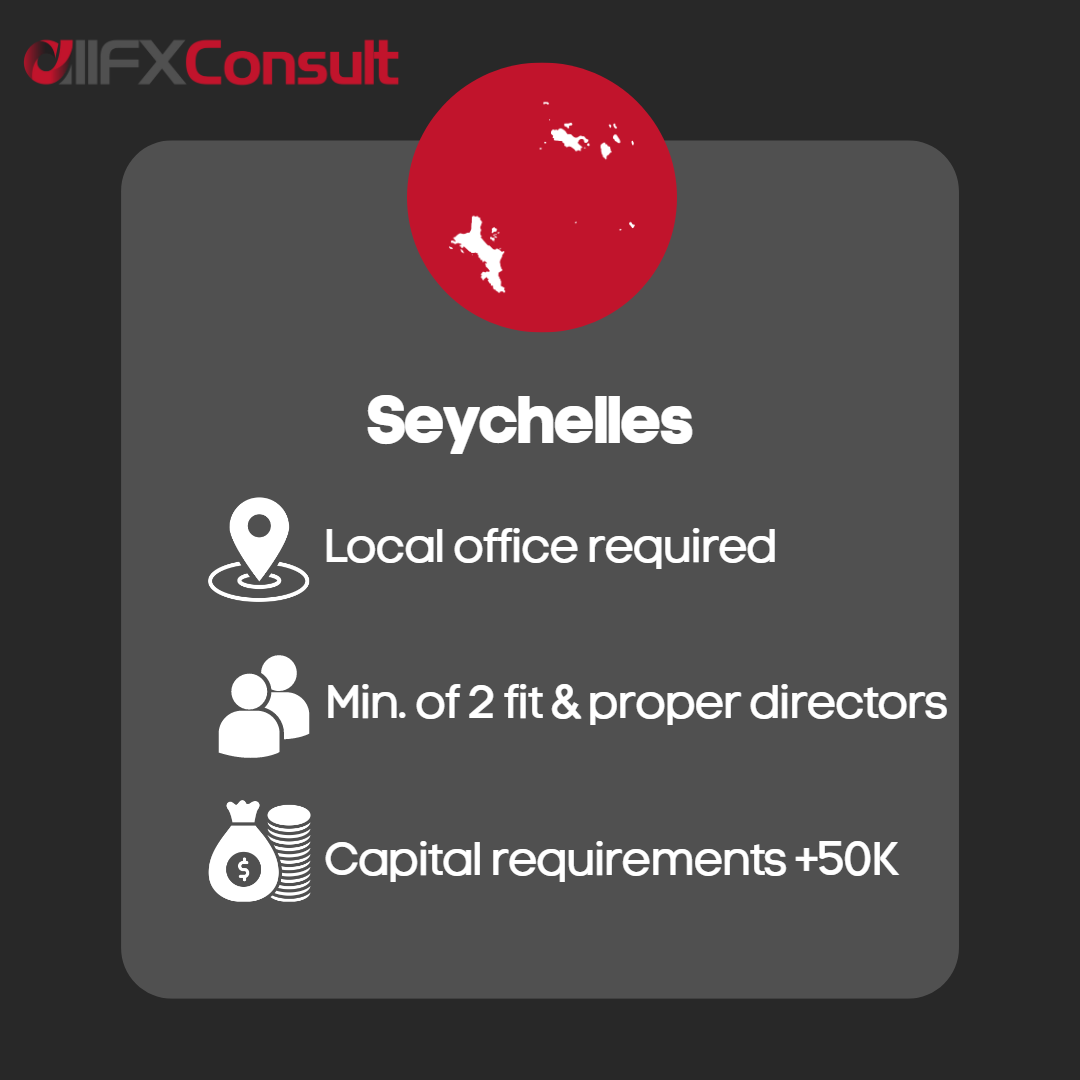

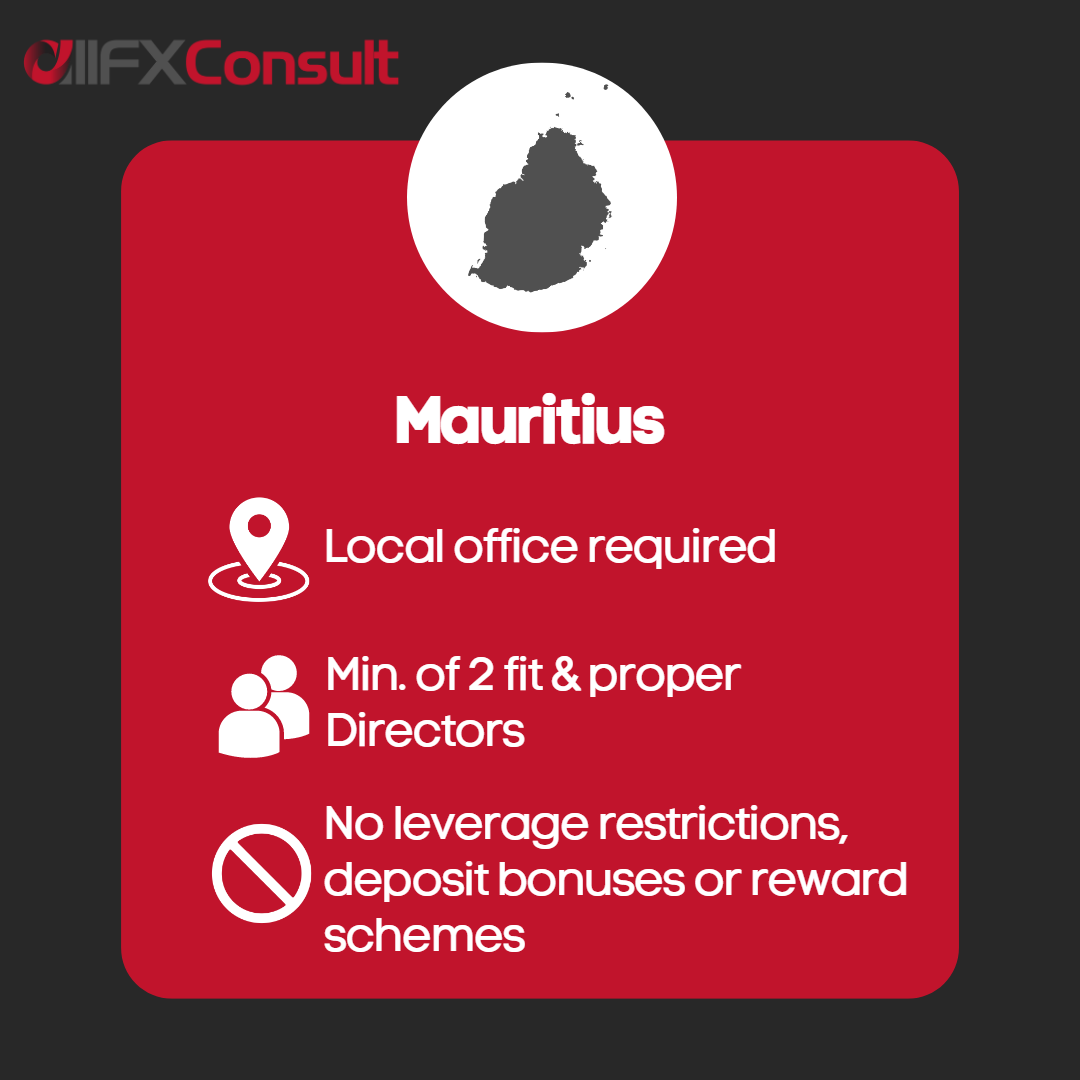

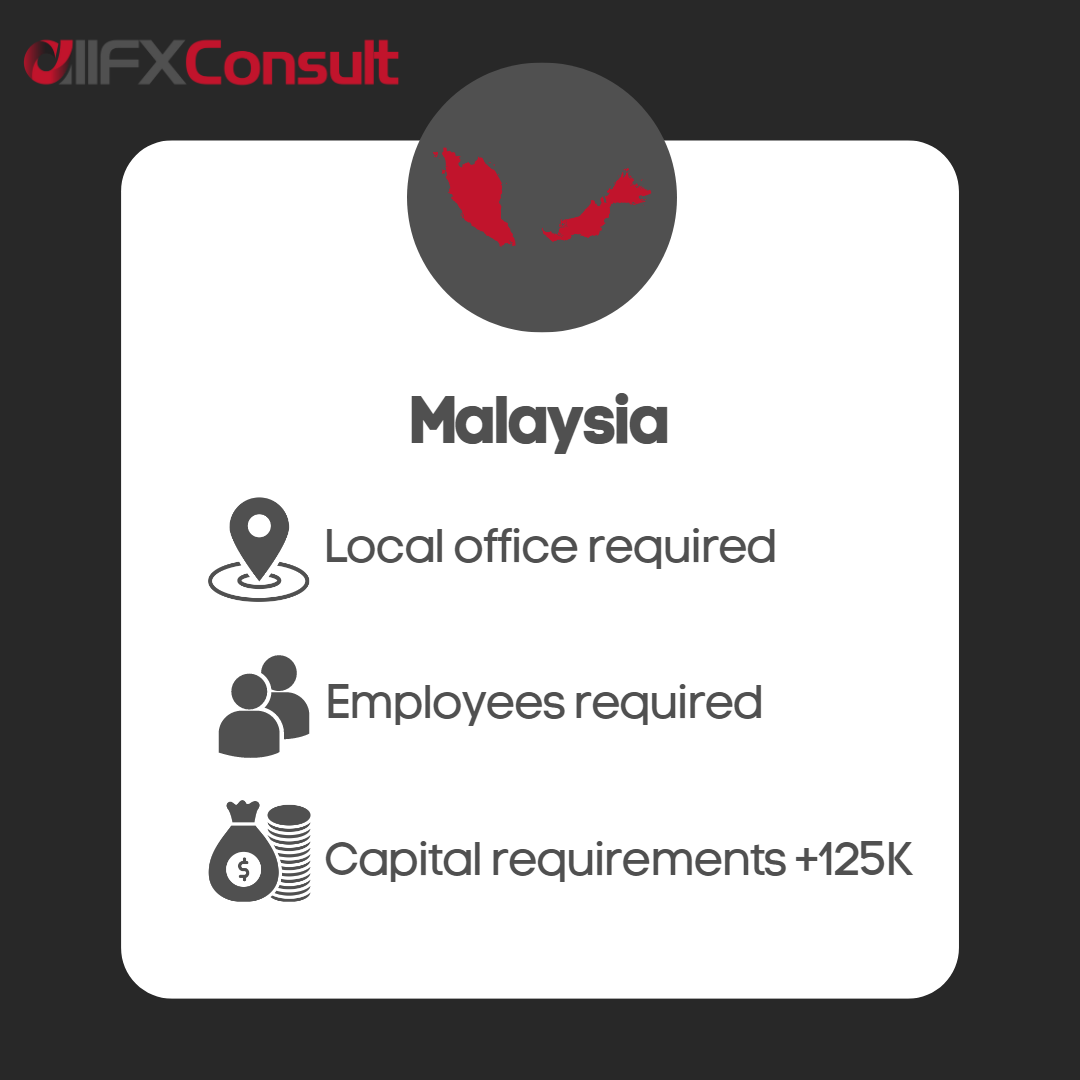

Register a companyWith license or not

3 of 7

Setup your bankingDirect or other

4 of 7

Build a websiteAdd info from plan

5 of 7

TechnologyPlatform, CRM

6 of 7

PSPs & walletsDirect/ Agent

Take a leap in the right direction

with 3 simple steps

Step 1

Contact us – You’re only but a click away from joining the biggest market in the world

Step 2

We will form a plan – understand the risks, the rewards, choose wisely not emotionally

Step 3

Connect, build and start your own forex brokerage in less than 2 months

Let’s begin

with step 1