A new era dawns on Argentina – an excellent case study to learn from or cavy of unorthodox ideologies with potentially disastrous effects?

A land of legends by the name of Lionel Messi and Diego Maradona! Could we include Pope Francis here too? He does get a near 2% admiration by the population of Argentina (on Statista) among former presidents and TV hosts.

Past is in the past though and a new sunrise, shines on one of the most beautiful countries and 3rd largest economy of South America after Brazil and Mexico. Javier Milei defeats Sergio Massa in the 2023 Argentine general elections, after winning the run-off round by 3 million votes, and a decision of the latter to concede.

Who is Sergio Massa? Argentina’s Minister of Economics since 2022, he run for President in the 2015 elections, where he lost from Mauricio Macri, yet another Argentine favorite (again based on Statista). With media pinning current inflation numbers (more like hyperinflation of 143%) on current government policies (including Massa’s) and associating the bad economic stance on the country to dark politics of the past, Argentina voted for a different future, calling for drastic change and reformation measures.

Why is this a new era for Argentina though?

Well, Argentines are celebrating Milei’s victory by chanting “out with all of them”. If that doesn’t describe their views on past leadership, maybe Milei’s anarcho-capitalist campaign on reconstructing Argentina by shutting the Central Bank, dollarizing the economy and embracing decentralizing finance, can. Which is the reason why we’re writing about this. And if this is not painting a picture of what’s coming, take a 15% spending cut by shutting down ministries of culture, education and diversity, and also by eliminating public subsidies and there you have it.

Note on Argentina’s public subsidies:

In a study on “The Incidence of Subsidies to Residential Public Services in Argentina: The Subsidy System in 2014 and Some Alternatives” by CHRISTOPH LAKNER, MARIA ANA LUGO, JORGE PUIG, LEANDRO SALINARDI and MARTHA VIVEROS, they write:

“Though subsidies can be a tool to protect the poor, in Argentina they led to distortions and a large share have been absorbed by upper classes and non-residential consumers.

In 2015, electricity bills reflected less than 10% of production costs and lower tariffs have led to an increased demand of public services. Not only have energy and transport subsidies distorted both demand and supply, they have also not been efficiently targeted to the poor; instead, they have been distributed across all income groups, with the non-poor receiving the largest shares.”

Although we are writing about Argentina for its economic reformation plans primarily, we can’t fail to mention that the new administration will be seismically shocking social issues as well, like regulations on gun control, abortion, private education and the privatization of the health sector.

It’s also worth mentioning that worldwide through history, social distress/unrest always called for change, whether an extreme leftist movement (Marxist ideology of proletariat uprising) or extreme right (fascist/nationalist movements and demagogues with more devious plans than just the reformation of a country).

Now that we have a prelude, what is the context of today’s topic? Politics and social issues aside, we’ll only touch on the economic reformations i.e. the Central Bank shutdown, the dollarization concept, the huggzies on decentralized finance with a pro-Bitcoin stance and its integration into the economy (following El Salvador). Will he legally tenderize Bitcoin in the country like a prime beef cut? Remains to be seen.

Happening now and reasons leading up to this

To begin with, why don’t we try and put some context to the Argentine economy, and then see what makes these elections different from the rest, and why these economic reforms are of interest moving forward.

Argentina as of 2023 (at the time of writing this article):

| Population | 46 million |

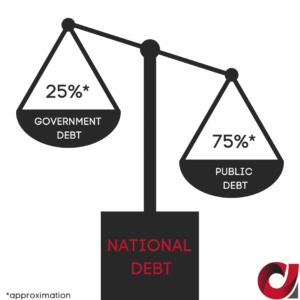

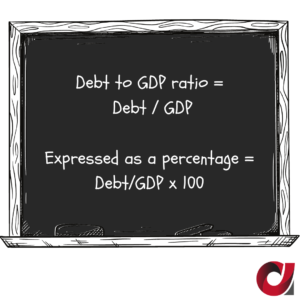

| National Debt | Over $400 billion ($43 billion is owed to IMF) |

| GDP | Over $600 billion |

| Unemployment Rate | 6.2% |

| Inflation Rate | 143% |

| Interest Rate | 133% |

| Poverty Rate | 40% |

As of late (since the country has been in economic turmoil for decades), Argentina was in a recession because of the pandemic like many other countries. In its 3rd year of droughts, pain was felt on its agricultural sector affecting soy, beef and wheat to say the least. Based on the International Production Assessment Division of the US, production yield – measured in Tons/Hectare – dropped since 2021 like so:

- Wheat: from 3.4 to 2.3 and up to 2.7

- Rice: from 7.3 to 6.6 and up to 6.8

- Barley: from 4.0 to 2.9 and up to 3.6

- Corn: from 7.9 to 5.1 and up to 7.7

- Soybean: from 2.8 to 1.7 and up to 2.9

Argentina’s natural resources

First and foremost, any country’s best natural resource are its people. Argentines are beautiful people, highly educated and outspoken. Maybe a shocking political reformation like this one, is what the country needs so that Argentines can finally shine the way they should.

- Lithium is used in batteries, a big component in the global energy transition, its used in medication treating bipolar disorders, it’s also used in glass/ceramics (stovetops, fiberglass) due to its corrosion resistance and durability.

- The 2nd largest shale gas formation (802 TCF) after China (1,115 TCF)

- The 4th largest oil shale formation (27 billion barrels) after Russia, US and China

- Large initiatives were taken by previous administrations for green energy transition (solar and wind) as part of the global climate change efforts. Another interesting view of the new administration is that climate change is a “socialist lie”. Milei also said that should he come to power, a company could pollute a river without restrictions. I hope there is humor somewhere in this sentence that I don’t see, because if not, in the name of economic reformation people voted for future green babies with 4 fingers, a tail and no toes.

- Sector accounts for a quarter of the country’s exports.

- 4th largest producer of soy worldwide.

- Produces maize (corn), wheat, cotton, sunflower seeds and more

- $30 billion worth of mining portfolio via 113 projects, 26 of which are in production and under construction.

- Further to lithium and energy, Argentina has deposits of copper, aluminum, uranium (40K tons, ranking 19th by reserves), iron, zinc, boron (used in fertilizers, insecticides, borax, fiberglass etc), potash (used in fertilizers)

- Argentina shares the same mountains with Chile, the largest copper exporter in the world (with revenue of $23 billion in 2022). To understand how behind in international trade Argentina is, it has large amounts of copper deposits like Chile, but exports none of it. That’s why 50% of the projects in the mining portfolio mentioned above, relate to copper.

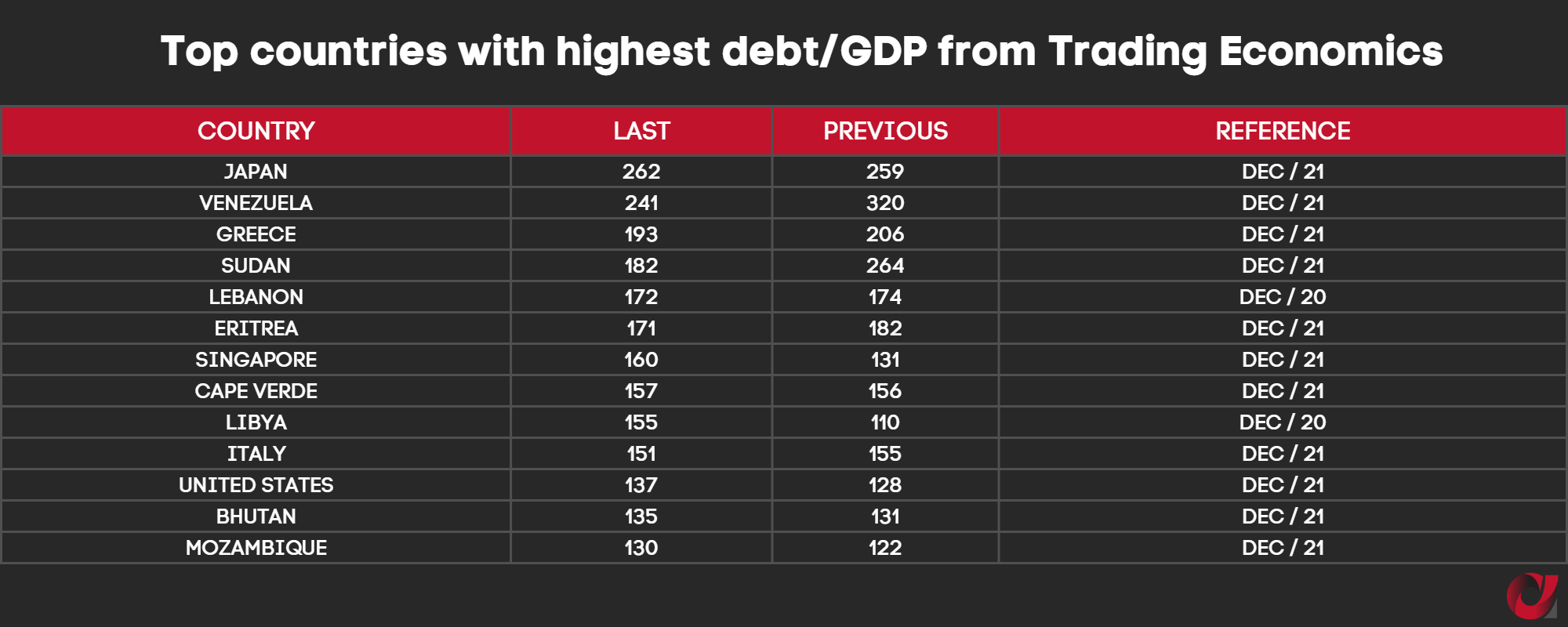

Argentina’s debt

Attributed solely to economic mismanagement – we’ve written about Argentina’s debt in previous articles – so a generic characterization would be a serial defaulter. Since 2001, the country defaulted already 3 times on its national debt.

- 2001 in the middle of a financial crisis

- Argentina was under military dictatorship (junta) from 1976-1983. New government reforms lead to hyperinflation of 200% by July 1989, president Alfonsin resigns.

- 1990s saw fixing the exchange rate of its currency to USD, tax evasion and money laundering, lower tax revenues and large amounts of borrowing by president Menem.

- Recession started in 1998, characterized as the great depression of Argentina, lasted for 3 years

- Argentina defaults on $132billion

- 2014 in the middle of a battle against holdout creditors. 3 options were at play:

- Pay creditors. Given the debt burden it was rejected by the government.

- Negotiate a deal. Regarded as a win-win, but the political cost on the government would have been too big. Also rejected by the government.

- Selective default. Which was chosen, and its economic/social implications are still felt to date.

- 2020 – middle of Covid 19 pandemic

- Yet another debt restructure, failing to pay half a billion to its creditors, Argentina defaults on its payments.

So can a country can survive without a Central Bank?

Weirdly so yes it can. Central Banks became mainstream in the 17th century. Prior to that, monetary policy was managed by the country’s Treasury. Though it was also a time when Gold and Silver were the currency, accepted and recognized across the board.

Taking this a step further, if a country doesn’t have its own currency (so it kinda outsources the situation) then what would the real implications be, if no Central Bank was present? Do Eurozone countries need a Central Bank since they outsource their currency to the ECB? Take Andorra and Monaco as an example, both in the Eurozone, without a Central Bank of their own doing just fine. Or Liechtenstein with the Swiss Franc for that matter. Tiny countries, I know, but doesn’t science begin with small controlled experiments, and based on their success decide on a True/False result?

This being said, the Central Banks have an independent role to play in a country’s economics, a weapon against manipulation and fraud by their own governments. Although this is dependent largely on the role of the Central Bank in the county and the control that the government has on its functions.

The three largest cases we could look into to review this, would be the US Fed, Europe’s ECB and China’s PBC. In the US, the Federal Reserve is authorized by Congressional law, so that a president can’t order the Fed to print money on a tantrum (for example billions of starched dollars, fresh off the press, and instead of being used to support the US citizens and a $34 trillion indebted economy, we see them being used abroad in wars/fights that have nothing to do with their own economic growth. Not judging of course, justified help should always be present by stronger countries to weaker ones, hopefully on the premise of human rights to freedom, rather than the fear of a bond selloff or monetary interests (more on this another time).

Also, on a random note, not sure if calling country leaders names (like dictators) ever served properly geopolitical relations, but a US president did call a Russian president a dictator, right before the Ukrainian war, and a US president did call a Chinese president a dictator, right before a potentially upcoming Cold War. Wait a minute… isn’t it the same president that keeps throwing the D word around, like popcorn on the head of the person sitting in front of you at the movies, that just won’t stop talking… Nahh, the name calling can’t be related to any international events…

So the Fed is authorized by Congress. The ECB is run as a result of an international treaty, with a Euro independent of national governments, raising the question again whether a Central Bank is needed or not. In China, the system is deliberately set up so that the president can indeed order the PBC to do things. A gift from a Marxist/Leninist ideology that may serve well or not, but serves nonetheless.

What is up with dollarization and how far back can we go to understand this?

1946 saw Peron come into power, inspired by nationalist movements in Europe, including Italy’s Mussolini. Together with a strong labour movement (he favoured the workers by increasing wages, welfare programs etc) and cutoff the country from international trade. Peronists are his legacy, in power for the majority of the past 2 decades (including the Kirchner husband and wife (2003-2007 president Nestor Kirchner and his wife Cristina Kirchner, president from 2007-2011, re-elected president from 2011-2015, and emerged again as vice president, in the last administration from 2019 to date).

This nationalist behaviour, combined with the decoupling from international trade and huge spending for the public, needed money. Government was printing money, because it could, to tackle with excessive fiscal deficits and the more it printed, the worse inflation became. Too much money pumped into the economy, chasing too few goods, is the definition of hyperinflation. Local stores would set a price for their products in the morning, and reprice them in the afternoon. That’s how quickly conditions changed. They worked for nothing because they earned nothing.

Argentines had to get creative.

Saving in the local currency, the Argentine Peso, with the numbers experienced over the last decade had little to no impact. So they started saving in USD a long time ago. A problem of its own though, since government controls allowed people to exchange only up to $200 a month at the official exchange rate. Currency black markets took advantage of the opportunity and Argentines illegally (but understandably) went with it, in an effort to hold some value in their money. To put things in perspective, the official rate for 1 USD was 360 pesos. Through black markets, 1 USD is 760 pesos.

Soybeans in Argentina have an export tax of 33%. If the export price is 1,000 dollars, the government takes 33% or $333, and the farmer the remaining $667. The farmer will exchange these dollars for pesos at the official exchange rate. When the dollar rate is bad, farmers have to make a decision between exchanging now at a bad rate, or exchanging later at a better price, or holding the produce in storage until a better price is at play. Dollars in the hands of people, empty coffers in the hands of the government.

Soy dollar (dolar soja) was the solution to this. Better exchange rate provided by the government specifically for soya sales and exports. In September 2022, the first plan brought in $7,5 billion in revenue, the 2nd in December 2022 brought in $3 billion, the 3rd plan in April 2023 brought in $5 billion and the 4th plan in August 2023 brought in $2.1 billion.

So how do we dollarize the economy?

Countries did it in the past like Panama, Ecuador and El Salvador, though none of the size of Argentina and especially with a poverty rate at 40%. To dollarize you need a stable economy and build foreign exchange reserves. You need access to capital markets and prudent reductions in fiscal spend. You need internal trust – your own people need to trust that it’s the way forward with short term pain and long term gain. And you need external trust – outside lenders and investors trusting that there is potential in the plan. With Argentina defaulting so many times, no one wanted to lend them money. Except the IMF. The debt to the IMF is double the one of Egypt, the second largest IMF borrower. Following is Ukraine, Pakistan, Ecuador, Colombia and African countries.

Does Milei have the trust – both internal and external – willing to do whatever to reign down the problems at hand and make “Argentina great again” like Donald Trump said to him after his win?

We sure hope so, because other than the fact that Argentina is a beautiful country, and other than the fact that it has highly educated and smart people, it also has the potential to increase its output exponentially and become a solid partner in the world stage.

We discuss all of the above and more in our Capital Markets Training – for corporations and individuals

The information provided is strictly for informational use and is not meant in any way to be construed as investment advice. One should seek expert advice, as all investment strategies involve risk of loss.

___________________________

More interesting topics to look into:

Forex White Label – Discover it all, requirements and options

EU Tied Agent – Should you consider it or not?

Forex jurisdictions – EU and Offshore with country stats and listed brokers

Start your Brokerage business by:

Connecting offshore: With our clients in Belize, Seychelles, the Caymans, Martial Islands and St. Vincent offering the most flexible IB and White Label solutions.

Connecting in the EU: With our clients in 15 out of the 28 member states offering strong partnerships to individuals and corporations with existing client base, looking to connect.

Contact us for a private conversation to discuss your case through the contact form or one of our emails at info@allfx–consult.com, partners@allfx-consult.com.

#argentina #startaforexbrokerage #ib #forex ib #whitelabel #forexwhitelabel #tied agent #regional partner #forexlicense #forexoffshorelicense

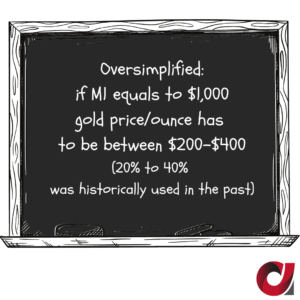

M1 is a measure of money supply (measuring from M0-M3). M1 is also known as narrow money, all the currencies and assets that can be easily converted into cash. The further you go on the M scale, the broader the money it measures and the less liquid (easily convertible to cash) the assets are. Rickards explained that 20-40% of M1 is historically a workable percentage used, when money was pegged to gold in the past (see image). The law in the US from early 1900s to 1950s said that gold price multiplied by the amount of gold in reserves had to amount to 40% of total money supply (Federal Reserve Act of 1913). Due to the Vietnam war and the need for money, they had to curtail the law, but 40% worked just fine. He also said that the Bank of England in the 1800s managed a successful gold standard when Britain became dominant power after the fall of Napoleon and until WW1 with 20% gold backing the money supply.

M1 is a measure of money supply (measuring from M0-M3). M1 is also known as narrow money, all the currencies and assets that can be easily converted into cash. The further you go on the M scale, the broader the money it measures and the less liquid (easily convertible to cash) the assets are. Rickards explained that 20-40% of M1 is historically a workable percentage used, when money was pegged to gold in the past (see image). The law in the US from early 1900s to 1950s said that gold price multiplied by the amount of gold in reserves had to amount to 40% of total money supply (Federal Reserve Act of 1913). Due to the Vietnam war and the need for money, they had to curtail the law, but 40% worked just fine. He also said that the Bank of England in the 1800s managed a successful gold standard when Britain became dominant power after the fall of Napoleon and until WW1 with 20% gold backing the money supply. Last but not least, there is a reason credit/debt is not taught the way it should to youngsters in schools. Keeping the majority

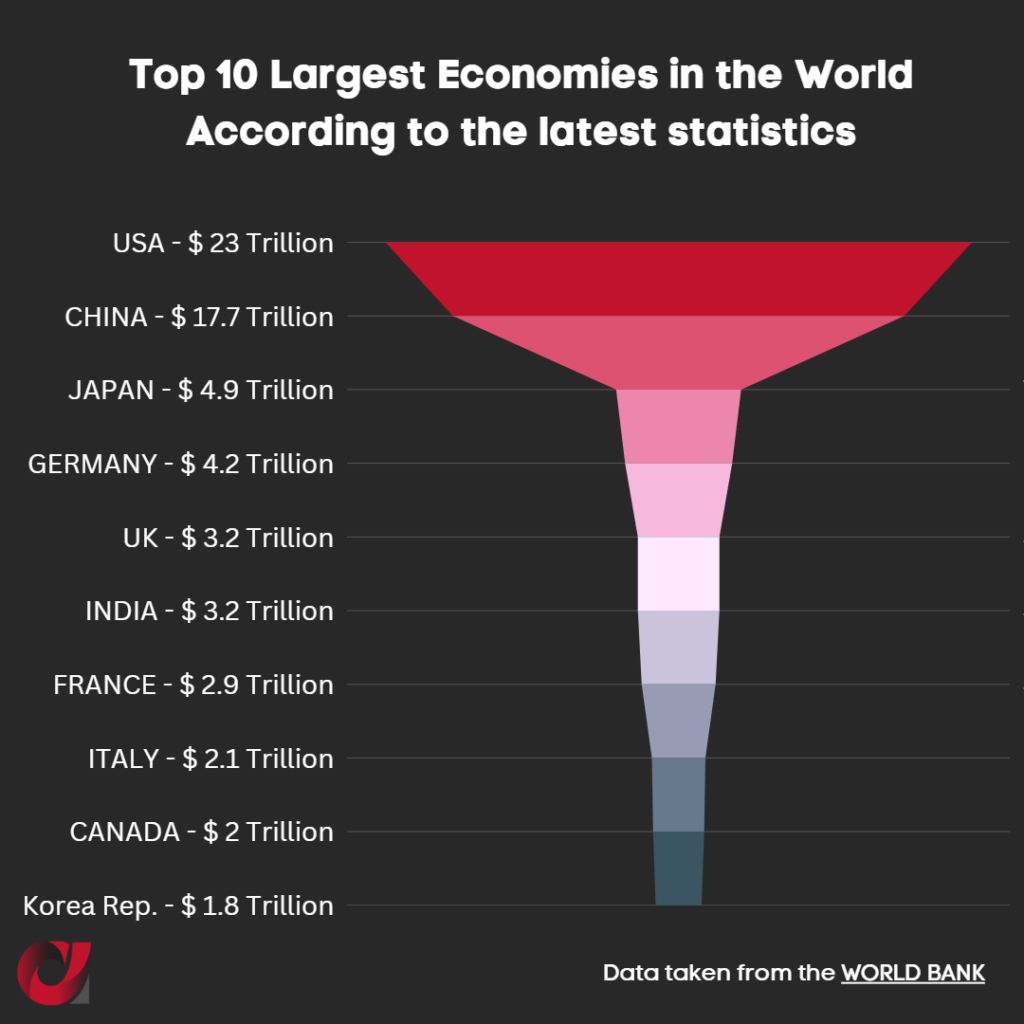

Last but not least, there is a reason credit/debt is not taught the way it should to youngsters in schools. Keeping the majority  When other sovereign nations are using your currency as their own, when over 65 countries peg their currency to yours, and when over 90% of forex trading involves your currency, you know you dominate. On the other side, when your GDP starts to decline at the same time that the GDP of competing countries is on the rise (with outlook of surpassing you) and/or when you are repositioned as a major partner in the global arena (EU exchanged more goods with other partners in 2021 compared to the US), you know that times might be changing.

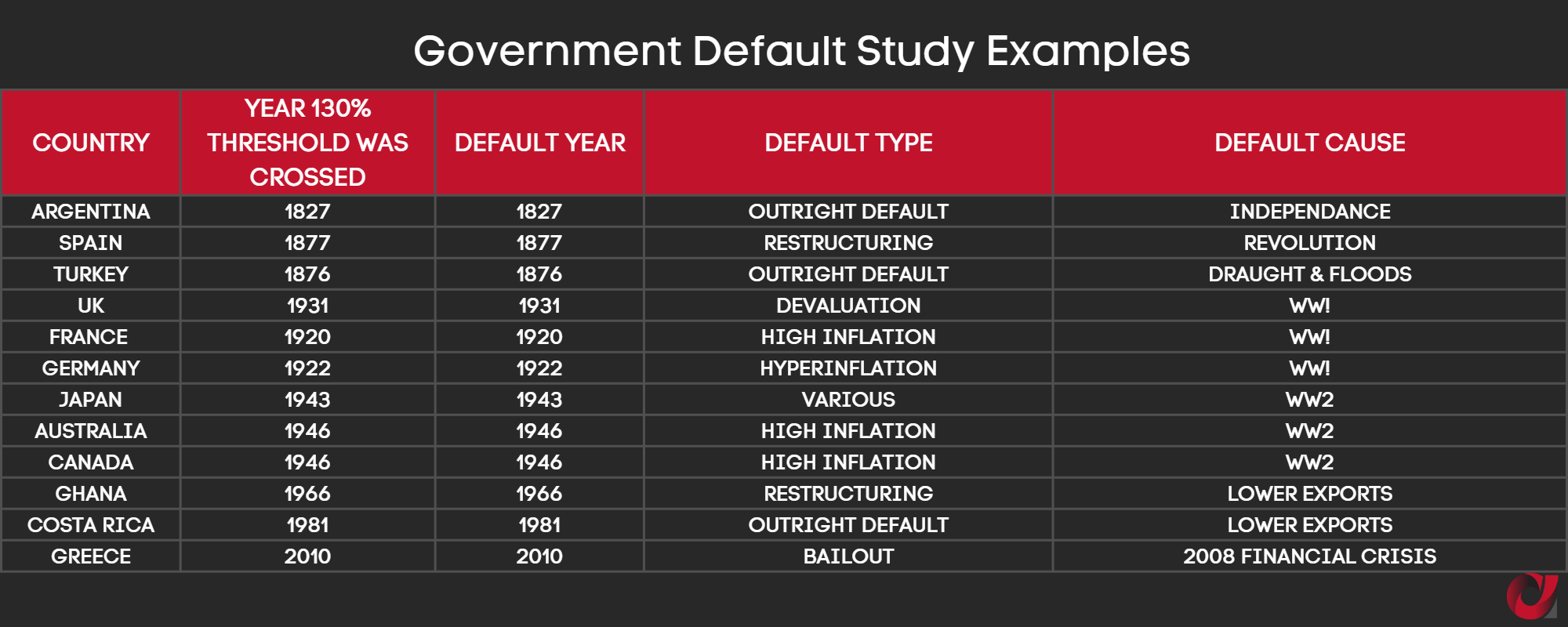

When other sovereign nations are using your currency as their own, when over 65 countries peg their currency to yours, and when over 90% of forex trading involves your currency, you know you dominate. On the other side, when your GDP starts to decline at the same time that the GDP of competing countries is on the rise (with outlook of surpassing you) and/or when you are repositioned as a major partner in the global arena (EU exchanged more goods with other partners in 2021 compared to the US), you know that times might be changing. And in all of the above, the country standing at the top of the podium was constantly challenged leading to conflicts and wars, the necessary funding of these wars, retreats and abdications, debasement (see image) of the currencies, ultimately leading to the fall of one empire and the rise of another.

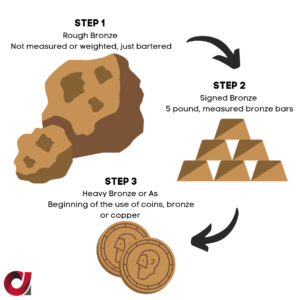

And in all of the above, the country standing at the top of the podium was constantly challenged leading to conflicts and wars, the necessary funding of these wars, retreats and abdications, debasement (see image) of the currencies, ultimately leading to the fall of one empire and the rise of another. Metals (precious as well as common) were used for bartering. Going back to 200 BC as an example, Bronze was heavily used as a medium of exchange, not so much for its value, as much for its crafting qualities (easily turned into tools or something else). The evolution of Bronze as a medium of exchange can be seen in the following steps (see image)

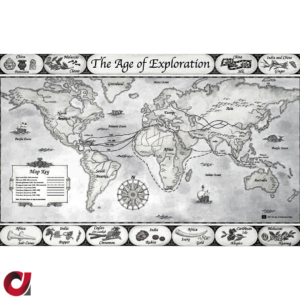

Metals (precious as well as common) were used for bartering. Going back to 200 BC as an example, Bronze was heavily used as a medium of exchange, not so much for its value, as much for its crafting qualities (easily turned into tools or something else). The evolution of Bronze as a medium of exchange can be seen in the following steps (see image) Trade routes at that time, were all land locked. Traders were still exploring to find safe passages and it wasn’t until approx. 110 BC that the Silk Route was established connecting China and Southeast Asia with Africa and Europe. Trade routes via sea, were recorded during the Age of Discovery/Age of Exploration. That was when European countries wanted to explore the world in the 1400s. It opened up a world of opportunities as well as brutal competition, which led to the discovery of the Americas as well as new trade routes to India and the Far East.

Trade routes at that time, were all land locked. Traders were still exploring to find safe passages and it wasn’t until approx. 110 BC that the Silk Route was established connecting China and Southeast Asia with Africa and Europe. Trade routes via sea, were recorded during the Age of Discovery/Age of Exploration. That was when European countries wanted to explore the world in the 1400s. It opened up a world of opportunities as well as brutal competition, which led to the discovery of the Americas as well as new trade routes to India and the Far East.